Johan Galtung

PEACE ECONOMICS: From a Killing to a

Living Economy

PROLOGUE A Vicious Cycle:

Inequality-Economic Crisis-Inequality

The current economic crisis has many

faces. Here is one:

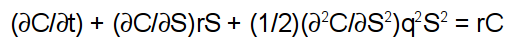

the famous 1974 Black-Scholes equation

to find the "correct price" for financial derivatives.

Based on partial derivatives over time, this is classical calculus

for continuous change; useful within a zone of stability, but not at

the edge, the tipping points explored in René Thom's catastrophe

theory from 1971. Intellectually this is like calculating the

increasing speed of an accelerating car heading for an abyss without

warnings. But, with warnings maybe no 1997 Nobel (actually the

Swedish State Bank) Prize in Economics?

One year later

their company, "Long Term Capital Management", had

liabilities of over $100 billion.1

The trade in derivatives is now at $1 quadrillion a year, ten times

the industrial economy of the 20th century. Many get rich, but theirs

collapsed. Maybe prison would have been more adequate for

intellectual sloppiness?

That equation is a part of the closed

paradigm of economism. Does it offer a solution, not only for banks

and bankers, but for the bottom 99.9%? The 0.1%/99.9% income ratio in

USA 2007 was 140; an unbelievable inequality, both cause and effect

of the crisis.

Some look at

Germany's decreasing unit labor cost 2005-2011 and high employment.2

With top rate quality export products and a single euro currency,

their eurozone trade surplus grew from 64 to 140 billion euros

2002-2009. They financed the trade deficit of

Greece-Italy-Portugal-Spain-Ireland (GIPSI)

with credits from German banks, at the end of 2009 to the tune of 522

billion euros. But they do not invest in GIPSI, only offer higher

interest credit for them to pay back the credits, thereby putting the

GIPSIs in debt

bondage.3

A very dangerous policy, close to a tipping edge, endangering not

only the euro and the economy, but the European Union peace project.

Are there alternatives? Of course,

stimulus, not bail-out.

A policy of debt

forgiveness4,

bailing out legitimate creditors, letting other banks collapse, would

be better than a debt bondage feeding hatred of the creditor,

invoking nazism memories, like Greece does.5

Terrorism next?

We need good debt maps to design

intelligent forgiveness policies for households, municipalities,

countries, regions. The way out of a complex man-made catastrophe is

not to punish the victims.

But we also need

political action unlikely to come from the Berlin-Frankfurt-Brussels

triangle. One strong formula would be GIPSIs

unite, you have only your German banks to lose.

They could jointly negotiate better terms, rejuvenate the

countryside, increase intra-GIPSI trade, lift themselves out of

bondage. But illegitimate, maybe illegal Goldman-Sachs has former

employees as prime ministers in Greece and Italy, economy minister in

Spain and top of the European Central Bank. That spells finance

economy, not real economy.6

Inside victim countries

periphery-periphery cooperation could alleviate much suffering

from basic needs deficits. Class warfare from above has sent the

economic shocks downward to the vulnerable: the women, the older, the

younger, the excluded, depriving them of money for

food-clothes-housing-health-education. But the old lady in poor

health with little money may offer housing to the younger in good

health, against cleaning, helping, company. Money may not change

hands: service for service, hours for hours, sharing togetherness.

A farmer produces food; student farm

hands could pay with culture. Neighboring farms could share sales

points directly from producers to consumers. And at a world level a

four lane highway through Africa could make Latin America, Africa and

Asia revive, and expand, the 500 AD-1500 AD globalized real economy

trade. GIPSI countries might link to that South-South-South through

North Africa.

Periphery-periphery cooperation

counteracts the inequality of hierarchy-exploitation, lifting the

bottom up. Legislation is of no avail if the politicians have

been bought by Big Capital.

In the giant Chinese 1991-2004

lifting up of 3-400 million, the local community was the unit of

development. The five-pronged approach--the public, private, civil

society, technical sectors, and a coordinator, in China the

party--gave micro credit to small companies dedicated to producing

necessities, food-clothes-housing-polyclinics-schools at low cost and

price, and to employing the most needy. When their own needs

were met, they sold to others at low prices, paid back the credit and

entered the economy with some cash in the pockets. Capi

-communism, the latter for needs, the former for wants and

markets. But the extreme West, the USA, may not bridge this gap

intellectually.

Some of the finance economy should be

punished, criminalized, like those who give credit far beyond their

capital, and those who contract loans far beyond their earning

capacity. The worst finance economy dealers should be boycotted and

local saving banks favored; global economies should be balanced with

more local economies.

The whole focus of

economics should be changed from the growth of the market economy to

meeting basic needs. From GNP to HDI, the Human Development Index of

basic needs satisfaction. The Czech economist Tomás Sedlácekvii7

concludes from the years after communism that egoism is not the

alternative; some state regulation is indispensable.8

There will be more

approaches and alternatives as more leave the sinking ship of

neo-liberal economism. The neo-liberals betrayed us. Had distribution

measures come with growth measures like latitude with longitude

rising, inequality within and between countries the last decades

would have become a key issue and led to policies.9

Rather than the horror of the likely, available, use of war

as the ultimate stimulus to get a stagnant inflation-deflation

economy running again.

But rational policies run against

inegalitarian class society.

The top became

super-rich. Those at the bottom sank into misery, illness, death

unless lifted up to meet basic needs. The inequality in wealth

economically came with inequality in force militarily, in power

politically and culturally in values that legitimize power

authorizing force protecting the wealth of the super-rich; the US 1%

vs 99%.10

That inequality causes crises that cause even more inequality. How?

Of these four the

economy defines the discourse. But not the real economy based on

land, industry, knowledge, technology; but pure capital, the finance

economy. The economists showed a way to rising inequality, like the

Black-Scholes11

formula to calculate the value of an option before it matures so that

it can be sold and bought at any time. This leads to ever longer

chains of buying and selling derivatives (derived from options), on

bets, on bets on bets; a finance industry with catastrophic system

consequences12,

even betting on basic needs, like housing, food13,

water, death14;

trusting that the demand for necessities is inelastic.

Whenever

derivatives change hands a commission is charged. The longer the

chain, the higher the unit price--like for drugs, the poor man's

derivative--up to a tipping point: a crash with much value to the

penultimate seller. For real estate, construction industries, banks

and people facing foreclosure: a catastrophe.15

This is not

"casino capitalism"; a casino gambler bets his own money

for own gains or losses, up to suicide. Derivative economy bets with

other peoples' money, pockets the gains, lets others take losses and

suicides; even clients they advise, and then bet against.16

A very vicious practice derived from

a very vicious theory. There is a link between rising inequality and

economic crisis: the less acquisitive power for the bottom 90-99%,

the less real economy growth, and the more the top 1% has to rely on

finance economy growth.

And,

the larger the gap between high growth in the finance economy and

little or no in the real economy, the more out of touch with reality

the financial objects, the higher the probability of a crisis,

quickly as a crash, slowly as a crisis.17

The vicious circle of two-way

causation is here: more inequality, more crisis, the more crisis the

more inequality. The high up want even more return on their money,

the low down are steeped in struggle against misery. Alternatives

stand a poor chance. What came first in our predicament, inequality

or crisis, is a chicken-egg problem.

But the "roots of inequality"

are worth looking at. There will be three perspectives: actor

attributes, actor interaction, and system structure.

Three independent, but synergizing, sources of inequality.

Attributes. People differ in

physical force, perseverance, intelligence, postponement of

gratification, risk-taking, empathy, creativity, solidarity,

ambiguity tolerance, spirituality; and family background,

egoism, greed, stinginess, cheating, lying, narcissism, paranoia,

inconsideration, materialism.18

10 positive, 10 negative: those justifying inequality as well

deserved emphasize the former, those against the latter, as proof of

injustice. Analysts use both.

Interaction. The general

formula is "unequal exchange". But how can some people

demand much higher pay per hour of work, and much more from an

exchange, than others? Two answers will be indicated: the mind-body

distinction, and accumulation along interaction chains.

Structure. The general

inequity formula is center-periphery interaction;

center-center and periphery-periphery are more equitable. The four

class resources--wealth, force, power, values--are more available to

the top, are convertible, and generate ever more center-periphery

distance. In addition, topdogs easily meet, interact with their

underdogs; but they are limited by resources, space and time.

NOTES

1.

In the first year it made a 40% profit, having borrowed over 25

times its equity. In 1998 it lost $4.6 billion, and was bailed out

by a group of banks supervised by US Federal Reserve. See

http://en.wikipedia.org/wiki/black-scholes.

2.

Floyd Norris, International

Herald Tribune,

17 February 2012.

3.

Rune Skarstein, the leading Norwegian economist on the crisis, in

Klassekampen,

16 March 2011. The CIA World

Fact Book

lists 190 countries according to current account balance (exchange

rates, not purchasing power parity, PPP): No. 1 China, No. 2 Japan;

No. 190 The USA: World

Debt Bondage I

(the US debt to China is $727 billion, to Japan $626 billion, very

close, then EU). No. 3 Germany; Nos. 180-185-188-189 4 of the 5

GIPSI, World

Debt Bondage II.

Could The USA

de-encircle China in return for debt forgiveness?

Could Germany forgive

debts in return for better relations?

4.

Le

Monde Diplomatique,

April 2012 lists many cases: in 1868 The USA canceled the debt of

the Southern states after the Civil War, in 1898 The USA canceled

the Cuban debt to Spanish creditors, in 1918 the Bolsheviks did not

recognize the debts incurred by the Czar, in 2003 The USA asked

Germany, France and Russia to cancel their demands on Iraq, in 2007

Ecuador declared major portions of their debt to be illegitimate, in

2008 the people of Iceland refused to pay the debts incurred by a

private bank to among others Dutch and English creditors. Of course,

the debtors take the initiative, not the creditors; wisdom might

turn this around.

5.

Among the reasons to avoid bail-out is suspension of the punishment

aspect of the market, socializing the losses while privatizing the

gains, encouraging the finance economy to stay its wrong course,

using the real economy to subsidize the finance economy; speeding up

the collapse.

The Final Report of

the National Commission on the Causes of the Financial and Economic

Crisis in the United States, Public Affairs 2010 is one more of

those US report, like on the Kennedy murder and on 9/11, leading to

more questions than it answers, as Jeff Madrick makes very clear in

his review in The New York Review of Books, 28 April 2011:

"These regulators are by and large the same agencies that

tolerated the excessively risky behavior in the first place. Even if

they write effective rules they will face pressure from Wall Street

lobbyists..." (p. 70).

6.

See Greg Smith, Why

I Left Goldman-Sachs: A Wall Street Story,

New York: Grand Central Publishing, 2012; following Michael Lewis

Liar's

Poker

on Salomon Bros. in the 1980s. Washington

Post,

25 April 2010: "Cheers at Goldman as housing market fell".

8.

An example: after the fall of communism in Hungary, people had a

great urge to be free from oppressive, intrusive government

regulations, and the role of government was reduced to a bare

minimum. In 1994, there was a shortage of paprika powder, an

essential ingredient in most Hungarian dishes. Some small

enterprises began to paint unripe paprika red, with poisonous lead

paint, to make it look ripe. Dozens of unsuspecting customers had to

be hospitalized. People finally realized that it is unreasonable to

expect each consumer to buy a small sample of a new food product,

send it to a lab to analyze whether it is safe to eat, and then buy

more. The government has to test new products for consumption safety

for everyone.

(http://articles.latimes.com/1994-10-11/news/wr-49091_1_paprika

accessed 7 April 2012).

9.

There have been some warnings but mainly post hoc analyses, like

Raghuram G. Rajan's Fault

Lines,

pointing to 35 years of increasing inequality in the USA: for every

dollar in real income increase 1976-2007 58% went to the richest 1%

of the households. Thus, in 2007 the hedge fund manager John Paulson

made 3.7 billion dollars, about 74,000 times the median income of US

households. More importantly: somebody paid that money. And James

Carroll writes (International

Herald Tribune,

4 January 2011): "US Census data for 2010 show the widest

rich-poor income gap on record. In 1968, the top 20 percent of

Americans had about 7 times the income of those living below the

poverty line. By 2008, that disparity had grown to about 13. By

2010--more than 14." At the same time the percentage living

below half of the poverty line is increasing. And the war economy

benefits: "Over-investment in arms leads to their use, period".

Andrew Hacker, in "We're More Unequal Than You Think", The

New York Review of Books,

23 January 2012: "Internal Revenue Service data show that the

best-off 5% of families had 15.9% of the income in 1972, 16.1% in

1985 and 20.0% in 2010 while the Gini index of inequality rose from

.359 via .389 to .440. With such massive warnings the

diagnosis-prognosis-therapy triangle should have been forthcoming,

like it does from competent meteorologists for hurricanes, and

competent physicians for pandemics. An incompetent science.

10.

The figures are shocking all over. In Spain there are close to 25%

living in misery, in "egalitarian Norway" the top 10% are

in command of 73% of the wealth, and so on. For an excellent Spanish

analysis, see Juan Díez Nicolás, "Poder Político y poder

financiero", ABC,

30 August 2012 and for an excellent general analysis see Samir Amin,

"Financial collapse, systemic crisis? Illusory answers and

necessary answers", World

Forum of Alternatives,

Caracas, 2008, about "financiarized oligopolies". For

Amir's writings see www.michelcollon.info.

11.

From 1973, with Robert Merton refining the equation to get the

prices right--US economists all three--Merton and Scholes got the

Swedish State Bank Prize in economics in 1997 after Black's death

(not Nobel prize). Maybe debt prison would have been a more adequate

response? But, as Charles Ferguson said when accepting the Oscar for

Inside

Job,

nobody has gone to jail for the worst financial crisis since the

Great Depression.

12.

A system breaks at its weakest points, like Lehman Bros. September

2008, or Madoff, the Ponzi pyramid scheme builder; leading to the

temptation to see Lehman Bros.-Madoff as causes, not as consequences

precipitating even worse consequences. Incidentally, 6 of the 10

biggest Lehman Bros. creditors were Japanese (International

Herald Tribune,

17 September 2008). Naivete about The USA?

From the point of view

of catastrophe theory, the system was for some time in a stability

zone trading derivatives worth a quadrillion dollars a year by 2007,

"10 times the total worth, adjusted for inflation, of all

products made by the world's manufacturing industries over the last

century" (Ian Stewart, professor of economics, University of

Warwick). A gap between finance and real economy was closed by a DJI

crash from the 12,000s to the 6,000s in 2008. At the time of writing

March-September 2012 the DJI has passed 13,000 again, first time

since September 2008.

13.

See the excellent article by Jean Ziegler about rice as a finance

product in Le

Monde Diplomatique,

February 2012.

14.

See "Vulture Investor Battles For Death-Bet Payoffs", Wall

Street Journal,

20 April 2012.

15.

In Spain real estate and construction are the sectors most behind in

paying their loans, thereby endangering banks. But the real crisis

is in the suffering due to foreclosures, so far about 150,000

"mortgage executions", with 238,000 pending (Soledad

Gallego-Díaz: "Hell and Good Intentions", El País,

English edition 5 March 2012). "Nothing could be done about

these evictions, we were told, because it would endanger the

stability of the system." Comments unnecessary.

16.

Der

Spiegel,

5/2009, p. 133, has a photo from a Wall Street demonstration with a

message to the bankers ("banksters"?) watching from above:

JUMP!

You fuckers!

17.

As Andrew Hacker puts it: "The crucial fact is that the upward

flow of money has reduced the spending power of those lower down,

most notably the bottom 60 percent". op.cit.

18.

There has been much research on negative attributes highly

correlated with becoming rich, such as ego-centrism,

self-righteousness, willingness to exploit, lack of empathy. George

Monbiot, columnist in The

Guardian

(in Klassekampen,

17 January 2012), refers to studies by Belinda Board and Katarina

Fritzon, and by Paul Babiak and Robert Hare (Snakes

in Suits),

and Branko Milanovic (The

Haves and the Have Nots).

An additional factor producing wealth and inequality is simply

differences in luck; not ability, they could just as well have been

throwing dice.