The Financial Bubble Era Comes Full Circle

ECONOMICS, 11 Jul 2022

Matt Taibbi | TK News - TRANSCEND Media Service

An Unstable Encounter with a $50 Billion Stablecoin

9 Jul 2022 – I spent much of the last month researching the #CryptoCrash, and the last week and a half engaged in an increasingly maddening search for a civilized and respectful way to write about one particular actor: Circle Internet Financial, makers of USDC, at $55 billion the second-biggest stablecoin in the world.

I’m giving up the hunt for “civilized and respectful.” That dog lived a long life, but it now must be taken out and shot. I’ve dealt with many frustrating institutions, from Bank of America to the press office of the FSB, but none produced such headaches. They’re the mother of all black boxes, and God help anyone invested in them.

Trouble started with one question. On April 12, Circle announced it had raised $400 million with investments from BlackRock, Fidelity, Marshall Wace and Fin Capital, noting BlackRock and Circle had entered into a “broader strategic partnership” that would include “exploring capital market applications for USDC” that would “drive the next evolution of Circle’s growth.” This would involve the establishment of a new, BlackRock-managed, government money market fund, the Circle Reserve Fund, through which BlackRock would become “a primary asset manager of USDC cash reserves.”

Sources called with concerns. The fund’s registration statement says “shares are only available for purchase by Circle Internet Financial, LLC.” Not only is this unusual — one legal expert I spoke with said he’d “never seen such a fund… available for sale solely to a single entity” — but it raised a potentially troublesome issue for USDC holders. If Circle is to be the sole counterparty to a reserve fund, that would mean reserves would belong to the company, not its users. This could raise the same issue that recently dogged its partner, the digital exchange Coinbase, when it revealed in an SEC filing that “In the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors.”

The firm insisted “your funds are safe with Coinbase,” but as noted in another story coming out today, the damage was done, and the news triggered market mayhem. Coinbase isn’t the same kind of company as Circle, but the issue of bankruptcy remoteness is relevant to both. It’s at the core of the whole dilemma of the cryptocurrency markets. Certainly the question of who actually owns and controls reserve assets exists, or seems to exist. Here Circle is unlike some competitors, whose user agreements specifically spell out that reserves are, say, “fully backed by US dollars held by Paxos Trust Company, LLC,” or “custodied pursuant to the Custody Agreement entered into by and between you and Gemini Trust Company, LLC.” Those describe trust agreements, which are truly bankruptcy remote.

Circle’s BlackRock fund suggested a different arrangement. Also, the new fund would be “permitted to invest up to one-third of its total assets in reverse repurchase agreements.” Would Circle be making use of that provision?

After 2008, we learned some firms really hated being boring old depository banks, because regulators didn’t allow them to do anything really risky with giant sums of customer cash they held that could easily earn huge returns at scale. It’s like walking into a casino with a trillion dollars in chips and being barred from all the really fun tables. This is how the so-called “London Whale” episode took place. A wing of JP Morgan Chase called the Chief Investment Office, whose ostensible purpose was to reduce risk at the company, started to make enormous returns of $400 million or more on trades its officers didn’t feel were directional bets at all, but hedges. The company felt these trades were only sort of risky. “We believed that what we were doing at the time was consistent with [American accounting practices],” is how one executive later described their attitude.

Then those “hedges” turned into giant suckholes of loss, and instead of unwinding them, the bank doubled down, and next thing you knew, they had a $12 billion bomb crater and Elizabeth Warren was screaming at an eye-rolling Jamie Dimon on television.

After 2008, remember, Chase had the reputation of being Wall Street’s “good bank,” or at least the non-stupid one, with the New York Times even describing Dimon as Barack Obama’s “favorite banker.” But the London Whale episode revealed the company’s extreme impatience with the idea that they owed it to anybody, either regulators or depositors, to refrain from engaging in certain types of risky behavior. This impatience was written all over executives’ faces at subsequent Senate hearings.

The big tell, always, is when finance executives start giving what one analyst described to me as “nuanced answers to yes and no questions.” In the Whale episode, Michigan Senator Carl Levin had to ask repeatedly if the bank had lied when it said in a public conference call that the chief banking regulator, the OCC, was getting data about those infamous trades on a “regular and recurring basis.” Chase Vice Chairman Douglas Braunstein kept talking around the question, first saying “I believed it to be a true statement at the time” that the bank was being “fully transparent” with regulators, then hedging again and again and again, before finally conceding, “They did not get the detailed positions regularly.”

Getting back to Circle, I reached out with simple questions. Do USDC holders bear bankruptcy risk, or not? Will they be making money lending their reserves or not? The firm at first was solicitous and seemed anxious to educate about their company structure. Then the answers became contradictory. Then they became “nuanced.” Finally there was so much spin, the company’s name began to make unpleasantly ironic sense.

For instance, Circle “is not a trust,” but believes it holds funds in trust; USDC both is and is not a virtual currency (it may be a “stored value product”); and in the unlikely event of a bankruptcy, USDC holders would be “shielded from Circle creditors,” although nothing is bullet-proof and of course there’s risk. How are USDC holders shielded from Circle creditors and “separated from a bankruptcy estate”? According to the firm, customers first of all are guarded “per the protections afforded under state money transmission laws.”

Without being cheeky, this is a little like saying the DMV is making sure you’re driving safely. Moreover, Circle is only regulated in the states where Circle has licenses, and the firm has obtained licenses only in those states were licenses are required (what happens to USDC holders in Wisconsin, Minnesota, and Wyoming, for instance?). Beyond that, by their own public admission, “not all states in which we are licensed regulate virtual currency activity as money transmission.”

Regarding the BlackRock fund’s provision allowing them to borrow up to a third of the reserves, I learned that government money market funds typically do not borrow, but also that the company would enjoy access to the Fed and its repo borrowing program.

The dealbreaker came after reading Circle’s User Agreement, which contains the following passage:

Circle is not a fiduciary, and Circle does not provide any trust or fiduciary services to any User in the course of such User visiting, accessing, or using the Circle website or services.

I had reason to be surprised to learn that Circle is not a fiduciary and does not provide any trust or fiduciary services. When I expressed that surprise to a Circle spokesperson, recalling certain recent communications involving the exact word, “fiduciary,” their response was:

The paragraph cited from the Circle Account User Agreement refers to Circle’s custody of supported digital assets in a Circle-hosted wallet, and does not relate to USDC reserves management.

Answers don’t get much more “nuanced” than this. The company was now saying Circle is not a fiduciary, and does not provide any trust or fiduciary services to anyone visiting, accessing, or using the Circle website or services, unless those services involve the company’s management of USDC reserves. In that case, the firm does believe it has a fiduciary responsibility with respect to reserve funds, as required by state law, ostensibly in those states where Circle both has a license and virtual currency is regulated as money transmission.

Asked where exactly its reserves are right now, the company replied:

As we have shared publicly, the cash portion of the reserve is held with a number of banking partners, including Silvergate Bank, Signature Bank and New York Community Bank. The US Treasury bills are purchased by BlackRock, and are held in custody at BNYMellon. We have not published a detailed breakdown of how much cash is held with which bank partner. We are working with many leading banks to onboard them and add them to our group of partners.

This is a non-answer. Circle discloses where some of its reserves are, but not all, and not how much of what is where. Now, Circle separately features a Yield program, which offers guaranteed returns. These were never as high as Terra’s preposterous and obviously Ponzoid 20% guaranteed returns, which quickly attracted $60 billion that vanished even more quickly, but the program exists nonetheless, at one time offering 12-month yields as high as 10.75%.

In the time it’s taken to write this piece the guaranteed return has dropped from 6% to 1% to 0.5%. In characteristic fashion, Circle’s web page on the subject contains both the incorrect statement, “Circle Yield’s interest rates offer superior returns compared to traditional fixed-income investments” like 1 month CDs and 8-week T-bills — this is no longer true — and the correct statement, “In comparison to traditional fixed-income investments, products like Circle Yield can offer superior returns.”

The company maintains that the program is relatively small, that there “is currently less than $300M in loan volume outstanding for the Circle Yield program,” and “no ‘exposure,’ as we are over-collateralized at 125%.” (It is “over-collateralized” by plummeting Bitcoin). All the same, the company began this past Tuesday, July 5 to allow customers with active loans to withdraw funds from Circle Yield before the conclusion of those loans, with no penalty, until August 2, 2022 at 11:59PM ET. Asked why they did this, the firm said:

There is currently much uncertainty in the digital asset lending and borrowing markets. Circle Yield is a regulated, 125% overcollareralized, fixed-term product, offered to businesses only, and has performed as designed during these turbulent times, with borrower margin calls being met in a timely fashion to sustain the 125% overcollaterlization. However, we recognize that our customers might wish to withdraw their assets entirely from these markets at this extraordinary time… We have made a one-time change to the legal product structure to enable all our customers to withdraw their funds if they so wish during this time of uncertainty.

Make of that what you will. Meanwhile, the firm also believes federal bankruptcy laws should protect USDC holders, but this belief depends on the notion, which Circle states for the record, that “USDC reserves are held in segregated accounts for the benefit of USDC holders, not Circle,” and “USDC reserve funds are held for the benefit of USDC token holders,” because “Circle does not and will not use USDC holders’ money to run its business or pay its debts.”

If Circle does not and will not use USDC holders’ money to run its business, how is it projecting to earn $438 million in revenues from its USDC reserves this year, and over $2.188 billion next year? Again, is USDC a utility-like product content to earn little caring for giant piles of money, or more like a profiteering financial firm that earns money creatively leveraging up its assets? This raises another question that first came up last year. If Circle is holding its reserves in segregated accounts strictly for the benefit of customers, why was it, at least at one time, keeping a not-insignificant portion of its reserves in commercial paper and instruments like Yankee CDs?

Last summer, after Allaire announced plans to go public via a $4.5 billion SPAC deal, Coinbase said that all of its USDC holdings were “backed by a dollar in a bank account.” As Bloomberg wrote, the promise “was important for the stablecoin, which unlike Bitcoin has a set price and can be redeemed by users for regular currency.”

However, after being contacted in August by Bloomberg reporter Joe Light, Coinbase president Emilie Choi began issuing a series of amended statements on Twitter, for instance: “We know that a lot of customers get USDC on Coinbase, and we previously said that every USDC is ‘backed by a dollar in a bank account.’ Our language could have been clearer here.”

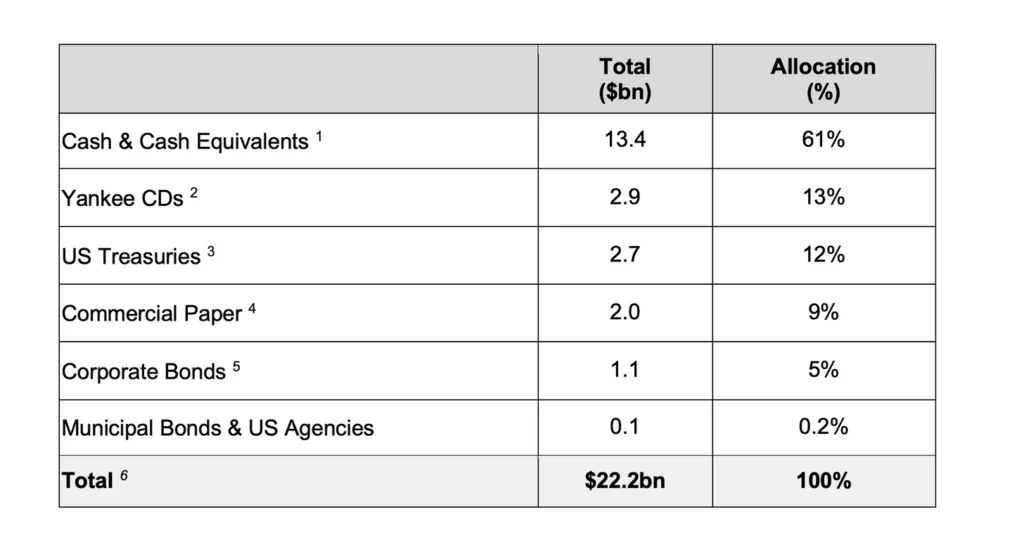

Circle then said that it had been backed entirely by cash until March, 2021, when it began to buy U.S. Treasuries to “accommodate the coin’s rapid growth,” as Bloomberg wrote. In fact, the very first time that Circle made a major disclosure in describing its reserve assets, releasing in July of 2021 an attestation by what one former regulator chucklingly called a “grownup” auditor Grant Thornton, it turned out only 61% of its reserves were in cash, with a surprisingly high amount held in riskier or less liquid investments like corporate bonds and commercial paper:

A spokesperson for the company also said that, as the news outlet put it, “the coin’s reserves moved to a broader portfolio of investments in May 2021.” In other words, by a seemingly extraordinary coincidence, Circle only branched out into riskier investments in the exact month before its first major audit-like disclosure, and just before Bloomberg ran a story saying that the “backed by a dollar in a bank account” representation was “not true.”

The response was brutal. “You can’t market a product with falsities,” Columbia Law School lecturer Lev Menand told Light. Such companies “say trust us and that’s all well and good until there’s a problem,” was how Georgetown professor Adam Levitin put it.

Circle from there began to make new gestures toward transparency, publishing regular attestations from Grant Thornton, each of which appeared to show moves away from riskier holdings and toward cash and short-term treasuries. For example, in July, 2021, Grant Thornton attested that 47% of the assets backing USDC were cash and cash equivalents, while 16% were in corporate bonds, and 8% were in commercial paper. Within a month the auditor was saying 100% of Circle’s reserves were “cash and cash equivalents,” although “Circle Internet Financial, LLC’s management is responsible for its assertions.” Then in early December, when Allaire testified before congress, he said (emphasis mine):

The dollar-denominated reserves backing USDC are held conservatively in the care, custody and control of the U.S. regulated banking system. These are strictly held in cash and short-duration U.S. treasuries and we have consistently reported on the status of these reserves and their sufficiency to meet demands for USDC outstanding with third party attestations from a leading global accounting firm.

Strictly speaking, this wasn’t true. Circle had indeed reported on its reserves, but hadn’t done so in detail until that spring of 2021, when it announced a sudden move into riskier investments. The Grant Thornton attestations soon after began dropping the detailed breakdowns from its reports, and moreover tweaked its language from saying reserve accounts were “correctly stated” to “fairly stated.” These reports include the curious lines, “Circle Internet Financial LLC’s management is responsible for its assertion,” and “Individuals who acquire and utilize USDC tokens and other crypto assets are responsible for informing themselves of the general risks and uncertainties.” The firm in its most recent “report” used the word “opinion” four times and “audit” zero times. Grant Thornton did not respond to requests for clarification as to whether or not they consider these reports audits, though the company, Circle, considers itself audited.

Circle’s rep has always been as the good crypto, not a target of armies of short-sellers like Tether. As far back as 2018, it made news by ostensibly seeking to become the “first cryptocurrency company to obtain a banking license,” and the company over the years has emphasized that it is “focused on providing even greater transparency, quality and scale for USDC reserves,” because “trust and transparency are our ultimate goals.” Four years after it first declared its intention to be the first coin with a bank license we’re still reading headlines like, “Circle Will Apply for U.S. Crypto Bank Charter in ‘Near Future,’” in the hopes now of becoming the fourth stablecoin to get licensed. The company does not believe current law allows it to become a bank, but similar companies didn’t seem to have had a problem.

None of this has dented Circle’s momentum or reputation. In fact, in mid-February, Circle and its partner, Bob Diamond’s Concord Acquisition Corporation, announced they were doubling the size of their SPAC (click here for a TK video refresher on what a SPAC is). The February agreement set the value of the new Concord-Circle deal at a whopping $9 billion, with a big chunk of that value, they said, coming from the booming success of USDC in the marketplace:

The new agreement… reflects improvements in Circle’s financial outlook and competitive position – particularly the growth and market share of USDC, one of the fastest growing dollar digital currencies. USDC’s circulation has more than doubled… reaching $52.5 billion as of February 16, 2022.

Diamond is perhaps best known for bringing American-style huge CEO compensation to Europe, and for stepping down as Barclays chief after Britain levied a then-record $92.7 million fine for manipulating the LIBOR interest rate benchmark. Less-well-remembered is his role in the largest bankruptcy in history, Lehman Brothers, an episode I wrote about in The Divide. After Barclays acquired the shipwrecked firm for pennies in September of 2008, the bank’s creditors sued, claiming Barclays absconded with between $4 and $7.6 billion in funds owed to them through a variety of schemes. The creditors mostly lost that case, which was eventually settled for $1.28 billion. This is relevant because the question of whether or not USDC reserves are truly bankruptcy remote is central to this story. Asked about this, Circle replied, “We are delighted by the support and involvement of all of our shareholders.”

Meanwhile, the players from the Circle side have their own history. Jeremy Allaire and at least one other future Circle officer were accused in 2002 of making misleadingly positive statements about a failing product called Spectra while selling “over $53,000,000.00” of stock in their company, Allaire Corporation, in the first three quarters of 2000. In August of 2000, Allaire was asked about an annual goal of 100% growth, and reportedly said, “We definitely think that is achievable.” A month later, the company announced a substantial third quarter loss, and its share price dropped 40% in three days, prompting the action.

Massachusetts District Judge William Young used remarkably strong language to reject a motion to dismiss the suit, saying, “It is difficult to conceive of a complaint pled with more particularity than the one presented,” and “in many respects, if this complaint is not specific enough, no complaint is.” He added:

Essentially, the Plaintiffs invested in a company which promised to build the best mousetrap ever. When it was done, the mousetrap was ugly, did not catch mice, and, as word got out, people stopped buying.

The case was eventually settled for $12 million, without an admission of wrongdoing. In conversations with former regulators, some raised a question as to whether or not the Allaire Corporation case might prevent Circle officers from ever obtaining a banking license, given that charters are only given to persons of “good character and responsibility.” Opinions on the matter were very mixed. However, it was certainly not a non-issue.

“Any case involving alleged fraud will be a matter of great concern to the banking regulators,” said former FDIC General Counsel Mike Krimminger. “If there were a settlement with no admission of guilt, there might be explanation that could be acceptable to regulators, but it will still be a real concern that could be fatal to an application.”

In any case, when asked this week why that old story shouldn’t make investors in a different, newer mousetrap nervous, a Circle spokesperson replied:

The case settled without any finding of wrongdoing… The defendants disputed the factual allegations, and as with the vast majority of securities class actions, the case settled. The factual allegations were never tested in court, and there is really nothing more to say about this 20 year old case.

In 2008, when reporters and investigators began pulling at the threads of terms like “fully hedged” or “triple-A tranche,” they often found there was almost no way to stop pulling, even if they wanted to. In fact, by the time people stopped pulling, the entire global financial system was basically a pile of string. It may very well be that the same experience awaits anyone who pulls at threads like “100% backed” or “secure wallet” or other such catch-phrases from any one of dozens of crypto companies. In other words, these issues may not be unique to Circle. But make no mistake: this is the definition of an “opaque ledger.” If every crypto company will struggle this badly to answer basic questions like Where’s your money? or What’s your risk?, the storm hasn’t even started yet.

______________________________________________

Matthew C. Taibbi is an American author, journalist, and podcaster. He has reported on finance, media, politics, and sports. He is a contributing editor for Rolling Stone, author of several books, a winner of the National Magazine Award for commentary, co-host of Useful Idiots, and publisher of a newsletter on Substack.

Matthew C. Taibbi is an American author, journalist, and podcaster. He has reported on finance, media, politics, and sports. He is a contributing editor for Rolling Stone, author of several books, a winner of the National Magazine Award for commentary, co-host of Useful Idiots, and publisher of a newsletter on Substack.

Go to Original – taibbi.substack.com

Tags: Banksters, Capitalism, Cryptocurrency, Economics, Elites, Finance, Mafia, Wall Street

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.