The Drain of Wealth: Colonialism before the First World War

HISTORY, 15 Feb 2021

Utsa Patnaik and Prabhat Patnaik | Monthly Review - TRANSCEND Media Service

British Indian Empire, “Political Map of the Indian Empire, 1893” from Constable’s Hand Atlas of India, London: Archibald Constable and Sons, 1893.

1 Feb 2021 – The Western European powers appropriated economic surplus from their colonies, and this materially and substantially aided their own industrial transition from the eighteenth century onward, as well as the diffusion of capitalism to the regions of new European settlement. In the literature on economic growth, however, we find little awareness of the existence of such transfers, let alone their sheer scale, or the specific real and financial mechanisms through which these transfers were effected. Much research still remains to be done in this area. In the case of India, however, for well over a century there has been a rich discussion on transfers, termed the drain of wealth, initiated by two outstanding writers, Dadabhai Naoroji and R. C. Dutt.1 Here, we confine ourselves to discussing transfers only in the context of India.

With few exceptions, the literature on the eighteenth- and nineteenth-century industrial transition in the core countries ignores the drain of wealth, or transfers, from the colonies.2 The mainstream interpretation posits a purely internal dynamic for the rise of capitalist industrialization, and some authors even suggest that the colonies were a burden on the metropolis, which would have been better off without them.

Conceptualizing the Drain of Wealth

In the case of India, the concept of drain is based on the fact that a substantial part, up to one third of total rupee tax revenues, was not spent in a regular manner but was used to acquire goods, which were exported and earned gold and foreign exchange from the world. However, these earnings, representing international purchasing power, were never permitted to accrue to the country; they were instead appropriated by the ruling power. The study by Folke Hilgerdt on the pattern of global trade balances and a detailed empirical investigation of Britain’s region-wide trade by S. B. Saul tell us that the gold and foreign exchange earned as export surplus by the tropical colonies, and preeminently by India (and treated by Britain as its own earnings), became so large from the last quarter of the nineteenth century that it underpinned the process of the rapid diffusion of capitalism.3 This took place through Britain’s large-scale capital exports, using its colonies’ export surplus earnings, that hastened the industrialization of Europe and regions of new European settlement. The other side of the process was declining per capita food availability and pauperization of the masses in the colonies.

This drain was multidimensional. First, there was an internal dimension, that is, extraction of economic surplus from producers through rent and taxes. In India, tax extraction in cash by the state was the most important method, with land revenue making up the bulk of taxes for much of the period. Independent producers paid land revenue directly to the state, while cultivating tenants were obliged to pay rent out of their economic surplus to the person designated as the landowner, who in turn paid the land revenue. The government’s opium and salt monopolies, whose burden fell on the peasants and workers, were additional important sources of revenue. However, taxation per se did not produce a drain. This arose from its combination with the second, external dimension stressed by Naoroji and Dutt, namely, the designation of a substantial part of the tax revenues as “expenditure abroad” in the budget—that is, not in the regular manner within the country, but as reimbursement to the producers for their export surplus with the world, which was kept in London. This export surplus earned specie and sterling, which was entirely siphoned off for its own use by the colonizing power via manipulated accounting mechanisms.

The use of the state budget in this manner—to pay producers of export surplus out of their own tax contribution while the international proceeds of commodity export surplus is never credited to the country—is not found in any sovereign country; it is specific to the colonial system. All producers of export goods were apparently paid. A part of colonial exports was paid for through imports of British manufactures, mainly textiles, but this import arose from keeping the colonial economy trade liberalized. Goods were absorbed at the expense of displacing local artisan spinners and weavers, whereas the metropolis practiced protection against colonial manufactures for well over a century. After deducting these virtually compulsory imports, the resulting net export surplus earnings were not paid to the producers in a regular manner, because they were paid out of the tax revenue raised within the country. The overwhelming bulk of such taxes were extracted from the very same producers as rent/land revenue and indirect taxes, especially from the salt monopoly. This meant that the producers were taxed out of their goods even while appearing to be paid.

To illustrate this proposition, suppose that a peasant-cum-artisan producer in India, in the period of the East India Company’s rule, paid ₹100 as tax to the state and sold ten yards of cloth and two bags of rice worth in total ₹50 to a local trader. This sale would be a normal market transaction and not connected in any way to the peasant producer’s tax payment, since the trader would advance personal funds for the purchase, expecting to sell the cloth and rice, and recoup the outlay with a profit. Now, suppose an agent of the Company, not a local trader, bought an additional ten yards of cloth and two bags of rice for export from the peasant-cum-artisan producer by paying the producer ₹50 of the same producer’s own money, out of the ₹100 total taken as taxes. This means the producer in this case was not paid at all. The producer might have raised questions if the agent of the Company who collected the tax also bought the producer’s goods out of that money. But the two agents were different, and the two acts—collecting tax and buying produce—took place at different times by separate agents, so the producer did not connect them. Purchase by the Company’s agent would appear to the producer as a normal market exchange no different from purchase by the internal trader, but it was qualitatively quite different, since a part of the producer’s own tax payment came back as disguised “payment”—a fact the producer did not know—while the producer’s cloth and rice were taken away. In this transaction, the form of half of the total tax of ₹100 paid changed from ₹50 cash to ten yards of cloth and two bags of rice. In effect, the peasant producer handed over these goods for export completely free to the Company, as the commodity equivalent of ₹50 tax, worth, say, £5 (at the then current exchange rate of ₹10 to £1). The cloth and rice were then exported to England, and sold, say, for £7 after adding freight, insurance, and trader’s margin. (Only the rice would be sold and the cloth reexported because there was an official ban from 1700 on the consumption of Asian textiles in England.)

Since the peasants and artisans were the main contributors to the total tax revenue, this meant they were not actually paid; all that happened was that the relevant part of their tax merely changed its form from cash to goods for export. This direct linking of the fiscal system with the trade system is the essence of drain in colonies where the producers were not slaves but nominally free petty producers, namely tax-paying peasants and artisans.

The transfer process at its inception was relatively transparent. The East India Company’s trade monopoly granted by the British Parliament began in 1600. The Company had to pay for its import surplus from Asia with silver, arousing the ire of the early mercantilists. The Company acquired tax revenue-collecting rights in Bengal province in 1765, and the substantive drain starts precisely from that date. Some form of drain was already taking place through underpayment for goods using coercion over petty producers, but this was nothing compared to the bonanza after 1765, when the free acquisition of export goods using local taxes started. Bengal’s population of about thirty million was nearly four times that of Britain, and the rapacity of the Company, which forcibly trebled revenue collection over the following five years, decimated one third of that population in the great 1770 famine. Full recovery had not taken place by 1792, and yet the land revenue fixed under the permanent settlement in that year in Bengal exceeded the British government’s taxes from land in Britain. In the next eighty years, revenue collections trebled as the Company, using Bengal as its economic base, acquired political control over several other Indian provinces—the Bombay Deccan, Madras, Punjab, and Awadh. Three wars were fought by the Burmese; fertile Lower Burma was occupied by 1856 and the entire country by 1885. Land revenue collection systems were promptly put in place—the very term for the British district administrator was Collector. Britain saw a steadily increasing and completely costless inflow of tax-financed commodities—textiles (up to the 1840s), rice, saltpeter, indigo, raw cotton, jute—which far exceeded its own requirements. This excess was reexported to other countries.

The transfer or drain consisted in the fact that Britain’s trade deficit with India did not create any external payment liability for Britain, as its trade with a sovereign country like France did. Britain’s perpetual trade deficit with France had to be settled in the normal way through outflow of specie, borrowing, or a combination of the two. This was true of its deficits with all other sovereign regions and also true of its trade with India up to 1765. After that date, when local tax collection began, the situation changed. On Britain’s external account, the cloth and rice import from India now created zero payment liability, since Indian producers had been “paid” already out of their own taxes—that is, effectively not paid at all. This system of getting goods for free as the commodity equivalent of the economic surplus extracted as taxes was the essence of the drain, or transfer. It did not merely benefit the Company as trader by raising its profit rate to dizzying heights, given that its outlay on purchasing the goods became zero, but it also benefited Britain as a country. The growing import surplus of tropical goods created no payment liability, and reexports of these free goods also bought England goods from other sovereign countries like France, reducing its trade deficit with them.

In England, it was clearly recognized that the apparently negative feature of a trade deficit vis-à-vis India was a net addition to England’s resources, since locally raised revenues served to acquire goods for import. In England’s Export and Import Report for the year 1790, it was stated:

The great excess of the Imports over the Exports in the East India trade, appears as a Balance against us, but this excess consisting of the produce of the Company’s territorial revenues and of the remittance of fortunes acquired by individuals, instead of being unfavourable is an acquisition of so much additional wealth to our public stock.4

Had the colony been a sovereign country, its foreign exchange earnings would have accrued entirely to itself, boosting its international purchasing capacity while the local producers of export surplus would have been issued the local currency equivalent of their earnings, not connected in any way to taxes they might or might not pay. The taxes they did pay would have been spent entirely under normal budgetary heads.

The colonizing power always needed to establish property rights in some form over the local population, because this was the necessary condition for surplus extraction and transfer. In India, this was the sovereign right of tax collection, but in the West Indies, plantation slavery meant that the extraction of surplus by British owners took the form mainly of slave rent, namely the excess of output net of material costs over the bare subsistence of the enslaved workers. In Ireland, English settler landlords took over the land of the local peasantry, and economic surplus was extracted as land rent as well as taxes. (Land rent is used here in the sense specified by Adam Smith and Karl Marx, as absolute ground rent, not in the sense in which the term is used by David Ricardo.)5 In all cases, goods were obtained free as the commodity equivalent of the economic surplus appropriated, no matter what the specific form in which this surplus was extracted, whether as slave rent, land rent, taxes, or a combination of all these.

Tax-financed transfer by the Company was direct and transparent. One quarter to one third of the annual net tax revenues was used for purchasing export goods, with cotton textiles making up the major part until the 1840s. Thereby the metropolis obtained a vast flow of goods, far in excess of its needs. It retained a part of these within the country and reexported the remainder to other countries, against the goods it needed from them. Cotton textile imports were entirely reexported because in 1700, at the insistence of the jealous British wool industry, Parliament in England had passed a law banning the consumption of imported pure cotton goods from India and Persia, and had enforced the ban in 1721 with heavy fines on those found in violation. All textiles imported by the Company from India were warehoused in English ports and reexported, mainly to Europe and the Caribbean. To perfect the spinning jenny and the water frame took seven decades. Once cotton yarn could be mechanically spun in England, starting in 1774, the ban on the consumption of pure cotton goods was lifted but the restriction on the entry of Asian textiles into the British market continued in the form of tariffs, which were raised steeply between 1775 and 1813, with the last tariffs ending only in 1846.6

Britain’s stringent protectionist policy against Asian textiles, maintained for nearly 150 years, has been ignored completely both in the Cambridge Economic History of India and in the widely read work of historians of Britain’s Industrial Revolution and technical change in cotton textiles. Recent authors continue to write in the same blandly amnesic tradition.7 We have to read earlier works by Friedrich List, Dutt, Paul Mantoux, and Paul Baran for the true picture regarding Britain’s mercantilist policies of discrimination against manufactures from tropical regions, which started even before they became colonies.8 Mantoux’s detailed account of machinery in cotton textiles, the driver of the Industrial Revolution in England, makes it clear that the ban on Asian textiles spurred innovation and import substitution to meet pent-up demand. List’s comments on discrimination against Indian textiles suggest the same. In Mantoux’s words regarding the ban on consumption of pure cottons, “the import of pure cottons from whatever source remained forbidden. No protection could be more complete, for it gave the manufacturers a real monopoly of the domestic market.”9

Under the Navigation Acts dating from the 1650s, every important colonial good, whatever its final destination, had to first come to Britain’s ports and then be reexported. The goods had to be carried only in British ships manned by British officers. There is a misconception that the most important import from colonies was raw materials. Foodstuffs were the most important import all through the eighteenth century and remained so until the mid–nineteenth century when raw cotton imports were growing rapidly.10

Phyllis Deane in 1965 in The First Industrial Revolution discussed at length how important reexports were in the eighteenth century, allowing Britain to purchase strategic naval materials from Europe (bar-iron, pitch and tar, timber).11 This discussion was cut out in her jointly authored book with W. A. Cole in 1969, and reexports were eliminated from both the import and the export figures, when the authors presented what they called “the volume of British trade.”12 They calculated this by taking retained imports plus domestic exports, a concept called special trade that is not to be found in any macroeconomics textbook, nor is it ever applied by the international organizations presenting trade data (the United Nations, World Bank, International Monetary Fund), which always take as the volume of trade the sum of total imports and total exports inclusive of reexports if they are present. This is the correct concept, for reexports financed imports, whether of final consumer goods or of raw materials, just as a country’s domestic exports did. Calculating from the Deane and W. A. Cole data series using the accepted trade concept, namely total imports plus total exports, we find that Britain’s total trade-to-gross domestic product ratio had reached 58 percent by the three years centered on 1800, compared to only 36 percent estimated by Deane and Cole using their special trade concept.13 The confusion was compounded by Simon Kuznets, who reproduced an earlier version of the Deane-Cole figures without mentioning they were not comparable with the trade figures of the other countries he presented.14 A critique of these trade estimates that have misled many development economists is available in a study by Utsa Patnaik.15

Asymmetry of Production Capacities between the North and South

A country located in the cold temperate region of Europe that controlled a tropical region sat, in effect, over an inexhaustible gold mine. It was more lucrative than gold, for gold seams might eventually run out, but the surplus-producing and taxable capacity of the peasants and artisans would not, as long as they were not entirely annihilated through overexploitation. They could be set to produce more tropical (and subtropical) crops like cane sugar, rice, tapioca, and spices; stimulants like coffee, tea, cacao, and tobacco; vegetable oils like groundnut, linseed, and palm oil; drugs like opium; raw materials like indigo, jute, sisal, and cotton; and cut more tropical hardwoods (teak, mahogany, rosewood, ebony) from the forest or from timber plantations—all goods that could never be produced in cold temperate lands.

Northern populations in cold temperate Europe could not then, or for that matter in present times, ever “import-substitute” in these goods, and for that very reason they prized them, developing an increasing appetite for them. Conversely, there was no particular good from temperate lands that the tropical countries wished to import in any substantial way, since they could produce all their traditional requirements. They produced at least two crops a year, while single cropping was imposed by climate in cold temperate lands; the larger countries in the South could produce in winter all of the temperate land crops, in addition to tropical crops in their monsoon season. The Chinese emperor Qianlong, responding to George III, who had sent an envoy to negotiate trade concessions, famously wrote “our Celestial Empire possesses all things in prolific abundance and lacks no product within its own borders.”16

This important material reality of asymmetric production capacities, which explains the historic drive by European countries to subjugate tropical areas and force them to trade at gunpoint, was not only ignored by Ricardo, but was explicitly assumed away by him.

Ricardo assumed in his model of comparative advantage that “both countries produce both goods”—indeed his assumption was that “all countries produce all goods”—while showing that specialization and exchange according to comparative cost advantage led to mutual benefit. The material fact was ignored that unit cost of production could not be defined for tropical goods in the cold temperate European countries where the output of such goods was and always will be zero, and hence absolute cost was not definable, let alone comparative cost advantage. The supply from domestic sources of a large range of goods was zero at any price, and this continues to be the case at present. Ricardo’s theory contained a simple material fallacy, the converse fallacy of accident, wherein a special case is assumed (both countries produce both goods) and is used to draw an inference (trade is mutually beneficial) that is then improperly applied to cases where the assumption is not true.17 Since Ricardo’s basic assumption was not true, the inference of mutual benefit did not follow. On the contrary, historical evidence shows that the less powerful country, obliged to specialize in export crops, loses out through area diversion (since augmenting cropped area needs state investment, which is not forthcoming), leading to falling domestic food grains output. It also sees a decline of domestic manufacturing output and an increase in unemployment when it is kept compulsorily open to imports of manufactures, since there is little unused land to absorb those thrown out of work.18

Compared to the demand for Britain’s own goods, tropical goods were demanded by Northern populations—to a greater extent given the permanent non-availability of these goods from domestic sources—and the demand was more income-elastic. Reexports of a substantial part of its total imports boosted the purchasing power of Britain’s domestic exports by 55 percent during the period from 1765 to 1821.19 Four-fifths of goods reexported by Britain were from tropical regions, and the reexports went mainly to Continental Europe. The Netherlands’ reexports of imported goods exceeded exports of its domestically produced goods in the eighteenth century.20 Thus, there was a double benefit from the drain: not only did the metropolis get prized tropical goods free for its own use, but they were also free to be exchanged for temperate land products in which the metropolis was deficient.

Asia, West Indies, and Ireland, taken together, accounted for half of all British imports during the period between 1784 and 1826. The total transfer, measured by the import surplus into Britain from its tropical colonies in Asia and West Indies (which embodied taxes and slave rent, and hence created no external liability), ranged from 5.3 to 6.1 percent of Britain’s gross domestic product (GDP) from 1801 to 1821.21 Ralph Davis’s data similarly show that the combined deficit of Britain with these colonies ranged from 4 to 6 percent of its GDP during most triennia between 1784 and 1786 and 1824 and 1826.22

We can arrive at a rough estimate of the drain from India for the period from 1765 to 1836 by using trade data for Britain. The timeseries from 1765 to 1822 in B. R. Mitchell and Deane’s data and price indices in A. H. Imlah’s work had been used earlier to estimate the import surplus into Britain from Asia as the measure of drain.23 Using the data from Davis, we bring the estimate up to 1836, after deducting the value of the China trade.24

The current value import surplus for 1765 to 1836 is found to total £270.254 million.25 We can calculate the present value of the drain by bringing forward the estimate of each year’s drain at a certain interest rate up to any recent date and then adding up the individual figures. However, we adopt a short-cut procedure that is slightly different. We bring the total drain amount up to the present at 5 percent interest rate from the midpoint of the period. And we do so up to (1) the time of Independence in 1947 and (2) the year 2020. Compounding at a low 5 percent interest rate from the midpoint of the period, which is 1800, including that year, we find the sum amounts to (1) £369.65 billion until Independence and to (2) £12,400 billion until 2020. Taking the midpoint of the total drain period as the initial year understates the estimate we would get from a proper compounding of each year’s figure to the terminal year.26

An acute observer, Montgomery Martin, in his 1838 book and while giving evidence to a select committee in 1840, deplored the drain on India. Taking the £3 million annual home charges as its measure, he applied the prevalent 12 percent interest rate and calculated its total value as £724 million for the three-decade period up to 1833.27 He pointed out that taking the annual drain, which was slightly in excess of £2 million over the previous fifty years, and applying the same interest rate gave “the enormous sum” of £8,400 million. “So constant and accumulating a drain even on England would soon impoverish her; how severe then must be its effects on India, where the wages of a labourer is from two pence to three pence a day?”28

Appropriating the Colonies’ Global Exchange Earnings

In 1833, the East India Company’s monopoly of Indian and Chinese trade finally ended, owing to demands from English manufacturers, who, after displacing Indian textiles from European markets, wanted free access to the Indian market. However, the Company continued to rule until the Great Rebellion of 1857–59. India’s exports to Britain declined, deindustrializing imports of yarn and cloth from Britain grew fast, and by the late 1840s India’s trade with that country registered a deficit. But Indian exports to the world continued to rise and far exceeded the new deficit with Britain, so that an overall rising merchandise export surplus was always maintained (see Table 1).29 This remained a large positive figure even after deducting the import of commodity gold.

Table 1. India’s Merchandise Export Surplus with the World, 1833–1940 in Current Prices in Rs. Crore (1 Crore = 10 million)

| Period | X – M | Period | X – M | |

| 1833–35 | 3.35 | 1887–89 | 29.14 | |

| 1836–38 | 6.82 | 1890–92 | 35.77 | |

| 1839–41 | 5.37 | 1893–95 | 35.42 | |

| 1842–44 | 6.74 | 1896–98 | 30.85 | |

| 1845–47 | 6.37 | 1899–01 | 32.24 | |

| 1848–50 | 7.12 | 1902–04 | 52.60 | |

| 1851–53 | 8.73 | 1905–07 | 50.00 | |

| 1854–56 | 8.81 | 1908–10 | 55.34 | |

| 1857–59 | 8.00 | 1911–13 | 73.74 | |

| 1860–62 | 16.23 | 1914–16 | 61.90 | |

| 1863–65 | 38.08 | 1917–19 | 87.21 | |

| 1866–68 | 15.41 | 1920–22 | –14.62 | |

| 1869–71 | 23.84 | 1923–25 | 141.23 | |

| 1872–74 | 21.56 | 1926–28 | 71.58 | |

| 1875–77 | 22.18 | 1929–31 | 51.09 | |

| 1878–80 | 23.55 | 1932–34 | 18.57 | |

| 1881–83 | 32.38 | 1935–37 | 39.77 | |

| 1884–86 | 27.49 | 1938–40 | 35.62 |

Source: K. N. Chaudhuri, “Foreign Trade and Balance of Payments 1757–1947,” in The Cambridge Economic History of India, vol. 2, c. 1757–c. 1970, ed. D. Kumar (Delhi: Orient Longman, Cambridge University Press, 1984).

The ensuing problem of what Irfan Habib calls “the realization of the tribute” was solved for the time being by promoting India’s exports to countries with which Britain ran trade deficits.30 The drive to expand opium exports to China where the trade was illegal, and to forcibly open up its ports in the Opium Wars, was part of the process of promoting triangular trade patterns. In India, local peasants were coerced under state monopoly into growing opium for a very low price, and the silver tael proceeds of the Company’s opium exports to China (via private shippers) were used to offset Britain’s deficits with China.

Gross revenue collections had trebled by the 1820s compared to the 1800s, as the Bombay Deccan and Madras were brought under land revenue settlements and the salt and opium monopolies yielded more revenues. The drain increased, but it was now carried out in a more roundabout manner than the earlier direct merchandise export surplus with Britain, since that direct surplus had turned into a deficit.

A more general solution had to be found to this problem of “realizing” the tribute. The solution came into effect in 1861 after India’s governance had passed to the Crown. It was simple and effective: the Secretary of State for India in Council (a minister of the British government based in London) invited foreign importers of Indian goods to deposit with him gold, sterling, and their own currencies as payment for their imports from India, against the issue of an official bill of exchange to an equivalent rupee value cashable in India. The exchange rate (rupee relative to sterling, the latter being fixed with respect to gold) at which these Council bills were sold was periodically adjusted carefully to a fraction of a farthing, so that foreign importers would never find it cheaper to send gold as payment directly to Indian exporters, incurring the relevant transport cost, even when that gold might come from Egypt or Australia, compared to using the London Council bill route. The exchange rate was thus administered to vary between “gold points,” adjusted to prevent the import of financial gold into India (and also to prevent its export, except when required by the metropolis). Foreign importers of Indian goods tended to prefer Council bills to any other private mode of remittance because they could be certain that the bills would always be honored, since they were issued by a minister of the British government, which meant a sovereign guarantee against default.

The Council bills could be cashed only in rupees. On submitting the bills through the exchange banks, the exporters in India who received them (by post or by telegraph) from foreign importers were paid by the Indian Treasury out of budgetary funds already set aside as expenditure incurred abroad.31 Exporters in turn paid the producers from whom they sourced the goods. Thus, the essential feature of the earlier drain was retained—producers were apparently paid but not actually paid for their export surplus because the payment came out of taxes raised in major part from the very same producers. The export surplus continued to be merely the commodity form of tax revenues.

However, the scope of this official mechanism was wider than that under the Company, in that the total export surplus earnings of British India from the entire world was appropriated. Internal redistribution of incomes also took place from the producing classes to the trading classes under this mechanism of transfer, since the export agents took a fairly large cut out of the producer’s price, so that a given value of drain to Britain entailed an even larger squeeze on producers’ incomes.

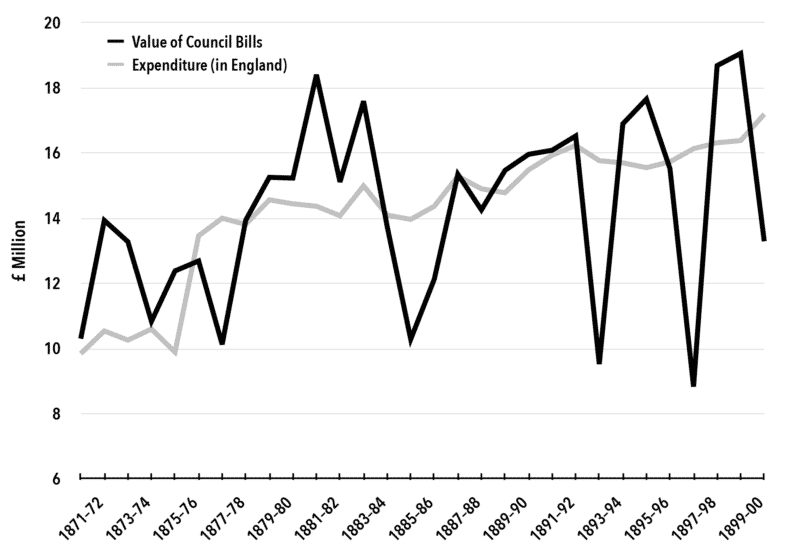

The total of commodity export surplus earnings over the period between 1871 to 1901 (£428.58 million) was identical to the total expenditure in England charged to Indian revenues (£428.93 million), as Table 2 shows. It is important to note that this surplus, defrayed through Council bills, is the balance of merchandise trade plus the balance of commodity gold flows. Additional financial gold flows also occurred that belong in the capital account. Chart 1, depicting these two series, makes clear that India’s export surplus earnings fluctuated greatly depending on internal factors and on world market conditions, but the sterling expenditure by England using these earnings rose much more steadily. This was because, to deal with fluctuations of trade, a form of buffer-stock operation with regard to currency was carried out, of sterling in England and of rupees in India. If India’s net external earnings rose sharply in a particular year, in excess of spending required by England, then the sterling balances maintained by the Secretary of State were added to, being drawn down in other years when the opposite situation prevailed. In such a case of sharp rise in external earnings, at the Indian end there would be an unusually large value of Council bills tendered and thus excess demand for rupees, so in addition to the bulk of the planned payment of the bills out of the budget, the paper currency reserve (and more rarely the gold standard reserve) at the margin would be drawn down, being replenished in other years of decline in India’s external earnings and hence slackening of demand for rupees.

Chart 1. India’s Commodity Export Surplus (Value of Council Bills) and Expenditure in England, 1871–1901 (£ million)

The new arrangement that operated from 1861 thus retained the basic feature of the earlier direct system under the Company: the merchandise export surplus continued to be “paid” to its colonized producers out of their own taxes, and hence was not paid for at all. It continued to be obtained gratis by the metropolis, with the global earnings from it and the gold and foreign exchange retained by the metropolis.

A small amount of financial gold as payment by foreigners for India’s exports may have evaded this system of economic control and reached India, perhaps through the ports in the princely states. But this is likely to have been negligible and is impossible to estimate. The overwhelming bulk of the rest of the world’s payments for India’s commodity export surplus was successfully intercepted and appropriated by the metropolis and never permitted to reach the colonized producers who had earned it, either as physical gold for financial payment purposes (as opposed to commodity gold, imported like any other good), or as foreign exchange denoted as a net credit for India. Not even the colonial government was credited with any part of India’s external earnings against which it could issue rupees, as would happen in a sovereign country. On the contrary, the Secretary of State in London had an official claim on the part of the Indian budget designated as Expenditure in England or sometimes as Expenditure Abroad. Issue of the rupee value of the entire external earnings out of this part of the budget was not only income deflating but also made for monetary stringency, lack of liquidity, and hence perpetually high interest rates.

In accounting terms, India’s large and rising commodity export surplus was shown as completely offset by the state-administered invisible debits (the tribute), which included all the rupee drain items of the budget, now expressed in sterling on the external account. But the administered, manipulated debits were not necessarily confined to the recurring drain items alone.

For the period of 1837–38 to 1900–01, we estimate the drain as £596.757 million by taking the series of Expenditure Abroad in the Indian budget that was paid out. From 1861, this was against Council bills tendered to the value of India’s commodity export surplus. This data series is available in both sterling and rupees from the Statistical Abstracts for British India. The midpoint of this period is 1868. Cumulating as before at 5 percent interest rate for the 79 years to 1947 and the 152 years to 2020, we obtain the total value of the drain by these dates as £28.17 billion and £992.14 billion, respectively. Adding these estimates to our estimate for the earlier period from 1765 to 1836, we obtain the figures in Table 3.

For an idea of the relative importance of the drain, the GDP of the United Kingdom in current prices for the dates 1836, 1900, and 1947 are also given. The value of the drain from 1765 to 1900, cumulated to 1947, gives us £397.8 billion, nearly thirty-eight times the 1947 GDP of the United Kingdom. Since nominal values are used here, with no adjustment for price change, the value of the drain up to 1900 would be a much higher multiple of the United Kingdom’s 1947 GDP when this is expressed in constant 1900 prices. Cumulated up to 2020, the drain amounts to £13.39 trillion, over four times the United Kingdom’s estimated GDP for that year.

Over most of the period, the exchange rate of the U.S. dollar against sterling was, at best, £1 = $4.84. Thus, the drain for 1765 to 1900 cumulated to 1947 in dollar terms is $1.925 trillion; cumulated up to 2020, it is $64.82 trillion. The former figure is greater than the combined 1947 GDP of the United Kingdom, the United States, and Canada. The latter figure is similarly much higher than the combined 2020 GDP of these countries.

Imposition of Sterling Indebtedness

Our estimates are minimal estimates, and they are by no means a full measure of the actual sums coming from India for Britain’s benefit. Over a run of years, the total of invisible demands was always pitched higher than India’s ability to meet the total through foreign exchange earnings, no matter how fast the latter might grow, so indebtedness to Britain was enforced. India’s huge external earnings not only magically disappeared into the yawning maw of the Secretary of State’s account in London, but the country was shown to be in perpetual deficit. Had its own gold and foreign exchange earnings from export surplus actually been credited to it, even partially if not wholly, then given the large size of these earnings, India could have imported technology to build up a modern industrial structure much earlier than Japan did after its 1868 Meiji Revolution, or exported capital itself and not been obliged to borrow. The Indian railways could have been built several times over from India’s own exceptionally high external earnings during the raw cotton boom of the 1860s and 1870s (see Table 1). Between 1860 and 1876, commodity export surplus earnings totaled £135 million, whereas railway and irrigation investment was only £26 million. But since all of India’s gold and foreign exchange earnings were appropriated by Britain using the method discussed earlier, borrowing from the London money market was thrust on India for building railways, at an interest rate guaranteed to foreign private lenders by the colonial government, regardless of the actual profitability of the railways.

While India’s entire external earnings went directly into the Secretary of State’s account in London, they were offset in accounting terms by administering a large number of arbitrary invisible liabilities denominated in sterling. These included all the annual drain items charged to the Indian budget under Expenditure in England and were expressed both in sterling and in rupees. These were also known as the home charges and had military expenses and interest on debt as the main components. There is a misconception that home charges were on account of the foreign administrators’ recompense in sterling for pensions, leave allowances, and the like. But all these administrative charges added together, based on budgetary data from 1861 to 1934, amounted on average to only 12.7 percent of the home charges.

Interest payments in sterling constituted the largest item, over half of home charges, not because there was much investment inflow (the entire subcontinent had received hardly one-tenth of total British foreign investment by 1913), but because practically every large extraneous expense was partly or wholly charged to the Indian revenues and their excess over India’s export surplus earnings was recorded as increase in India’s sterling debt. These extra expenses comprised the costs arising from Britain’s many imperial wars of conquest outside Indian borders; the sterling cost of suppressing the Great Rebellion of 1857 in India; indemnifying the East India Company as governance passed to the Crown and guaranteeing a return from the Indian budget to its shareholders; the cost of the Red Sea and the Mauritius to Cape Town telegraph lines; the cost of maintaining British legations in a number of countries; the cost of importing monetary gold in the 1890s for the reserve requirements of the gold exchange standard, most of this gold being later absorbed by Britain against issue of securities; and many other such items.

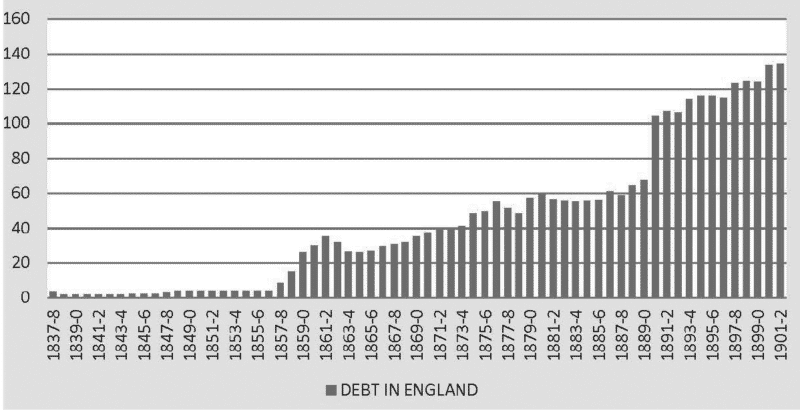

These costs, always in excess of India’s fast-rising foreign earnings, were shown as a cumulating debt that India owed. There was a quantum jump by nine times in sterling debt between 1856 and 1861 alone, from £4 million to £35 million against the cost of suppressing the Great Rebellion. Sterling debt rose again in the 1870s, doubling to £70 million, and exceeded rupee debt in the mid–1880s, again registering a quantum jump from 1891 as monetary gold was imported by the government for reserve requirements. By 1901, total sterling debt stood at £135 million, over one-fifth of British India’s GDP and eight times its annual export surplus earnings.

From the turn of the century, four-fifths of the monetary gold, imported at great Indian expense for backing its currency, was physically shifted to London against issue of British government securities by suitably amending the provisions on reserve requirements. Inflow of this “Indian gold” over several years, eagerly awaited by private investment firms in London, was the basis for extending loans to these firms at a low interest rate, namely pumping cheap liquidity into the London money market.32 India, meanwhile, continued to pay interest on the debt incurred for importing the gold. Chart 2 traces the movement of sterling debt from 1837 to 1902.

Chart 2. India’s Sterling Debt, 1837–38 to 1901–02 (£ million)

Because the government in Britain controlled the nature and amount of invisible liabilities it chose to heap on India, it could adjust these liabilities to the annual fluctuations (that it could not control) of export surplus earnings. Furthermore, it did not confine total liabilities to the actual total of external earnings but imposed indebtedness whenever it needed extra funds. The adjustment was always carried out in an asymmetric manner. When India’s export surplus earnings rose to an unusual extent, additional demands were promptly added to the normal drain items, in order to siphon off these earnings. In 1919, export surplus earnings reached a peak of £114 million. War materials worth £67 million imported from India were not paid for by Britain constituting a forced contribution.33 Additionally, munificent “gifts” from India were presented by the British to themselves. For example, an additional £100 million (a very large sum, exceeding India’s entire annual budget and amounting to 3 percent of Britain’s national income at that time) was transferred as a “gift” from India to Britain during the First World War, a gift no ordinary Indian knew about, followed by another £45 million “gift” the next year, both by increasing India’s debt burden.34 However, if India’s export earnings fell, owing, say, to world recessionary conditions, the sum demanded as sterling tribute was never lowered, and any gap between tribute and actual earnings was covered by (enforced) borrowing by India. Even during the Great Depression years, when India’s export earnings fell drastically, the tribute was not lowered, so in addition to enforced debt, the large distress outflow of financial gold was also mandated.

Such manipulation of invisible liabilities by the government ensured that, over any given run of years, India’s current account was always made to remain in deficit no matter how large its merchandise surplus became, excepting the two years of import surge after the First World War when there was a commodity trade deficit. (Gold outflow during the Depression years was noncommodity or financial gold.)

Both Naoroji and Dutt were acutely aware that when monies raised from producers in India were not spent in their entirety within the country under normal budgetary heads it meant a severe squeeze on the producers’ incomes. Dutt supported and quoted an influential administrator, George Wingate, writing in the 1830s: “The tribute paid to Great Britain is by far the most objectionable feature in our existing policy. Taxes spent in the country from which they are raised are totally different in their effects from taxes raised in one country and spent in another. As regards its effects on national production, the whole amount might as well be thrown into the sea as transferred to another country.”35

They were right, for surplus budgets to an unimaginably large extent were being operated with a strongly deflationary impact on mass purchasing power. (The budgets appeared to be balanced only by including the drain items on the expenditure side.) Such income deflation was the necessary economic mechanism of imperialism since there was no overt use of force to promote export crops save in the early years of indigo and opium cultivation. Income deflation reduced the producers’ consumption of basic staple food grains and achieved both the diversion of cultivated land area to non-grain export crops, and the export of food grains. The steady decline in per capita food grain absorption in British India was an expression of this income deflation.36 What needed to be added to Wingate’s remarks is that for the colonial rulers, the taxation revenues in the Indian budget explicitly set aside as Expenditure in England were not “thrown into the sea” but were embodied in vast volumes of goods that were completely free for Britain, which imported them far in excess of its domestic needs for reexporting the balance to other countries.

While the pre-British rulers, including invaders, had raised taxes, they had become a permanent part of the domiciled population, spending all public funds within the country. There was no tax-financed export drive producing a drain, hence no income-deflating impact on producers as under British rule. Naoroji and Dutt pointed out that the very existence of the large number of specific heads of spending outside the country, which constituted the drain items in the budget, arose from India being a colony, run for the sole benefit of the metropolis. Home charges were not the cost of administering India, for the regular salaries of British civil and military personnel serving in India were paid from the domestic expenditure part of the budget. The sterling charges were for furlough, leave, and pension allowances and averaged only 12.7 percent from 1861 to 1934. The major part, over 77 percent of home charges, comprised interest payments on debt arising mainly from military spending abroad and current military expenditures, while 10 percent went on purchase of government stores. The cost of colonial wars of conquest outside India was always put partly or mainly on the Indian revenues.37 This parasitic pattern was to be disastrously repeated as late as 1941 to 1946, when the enormous burden of financing Allied war spending in South Asia was put on the Indian revenues through a forced loan, raised through a rapid profit inflation that resulted in three million civilians starving to death.

We have talked of the metropolitan economy appropriating a part of the surplus of the colony gratis, which constitutes the drain. But since a part, however small, of these drain items were expenditures for specific purposes, whose recipients were specific economic agents in the metropolis being compensated for specific services rendered, the question arises: Can we legitimately talk of the metropolis extracting a “drain” from the colony?

This question can be answered on two levels. First, how the proceeds of the drain are distributed is irrelevant to the fact of the drain, just as how the proceeds of an extortion racket are distributed and how the different agents involved are compensated for their services does not change the fact of extortion itself. Colonial drain was analogous to extortion, and the claim of the metropolitan country that it was providing “governance” was analogous to the extortionist claim of providing “protection.” Second, even if local administrative functions had been transferred in entirety to Indians, this, while desirable on independent grounds, would not have reduced the drain by one iota, as long as political control was retained by Britain, so that it continued to link the internal budget with external earnings. As we have seen, the whole of India’s external earnings was intercepted in London and appropriated by Britain, while its rupee equivalent was “paid” to producers in India who had earned the export surplus, out of taxes raised from the very same producers. Whatever specific invisible liabilities were detailed on the debit side to justify this appropriation affected neither the actual existence of this drain nor its value. Even if, hypothetically, no sterling leave and furlough allowances or pensions for British administrators and soldiers were charged to the revenues (these in any case accounted for only one-eighth of the home charges), these particular charges could have been substituted by any other items the rulers’ ingenuity could devise—say by the cost of maintaining some of the Queen Empress’s many palaces in Britain, on the argument that she ruled India.

Notes

- ↩ Dadabhai Naoroji, Poverty and Un-British Rule in India (London: Swan Sonnenschein & Co., 1901), reprinted by the Publications Division of the Government of India in 1969; Romesh Chunder Dutt, Economic History of India, vol. 1, Under Early British Rule 1757–1837 (London: Kegan Paul, 1903), and vol. 2, In the Victorian Age 1837–1900 (London: Kegan Paul, 1905), reprinted by the Publications Division of the Government of India in 1970. The literature discussing the drain, whether directly or tangentially, includes A. K. Bagchi, “Some International Foundations of Capitalist Growth and Underdevelopment,” Economic and Political Weekly 7, nos. 31–33 (1972); A. K. Bagchi, The Presidency Banks and the Indian Economy, 1876–1914 (Delhi: Oxford University Press, 1989); A. K. Bagchi, Perilous Passage: Mankind and the Global Ascendancy of Capital (Delhi: Oxford University Press, 2005); A. K. Banerjee, India’s Balance of Payments: Estimates of Current and Capital Accounts 1921–22 to 1938–39 (Bombay: Asia Publishing House, 1963); A. K. Banerjee, Aspects of Indo-British Economic Relations (Bombay: Oxford University Press, 1982); D. Banerjee, Colonialism in Action (Delhi: Orient Longman, 1999); S. Bhattacharya, The Financial Foundations of the British Raj (Delhi: Orient Longman, 1971); K. N. Chaudhuri, “Foreign Trade and Balance of Payments 1757–1947,” in The Cambridge Economic History of India, vol. 2, ed. D. Kumar (Delhi: Orient Longman and Cambridge University Press, 1984); B. N. Ganguli, Dadabhai Naoroji and the Drain Theory (New York: Asia Publishing House, 1965); S. Habib “Colonial Exploitation and Capital Formation in England in the Early Stages of the Industrial Revolution,” Proceedings of the Indian History Congress, Aligarh, 1975; J. M. Keynes, “Review of T. Morrison’s The Economic Transition in India,” Economic Journal 22 (1911); Angus Maddison, The World Economy (Paris: OECD Development Centre Studies, 2006); T. Morison, The Economic Transition in India (London: Murray, 1911); A. Mukherjee, “The Return of the Colonial in Indian Economic History: The Last Phase of Colonialism in India,” Social Scientist, vol. 36, no. 3–4 (2008); A. Mukherjee, “Empire: How Colonialism Made Modern Britain,” Economic and Political Weekly XLV, no.50 (2010); Y. S. Pandit, India’s Balance of Indebtedness (London: Allen and Unwin, 1937); Utsa Patnaik, “Transfer of Tribute and the Balance of Payments,” Social Scientist 12, no.12 (1984); Utsa Patnaik, “The Free Lunch: Transfers from the Tropical Colonies and Their Role in Capital Formation in Britain during the Industrial Revolution,” in Globalization Under Hegemony: The Changing World Economy, ed. K. S. Jomo (Delhi: Oxford University Press, 2006); Sunanda Sen, Colonies and the Empire: India 1890–1914 (Delhi: Orient Longman, 1992).

- ↩ The exceptions include Paul A. Baran, The Political Economy of Growth (New York: Monthly Review Press, 1957); Maddison, The World Economy; H. Heller, The Birth of Capitalism (London: Pluto, 2011); and Branko Milanovic, “Ethical Case and Economic Feasibility of Global Transfers,” MPRA Paper No. 2587, 2007.

- ↩ See Folke Hilgerdt, “The Case for Multilateral Trade,” American Economic Review 33, no.1, part 2 (March 1943); S. B. Saul, Studies in British Overseas Trade 1870–1914 (Liverpool: Liverpool University Press, 1960).

- ↩ Quoted by B. N. Ganguli, Dadabhai Naoroji and the Drain Theory, 9. Emphasis added.

- ↩ Both Adam Smith and Karl Marx had stressed that the rent of land arose from the ownership of land in a few hands, which enabled the owner, who did not necessarily have to make any outlay in production at all, to extract surplus for its use from the actual producer. Ricardo, however, inverted this concept and labeled as rent surplus profit over and above average profit obtained in production. For Marx’s critique of Ricardo’s concept, see Karl Marx, Theories of Surplus Value, part 2 (Moscow: Progress Publishers, 1968); Utsa Patnaik, introduction to The Agrarian Question in Marx and His Successors, ed. Utsa Patnaik (Delhi: Leftword, 2007).

- ↩ Paul Mantoux, The Industrial Revolution in the Eighteenth Century, trans. Marjorie Vernon (1928; repr. London: Methuen, 1970); Romesh Chunder Dutt, Economic History of India, vol. 2 (London: Kegan Paul, 1905).

- ↩ Kumar, ed., The Cambridge Economic History of India, vol. 2. See E. J. Hobsbawm, Industry and Empire: From 1750 to the Present Day (Harmondsworth: Penguin, 1972); David Landes, The Unbound Prometheus: Technological Change and Industrial Development in Western Europe from 1850 to the Present (Cambridge: Cambridge University Press, 1969); P. Deane and W. A. Cole, British Economic Growth 1688–1959: Trends and Structure (Cambridge: Cambridge University Press, 1969); and B. R. Tomlinson, The New Cambridge Economic History of India: The Economy of Modern India 1860–1970 (Cambridge: Cambridge University Press, 1993).

- ↩ See Friedrich List, The National System of Political Economy, translated by G. A. Matile (Philadelphia: Lippincott & Co., 1856); Dutt, Economic History of India, vol. 1; Mantoux, The Industrial Revolution in the Eighteenth Century; Baran, The Political Economy of Growth.

- ↩ Mantoux, The Industrial Revolution, 256.

- ↩ Ralph Davis, The Industrial Revolution and British Overseas Trade (Leicester: Leicester University Press, 1979); Utsa Patnaik, “India’s Global Trade and Britain’s International Dominance,” in The Changing Face of Imperialism, ed. S. Sen and M. C. Marcuzzo (Delhi: Routledge, 2018).

- ↩ Phyllis Deane, The First Industrial Revolution (Cambridge: Cambridge University Press, 1965).

- ↩ Deane and Cole, British Economic Growth.

- ↩ See Table B.2 in Utsa Patnaik, “New Estimates of Eighteenth Century British Trade and Their Relation to Transfers from Tropical Colonies,” in The Making of History: Essays Presented to Irfan Habib, ed. K. N. Panikkar, T. J. Byres, and Utsa Patnaik (Delhi: Tulika, 2000).

- ↩ Simon Kuznets, “Foreign Trade: Long-term Trends,” Economic Development and Cultural Change 15, no. 2, part 2 (January 1967). Though he put “special trade” against the Deane and Cole figures, he did not explain what “special trade” meant.

- ↩ Utsa Patnaik, “Misleading Trade Estimates in Historical and Economic Writings,” in Excursus in History: Essays on Some Ideas of Irfan Habib, ed. Prabhat Patnaik (Delhi: Tulika, 2011).

- ↩ Backhouse and J. O. P. Bland, Annals and Memoirs of the Court of Peking (Boston: Houghton Mifflin, 1914), 322–31.

- ↩ Ricardo’s theory serves a very useful apologetic function for advanced countries by obfuscating the reality of possible adverse welfare outcome for the less developed country obliged to trade for extra-economic reasons. I. Kravis, in his “Availability and Other Influences on the Commodities Composition of Trade,” Journal of Political Economy LXIV (April 1956), had provided an alternative theory to comparative advantage, but he did not critique Ricardo’s theory adequately.

- ↩ Samuelson’s “linear programming” interpretation of Ricardo, in which, with free trade, the vector of world output (namely for all the trading countries together) increases, is obviously not valid in a situation where (taking just two countries) one country cannot produce one good at all. If the production of this good in the other country is constrained by the non-augmentability of fully used-up land area, then the total “world” output of this good will remain unchanged after trade, while that of the other will contract; this was the case with colonial trade. Paul A. Samuelson, “A Modern Treatment of the Ricardian Economy: I. The Pricing of Goods and of Labor and Land Services,” Quarterly Journal of Economics 73, no. 1 (February 1959): 1–35. For a critique, see Utsa Patnaik, “Ricardo’s Fallacy,” in The Pioneers of Development Economics, ed. K. S. Jomo (Delhi: Tulika, 2005).

- ↩ Estimated by Utsa Patnaik in “The Free Lunch,” using data from B. R. Mitchell and Phyllis Deane, Abstract of British Historical Statistics (Cambridge: Cambridge University Press, 1962).

- ↩ Maddison, The World Economy.

- ↩ See Utsa Patnaik, “The Free Lunch.”

- ↩ Davis, The Industrial Revolution and British Overseas Trade. Calculated from Davis, statistical appendix to The Industrial Revolution and British Overseas Trade. See Utsa Patnaik, “India’s Global Trade and Britain’s International Dominance,” in The Changing Face of Imperialism, ed. Sunanda Sen and Maria Cristina Marcuzzo (Delhi: Routledge, 2018).

- ↩ H. Imlah, Economic Elements in the Pax Britannica: Studies in British Foreign Trade in the Nineteenth Century (Cambridge: Harvard University Press, 1958).

- ↩ See Utsa Patnaik, “The Free Lunch.”

- ↩ Imports are taken here at free on board values, namely values at port of origin, thus attributing freight, insurance, and commission as incomes to Britain. This figure is therefore lower than that mentioned in an earlier estimate.

- ↩ While our procedure for calculating the present value of the “drain” (D) for say a five-year period should ideally have been D = [d1(1+r)T-1+d2(1+r)T-2+….d5(1+r)T-5], where T is the date to which the sum is being calculated, we use the shortcut of taking D as [(d1+d2+…d5)](1+r)T-3, since year 3 is the midpoint of the period.

- ↩ Quoted in Dutt, Economic History of India, vol. 1, 285. At Martin’s 12 percent interest rate, the drain from 1765 to 1836 alone, by 1947 would amount to £5200 trillion (compare with 1947 GDP of the United Kingdom of £10.5 billion).

- ↩ Quoted in Dutt, Economic History of India, vol. 1, 285.

- ↩ Up to 1874, the exchange rate was close to £1 = ₹10, so the figures in the first column in Rs. crores give the value in £million. For the second column £1= ₹15 will give a rough idea of the sterling equivalent.

- ↩ Irfan Habib, Essays in Indian History (Delhi: Tulika,1995).

- ↩ Reverse Councils were bills payable in sterling against rupees tendered for imports in India, but other than two years after the First World War, since India always posted export surplus, the net flow was of Council Bills.

- ↩ de Cecco, The International Gold Standard: Money and Empire (New York: St. Martin’s, 1984).

- ↩ Panandikar, Some Economic Consequences of the War for India (Bombay, 1921), 203.

- ↩ I. Levkovsky, Capitalism in India: Basic Trends in Its Development (Delhi: People’s Publishing House, 1966), 96–97, quoting Panandikar, Some Economic Consequences of the War for India.

- ↩ Dutt, Economic History of India, vol. 2, 154–55.

- ↩ Some writers have ignored the specificity of the macroeconomics of a colonized economy subject to such a drain, and therefore they were misled into applying standard reasoning to it. K. N. Chaudhury, “Foreign Trade and the Balance of Payments 1757–1947,” in Cambridge Economic History of India, ed. Kumar, for instance, says that India’s export surplus should have given rise to foreign trade multiplier effects. In fact, however, since the export surplus was matched by a budgetary surplus (with the drain items being shown in both cases to balance the accounts), and the overwhelming bulk of the tax burden fell on the working people, especially the peasantry, whose savings propensity was negligible, the aggregate demand in the colony, even following Keynesian reasoning, would not increase with the size of the drain. In addition, since exports were of products that were grown on the limited tropical landmass, products whose particular output rather than the level of aggregate demand determined overall employment and output in the economy, the export surplus would have a deflationary effect. See Prabhat Patnaik, “On the Macroeconomics of a Colonial Economy,” in Excursus in History for a critique.

- ↩ Bhattacharya, The Financial Foundations of the British Raj.

Go to Original – monthlyreview.org

Tags: Asia, British Colonialism, Colonialism, Colonization, East India Company, English Colonialism, Europe, India, South Asia

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.