Nuclear Power in India

ENERGY, 12 Jan 2015

World Nuclear Association – TRANSCEND Media Service

Updated 31 December 2014

- India has a flourishing and largely indigenous nuclear power program and expects to have 14,600 MWe nuclear capacity on line by 2020. It aims to supply 25% of electricity from nuclear power by 2050.

- Because India is outside the Nuclear Non-Proliferation Treaty due to its weapons program, it was for 34 years largely excluded from trade in nuclear plant or materials, which has hampered its development of civil nuclear energy until 2009.

- Due to earlier trade bans and lack of indigenous uranium, India has uniquely been developing a nuclear fuel cycle to exploit its reserves of thorium.

- Since 2010, a fundamental incompatibility between India’s civil liability law and international conventions limits foreign technology provision.

- India has a vision of becoming a world leader in nuclear technology due to its expertise in fast reactors and thorium fuel cycle.

India’s primary energy consumption more than doubled between 1990 and 2011 to nearly 25,000 PJ. India’s dependence on imported energy resources and the inconsistent reform of the energy sector are challenges to satisfying rising demand.

Electricity demand in India is increasing rapidly, and the 1128 billion kilowatt hours (TWh) gross produced in 2012 was more than triple the 1990 output, though still represented only some 750 kWh per capita for the year. With large transmission losses – 193 TWh (17%) in 2012, this resulted in only about 869 billion kWh consumption. Gross generation comprised 801 TWh from coal, 94 TWh from gas, 23 TWh from oil, 33 TWh from nuclear, 126 TWh from hydro and 50 TWh from other renewables. Coal provides more than two-thirds of the electricity at present, but reserves are effectively limited* – in 2013, 159 million tonnes was imported, and 533 million tonnes produced domestically. The per capita electricity consumption figure is expected to double by 2020, with 6.3% annual growth, and reach 5000-6000 kWh by 2050, requiring about 8000 TWh/yr then. There is an acute demand for more and more reliable power supplies. One-third of the population is not connected to any grid.

* Quoted resources are 293 billion tonnes, but much of this is in forested areas of eastern India – Jharkhand, Orissa, Chhattisgarh, and West Bengal. While the first three of these are the main producing states, nevertheless permission to mine is problematical and infrastructure limited.

At mid-2012, 203 GWe was on line with 20.5 GWe having been added in 12 months. In September 2012 it had 211 GWe. The government’s 12th five-year plan for 2012-17 is targeting the addition of 94 GWe over the period, costing $247 billion. Three quarters of this would be coal- or lignite-fired, and only 3.4 GWe nuclear, including two imported 1000 MWe units planned at one site and two indigenous 700 MWe units at another. By 2032 total installed capacity of 700 GWe is planned to meet 7-9% GDP growth, and this was to include 63 GWe nuclear. The OECD’s International Energy Agency predicts that India will need some $1600 billion investment in power generation, transmission and distribution to 2035.

India has five electricity grids – Northern, Eastern, North-Eastern, Southern and Western. All of them are interconnected to some extent, except the Southern grid. All are run by the state-owned Power Grid Corporation of India Ltd (PGCI), which operates more than 95,000 circuit km of transmission lines. In July 2012 the Northern grid failed with 35,669 MWe load in the early morning, and the following day it plus parts of two other grids failed again so that over 600 million people in 22 states were without power for up to a day.

A KPMG report in 2007 said that transmission and distribution (T&D) losses were worth more than $6 billion per year. A 2012 report costed the losses as $12.6 billion per year. A 2010 estimate shows big differences among states, with some very high, and a national average of 27% T&D loss, well above the target 15% set in 2001 when the average figure was 34%. Installed transmission capacity was only about 13% of generation capacity.

India’s priority is economic growth and to alleviate poverty. The importance of coal means that CO2 emission reduction is not a high priority, and the government has declined to set targets ahead of the 21st Conference of the Parties on Climate Change to be held in Paris in 2015. The environment minister in September 2014 said it would be 30 years before India would be likely to see a decrease in CO2 emissions.

Nuclear power

NPCIL supplied 35 TWh of India’s electricity in 2013-14 from 5.3 GWe nuclear capacity, with overall capacity factor of 83% and availability of 88%. Some 410 reactor-years of operation had been achieved to December 2014. India’s fuel situation, with shortage of fossil fuels, is driving the nuclear investment for electricity, and 25% nuclear contribution is the ambition for 2050, when 1094 GWe of base-load capacity is expected to be required. Almost as much investment in the grid system as in power plants is necessary.

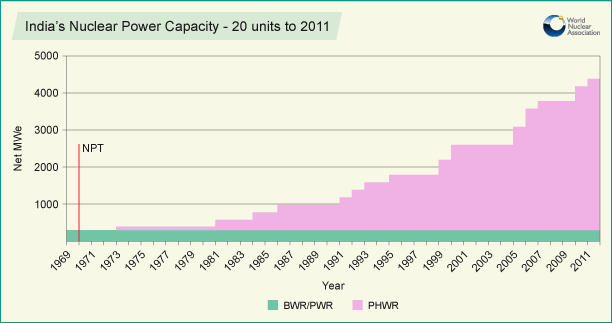

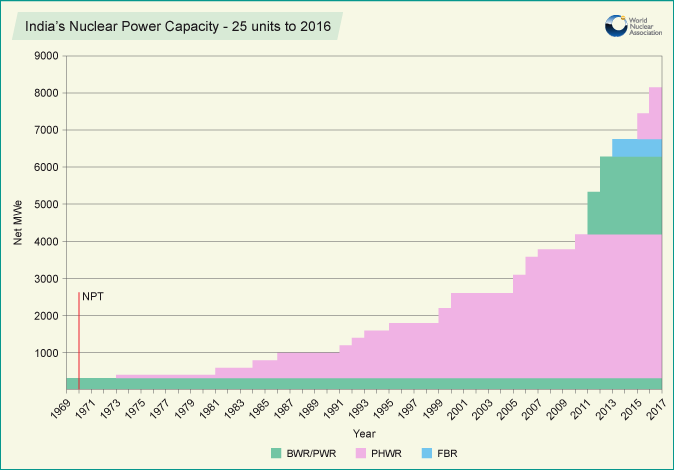

The target since about 2004 has been for nuclear power to provide 20 GWe by 2020, but in 2007 the Prime Minister referred to this as “modest” and capable of being “doubled with the opening up of international cooperation.” However, it is evident that even the 20 GWe target would require substantial uranium imports. In June 2009 NPCIL said it aimed for 60 GWe nuclear by 2032, including 40 GWe of PWR capacity and 7 GWe of new PHWR capacity, all fuelled by imported uranium. This 2032 target was reiterated late in 2010 and increased to 63 GWe in 2011. But in December 2011 parliament was told that more realistic targets were 14,600 MWe by 2020-21 and 27,500 MWe by 2032, relative to present 4780 MWe and 10,080 MWe when reactors under construction were on line in 2017.*

* “the XII Plan [2012-17] proposals are being finalized which envisage start of work on eight indigenous 700 MW Pressurised Heavy Water Reactors (PHWRs), two 500 MW Fast Breeder Reactors (FBRs), one 300 MW Advanced Heavy Water Reactor (AHWR) and eight Light Water Reactors of 1000 MW or higher capacity with foreign technical cooperation. These nuclear power reactors are expected to be completed progressively in the XIII and XIV Plans.”

The 16 PHWRS and LWRs are expected to cost $40 billion. The eight 700 MWe PHWRs would be built at Kaiga in Karnataka, Gorakhpur in Haryana’s Fatehabad District, Banswada in Rajasthan, and Chutka in Madhya Pradesh.

In July 2014 the new Prime Minister urged DAE to triple the nuclear capacity to 17 GWe by 2024. He praised “India’s self-reliance in the nuclear fuel cycle and the commercial success of the indigenous reactors.” He also emphasized the importance of maintaining the commercial viability and competitiveness of nuclear energy compared with other clean energy sources.

After liability legislation started to deter foreign reactor vendors, early in 2102 the government said it wanted to see coal production increase by 150 Mt/yr (from 440 Mt/yr) to support 60 GWe new coal-fired capacity to be built by 2015. This would involve Rs 56 billion new investment in rail infrastructure.

Longer term, the Atomic Energy Commission however envisages some 500 GWe nuclear on line by 2060, and has since speculated that the amount might be higher still: 600-700 GWe by 2050, providing half of all electricity. Another projection is for nuclear share to rise to 9% by 2037.

Other energy information for India: US Energy Information Administration Analysis Brief on India

Indian nuclear power industry development

Nuclear power for civil use is well established in India. Since building the two small boiling water reactors at Tarapur in the 1960s, its civil nuclear strategy has been directed towards complete independence in the nuclear fuel cycle, necessary because it is excluded from the 1970 Nuclear Non-Proliferation Treaty (NPT) due to it acquiring nuclear weapons capability after 1970. (Those five countries doing so before 1970 were accorded the status of Nuclear Weapons States under the NPT.)

As a result, India’s nuclear power program has proceeded largely without fuel or technological assistance from other countries (but see later section). The pressurised heavy-water reactor (PHWR) design was adopted in 1964, since it required less natural uranium than the BWRs, needed no enrichment, and could be built with the country’s engineering capacity at that time – pressure tubes rather than a heavy pressure vessel being involved. Its power reactors to the mid-1990s had some of the world’s lowest capacity factors, reflecting the technical difficulties of the country’s isolation, but rose impressively from 60% in 1995 to 85% in 2001-02. Then in 2008-10 the load factors dropped due to shortage of uranium fuel.

India’s nuclear energy self-sufficiency extended from uranium exploration and mining through fuel fabrication, heavy water production, reactor design and construction, to reprocessing and waste management. It has a small fast breeder reactor and is building a much larger one. It is also developing technology to utilise its abundant resources of thorium as a nuclear fuel.

The Atomic Energy Establishment was set up at Trombay, near Mumbai, in 1957 and renamed as Bhabha Atomic Research Centre (BARC) ten years later. Plans for building the first Pressurised Heavy Water Reactor (PHWR) were finalised in 1964, and this prototype – Rajasthan 1, which had Canada’s Douglas Point reactor as a reference unit, was built as a collaborative venture between Atomic Energy of Canada Ltd (AECL) and NPCIL. It started up in 1972 and was duplicated Subsequent indigenous PHWR development has been based on these units, though several stages of evolution can be identified: PHWRs with dousing and single containment at Rajasthan 1-2, PHWRs with suppression pool and partial double containment at Madras, and later standardized PHWRs from Narora onwards having double containment, suppression pool, and calandria filled with heavy water, housed in a water-filled calandria vault.

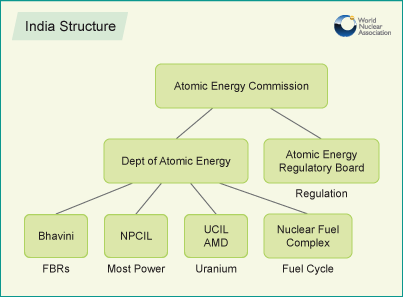

The Indian Atomic Energy Commission (AEC) is the main policy body.

The Nuclear Power Corporation of India Ltd (NPCIL) is responsible for design, construction, commissioning and operation of thermal nuclear power plants. At the start of 2010 it said it had enough cash on hand for 10,000 MWe of new plant. Its funding model is 70% equity and 30% debt financing. However, it is aiming to involve other public sector and private corporations in future nuclear power expansion, notably National Thermal Power Corporation (NTPC) – see subsection below. NTPC is very much larger than NPCIL and sees itself as the main power producer. NTPC is largely government-owned. The 1962 Atomic Energy Act prohibits private control of nuclear power generation, though it allows minority investment. As of late 2010 the government had no intention of changing this to allow greater private equity in nuclear plants.

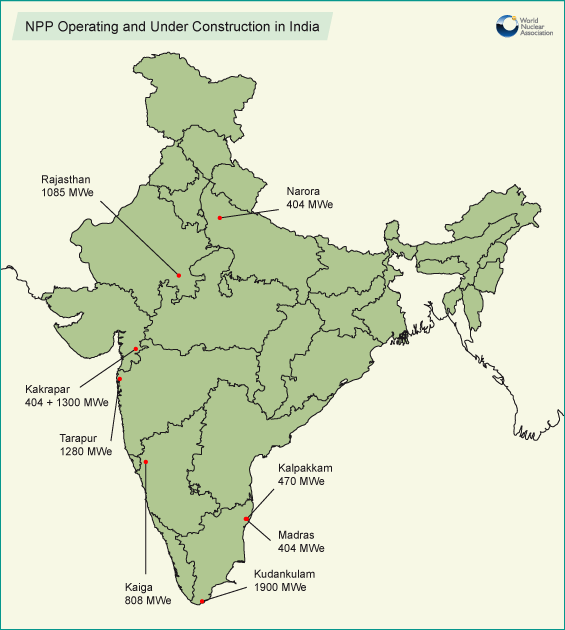

India’s operating nuclear power reactors:

| Reactor | State | Type | MWe net, each | Commercial operation | Safeguards status* |

| Tarapur 1&2 | Maharashtra | GE BWR | 150 | 1969 | Item-specific, Oct 2009 |

| Kaiga 1&2 | Karnataka | PHWR | 202 | 1999, 2000 | nil |

| Kaiga 3&4 | Karnataka | PHWR | 202 | 2007, 2012 | nil |

| Kakrapar 1&2 | Gujarat | PHWR | 202 | 1993, 1995 | December 2010 under new agreement |

| Madras 1&2 (MAPS) | Tamil Nadu | PHWR | 202 | 1984, 1986 | nil |

| Narora 1&2 | Uttar Pradesh | PHWR | 202 | 1991, 1992 | Due in 2014 under new agreement |

| Rajasthan 1&2 | Rajasthan | Candu PHWR | 90, 187 | 1973, 1981 | Item-specific, Oct 2009 |

| Rajasthan 3&4 | Rajasthan | PHWR | 202 | 1999, 2000 | March 2010 under new agreement |

| Rajasthan 5&6 | Rajasthan | PHWR | 202 | Feb & April 2010 | Oct 2009 under new agreement |

| Tarapur 3&4 | Maharashtra | PHWR | 490 | 2006, 2005 | nil |

| Kudankulam 1 | Tamil Nadu | PWR (VVER) | 917 | December 2014 | Item-specific, Oct 2009 |

| Total (21) | 5302 MWe |

Madras (MAPS) also known as Kalpakkam

Rajasthan/RAPS is located at Rawatbhata and sometimes called that

Kaiga = KGS, Kakrapar = KAPS, Narora = NAPS

* The safeguarded units to March 2014 are listed in the Annex to India’s Additional Protocol with IAEA. Tarapur 1&2 and Rajasthan 1&2 have INFCIRC/66 type, the others INFCIRC/754 type.

Nuclear reactors deployed in India

In December 2014 the 40% of nuclear capacity under safeguards was operating on imported uranium at rated capacity. The remainder, which relies on indigenous uranium, was operating below capacity, though the supply situation was said to be improving.

The two Tarapur150 MWe Boiling Water Reactors (BWRs) built by GE on a turnkey contract before the advent of the Nuclear Non-Proliferation Treaty were originally 200 MWe. They were down-rated due to recurrent problems but have run well since. They have been using imported enriched uranium (from France and China in 1980-90s and Russia since 2001) and are under International Atomic Energy Agency (IAEA) safeguards. However, late in 2004 Russia deferred to the Nuclear Suppliers’ Group and declined to supply further uranium for them. They underwent six months refurbishment over 2005-06, and in March 2006 Russia agreed to resume fuel supply. In December 2008 a $700 million contract with Rosatom was announced for continued uranium supply to them.

The two small Canadian (Candu) PHWRs at Rajasthan nuclear power plant started up in 1972 & 1980, and are also under safeguards. Rajasthan 1 was down-rated early in its life and has operated very little since 2002 due to ongoing problems and has been shut down since 2004 as the government considers its future. Rajasthan 2 was downrated in 1990. It had major refurbishment 2007-09 and has been running on imported uranium at full capacity.

The 220 MWe PHWRs (202 MWe net) were indigenously designed and constructed by NPCIL, based on a Canadian design. The only accident to an Indian nuclear plant was due to a turbine hall fire in 1993 at Narora, which resulted in a 17-hour total station blackout. There was no core damage or radiological impact and it was rated 3 on the INES scale – a ‘serious incident’.

The Madras (MAPS) reactors were refurbished in 2002-03 and 2004-05 and their capacity restored to 220 MWe gross (from 170). Much of the core of each reactor was replaced, and the lifespans extended to 2033/36.

Kakrapar unit 1 was fully refurbished and upgraded in 2009-10, after 16 years operation, as was Narora 2, with cooling channel (calandria tube) replacement.

Following the Fukushima accident in March 2011, four NPCIL taskforces evaluated the situation in India and in an interim report in July made recommendations for safety improvements of the Tarapur BWRs and each PHWR type. The report of a high-level committee appointed by the Atomic Energy Regulatory Board (AERB) was submitted at the end of August 2011, saying that the Tarapur and Madras plants needed some supplementary provisions to cope with major disasters. The two Tarapur BWRs have already been upgraded to ensure continuous cooling of the reactor during prolonged station blackouts and to provide nitrogen injection to containment structures, but further work is recommended. Madras needs enhanced flood defences in case of tsunamis higher than that in 2004. The prototype fast breeder reactor (PFR) under construction next door at Kalpakkam has defences which are already sufficiently high, following some flooding of the site in 2004.

The Tarapur 3&4 reactors of 540 MWe gross (490 MWe net) were developed indigenously from the 220 MWe (gross) model PHWR and were built by NPCIL. The first – Tarapur 4 – was connected to the grid in June 2005 and started commercial operation in September. Tarapur 4’s criticality came five years after pouring first concrete and seven months ahead of schedule. Its twin – unit 3 – was about a year behind it and was connected to the grid in June 2006 with commercial operation in August, five months ahead of schedule. Tarapur 3 & 4 cost about $1200/kW, and are competitive with imported coal.

Future indigenous PHWR reactors will be 700 MWe gross (640 MWe net). The first four are being built at Kakrapar and Rajasthan. They are due on line by 2017 after 60 months construction from first concrete to criticality. Cost is quoted at about Rs 12,000 crore (120 billion rupees) each, or $1700/kW. Up to 40% of the fuel they use will be slightly enriched uranium (SEU) – about 1.1% U-235, to achieve higher fuel burn-up – about 21,000 MWd/t instead of one third of this. Initially this fuel will be imported as SEU.

Kudankulam 1&2: Russia’s Atomstroyexport is supplying the country’s first large nuclear power plant, comprising two VVER-1000 (V-412) reactors, under a Russian-financed US$ 3 billion contract. A long-term credit facility covers about half the cost of the plant. The AES-92 units at Kudankulam in Tamil Nadu state have been built by NPCIL and also commissioned and operated by NPCIL under IAEA safeguards. The turbines are made by Silmash in St Petersburg. Unlike other Atomstroyexport projects such as in Iran, there have been only about 80 Russian supervisory staff on the job. Construction started in March 2002.

Russia is supplying all the enriched fuel through the life of the plant, though India will reprocess it and keep the plutonium*. The first unit was due to start supplying power in March 2008 and go into commercial operation late in 2008, but this schedule slipped by six years. In the latter part of 2011 and into 2012 completion and fuel loading was delayed by public protests, but in March 2012 the state government approved the plant’s commissioning and said it would deal with any obstruction. Unit 1 started up in mid-July 2013, was connected to the grid in October 2013 and entered commercial operation at the end of December 2014. It had reached full power in mid-year but then required turbine repairs, though it generated 2.8 TWh in its first year. Unit 2 is expected to start up in April 2015. Each is 917 MWe net.

* The original agreement in 1988 specified return of used fuel to Russia, but a 1998 supplemental agreement allowed India to retain and reprocess it.

While the first core load of fuel was delivered early in 2008 there have been delays in supply of some equipment and documentation. Control system documentation was delivered late, and when reviewed by NPCIL it showed up the need for significant refining and even reworking some aspects. The design basis flood level is 5.44m, and the turbine hall floor is 8.1m above mean sea level. The 2004 tsunami was under 3m.

A small desalination plant is associated with the Kudankulam plant to produce 426 m3/hr for it using four-stage multi-vacuum compression (MVC) technology. Another reverse osmosis (RO) plant is in operation to supply local township needs.

Kaiga 3 started up in February, was connected to the grid in April and went into commercial operation in May 2007. Unit 4 started up in November 2010 and was grid-connected in January 2011, but is about 30 months behind original schedule due to shortage of uranium. The Kaiga units are not under UN safeguards, so cannot use imported uranium.

Rajasthan 5 started up in November 2009, using imported Russian fuel, and in December it was connected to the northern grid. RAPP 6 started up in January 2010 and was grid connected at the end of March. Both are now in commercial operation.

Under plans for the India-specific safeguards to be administered by the IAEA in relation to the civil-military separation plan, eight further reactors were to be safeguarded (beyond Tarapur 1&2, Rajasthan 1&2, and Kudankulam 1&2): Rajasthan 3&4 from 2010, Rajasthan 5&6 from 2008, Kakrapar 1&2 by 2012 and Narora 1&2 by 2014.

India’s nuclear power reactors under construction:

| Reactor | Type | MWe gross, net, each |

Project control | Construction start | Commercial operation due | Safeguards status |

| Kudankulam 2 | PWR (VVER) | 1000, 917 | NPCIL | July 2002 | 2015 | item-specific, Oct 2009 |

| Kalpakkam PFBR | FBR | 500, 470 | Bhavini | Oct 2004 | 2015 | – |

| Kakrapar 3 | PHWR | 700, 630 | NPCIL | Nov 2010 | June 2015 | |

| Kakrapar 4 | PHWR | 700, 630 | NPCIL | March 2011 | Dec 2015 | |

| Rajasthan 7 | PHWR | 700, 630 | NPCIL | July 2011 | June 2016 | |

| Rajasthan 8 | PHWR | 700, 630 | NPCIL | Sept 2011 | Dec 2016 | |

| Total (6) | 4300 MWe gross |

Rajasthan/RAPS also known as Rawatbhata

In mid-2008 Indian nuclear power plants were running at about half of capacity due to a chronic shortage of fuel. Average load factor for India’s power reactors dipped below 60% over 2006-2010, reaching only 40% in 2008. Some easing after 2008 was due to the new Turamdih mill in Jharkhand state coming on line (the mine there was already operating). Political opposition has delayed new mines in Jharkhand, Meghalaya and Telengana.

A 500 MWe prototype fast breeder reactor (PFBR) started construction in 2004 at Kalpakkam near Madras. It was expected to start up about the end of 2010 and produce power in 2011, but this schedule is delayed significantly. Construction was reported 94% complete in February 2013, and 1750 tonnes of sodium coolant was being loaded in June 2014.

In contrast to the situation in the 1990s, most reactors under construction more recently have been on schedule (apart from fuel shortages 2007-09), and the first two – Tarapur 3&4 – were slightly increased in capacity. These and future planned ones were 450 (now 490) MWe versions of the 202 MWe domestic products. Beyond them and the last of the 202 MWe units, future PHWR units will be nominal 700 MWe.

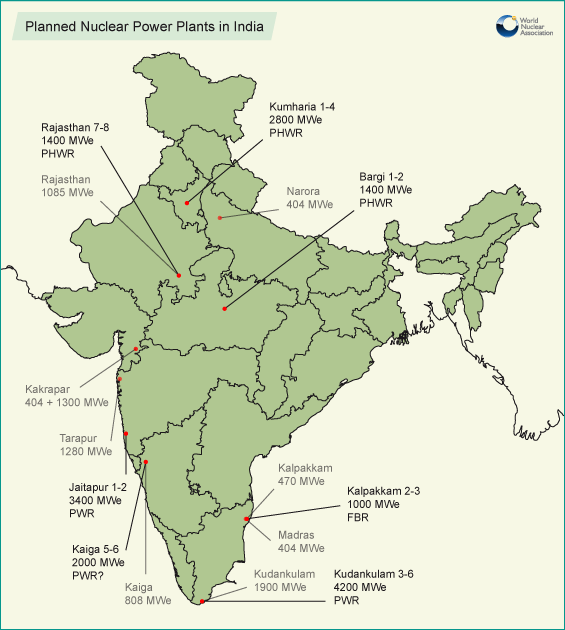

In 2005 four sites were approved for eight new reactors. Two of the sites – Kakrapar and Rajasthan – would have 700 MWe indigenous PHWR units, Kudankulam would have imported 1000 MWe VVER light water reactors alongside the two being built there by Russia, and the fourth site was greenfield for two 1000 MWe LWR units – Jaitapur (Jaithalpur) in the Ratnagiri district of Maharashtra state, on the west coast. The plan has since expanded to six 1600 MWe EPR units here.

In April 2007 the government gave approval for the first four of eight planned 700 MWe PHWR units: Kakrapar 3&4 and Rajasthan 7&8, using indigenous technology. In mid-2009 construction approval was confirmed, and late in 2009 the finance for them was approved. Site works at Kakrapar were completed by August 2010. First concrete for Kakrapar 3&4 was in November 2010 and March 2011 respectively, after Atomic Energy Regulatory Board (AERB) approval. The AERB approved Rajasthan 7&8 in August 2010, and site works then began. First concrete was in July 2011. Construction is then expected to take 66 months to commercial operation. Their estimated cost is Rs 123.2 billion ($2.6 billion). In September 2009 L&T secured an order for four steam generators for Rajasthan 7&8, having already supplied similar ones for Kakrapar 3&4. In December 2012 L&T was awarded the $135 million contract for balance of turbine island for Rajasthan 7&8.

Construction costs of reactors as reported by AEC are about $1200 per kilowatt for Tarapur 3&4 (540 MWe), $1300/kW for Kaiga 3&4 (220 MWe) and expected $1700/kW for the 700 MWe PHWRs with 60-year life expectancy.

Nuclear industry developments in India beyond the trade restrictions

Following the Nuclear Suppliers’ Group agreement which was achieved in September 2008, the scope for supply of both reactors and fuel from suppliers in other countries opened up. Civil nuclear cooperation agreements have been signed with the USA, Russia, France, UK, South Korea, Czech Republic and Canada, as well as Argentina, Kazakhstan, Mongolia and Namibia. On the basis of the 2010 cooperation agreement with Canada, in April 2013 a bilateral safeguards agreement was signed between the Department of Atomic Energy (DAE) and the Canadian Nuclear Safety Commission (CNSC), allowing trade in nuclear materials and technology for facilities which are under IAEA safeguards. A similar bilateral agreement with Australia was signed in 2014. Both will apply essentially to uranium supply.

The initial two Russian PWR types at the Kudankulam site were apart from India’s three-stage plan for nuclear power and were simply to increase generating capacity more rapidly. Now there are plans for eight 1000 MWe units at that site, and in January 2007 a memorandum of understanding was signed for Russia to build the next four there, as well as others elsewhere in India. A further such agreement was signed in December 2010, and Rosatom announced that it expected to build no less than 18 reactors in India. Then in December 2014 another high-level nuclear cooperation agreement was signed with a view to Russia building 20 more reactors plus cooperation in building Russian-designed nuclear power plants in third countries, in uranium mining, production of nuclear fuel, and waste management. India was also to confirm a second location for a Russian plant – Haripur in West Bengal being in some doubt. Most of the new units are expected to be the larger 1200 MWe AES-2006 designs. Russia is reported to have offered a 30% discount on the $2 billion price tag for each of the phase 2 Kudankulam reactors. This is based on plans to start serial production of reactors for the Indian nuclear industry, with much of the equipment and components proposed to be manufactured in India, thereby bringing down costs.

Between 2010 and 2020, further nuclear plant construction is expected to take total gross capacity to 21,180 MWe. The nuclear capacity target is part of national energy policy. This planned increment includes those set out in the Table below including the initial 300 MWe Advanced Heavy Water Reactor (AHWR).

Looking beyond the Russian light water reactors, NPCIL had meetings and technical discussions with three major reactor suppliers – Areva of France, GE-Hitachi and Westinghouse Electric Corporation of the USA for supply of reactors for these projects and for new units at Kaiga. These resulted in more formal agreements with each reactor supplier early in 2009, as described in the Nuclear Energy Parks subsection below. The benchmark capital cost sanctioned by DAE for imported units was quoted at $1600 per kilowatt. An important aspect of all these agreements is that, as with Kudankulam, India will reprocess the used fuel to recover plutonium for its indigenous three-stage program, using a purpose-built and safeguarded Integrated Nuclear Recycle Plant.

In late 2008 NPCIL announced that as part of the Eleventh Five Year Plan (2007-12), it would start site work for 12 reactors including the rest of the eight 700 MWe PHWRs, three or four fast breeder reactors and one 300 MWe advanced heavy water reactor (AHWR) in 2009. NPCIL said that “India is now focusing on capacity addition through indigenisation” with progressively higher local content for imported designs, up to 80%. Looking further ahead its augmentation plan included construction of 25-30 light water reactors of at least 1000 MWe by 2030. In the event only four 700 MWe PHWR units started construction over 2007-12.

Early in 2012 NPCIL projections had the following additions to the 10.08 GWe anticipated in 2017 as “possible”: 4.2 GWe PHWR, 7.0 GWe PHWR (based on recycled U), 40 GWe LWR, 2.0 GWe FBR.

In June 2012 NPCIL announced four new sites for twin PHWR units: at Gorakhpur/ Kumbariya near Fatehabad district in Haryana, at Banswada in Rajasthan, at Chutka in Mandla district and at Bheempur also in Madhya Pradesh. Initially these would add 2800 MWe, followed by a further 2800. Site work has started at Gorakhpur with Haryana state government support.

The EIA report for Chutka Madhya Pradesh power plant was released in March 2013, the expected cost for two units is Rs 16550 crores ($2.78 billion). Construction start is planned for June and December 2015, with completion in December 2020 and June 2021.

NPCIL is also planning to build an indigenous 900 MWe PWR, the Indian Pressurised Water Reactor (IPWR), designed by BARC in connection with its work on submarine power plants. A site for the first plant is being sought, a uranium enrichment plant is planned, the reactor pressure vessel forging will be carried out by Larsen & Toubro (L&T) and NPCIL’s new joint venture plant at Hazira, and the turbine will come from Bharat Heavy Electricals Limited (BHEL).

Meanwhile, NPCIL is offering both 220 and 540 MWe PHWRs for export, in markets requiring small- to medium-sized reactors.

Power reactors planned or proposed

| Reactor | State | Type | MWe gross, each | Project control | Start construction | Start operation |

| Kudankulam 3 | Tamil Nadu | AES-92 | 1050 | NPCIL | Jan 2016 | 2022 |

| Kudankulam 4 | Tamil Nadu | AES-92 | 1050 | NPCIL | 2017? | 2023 |

| Jaitapur 1&2 | Ratnagiri, Maharashtra | EPR x 2 | 1700 | NPCIL | 2015-16? | ? |

| Gorakhpur 1&2 | Haryana (Fatehabad district) | PHWR x 2 | 700 | NPCIL | June 2015 | 2021, 22 |

| Chutka 1&2 | Madhya Pradesh | PHWR x 2 | 700 | NPCIL | 6 & 12/2015 | 2020, 21 |

| Bhimpur 1&2 | Madhya Pradesh | PHWR x 2 | 700 | NPCIL | 2014? | |

| Mahi Banswara 1&2 | Rajasthan | PHWR x 2 | 700 | NPCIL | by 2017 | |

| Kaiga 5&6 | Karnataka | PHWR x 2 | 700 | NPCIL | by 2017 | |

| Kovvada 1-2 | Srikakulam, Andhra Pradesh | ESBWR x 2 | 1600 | NPCIL | site works, 2016? | |

| Mithi Virdi 1&2 | Bhavnagar, Gujarat | AP1000 x 2 | 1250 | NPCIL | 2016? | |

| Kudankulam 5&6 | Tamil Nadu | AES 92 x 2 | 1050 | NPCIL | ? | |

| Kalpakkam 2&3 | Tamil Nadu | FBR x 2 | 500 | Bhavini | 2014? | 2019-20 |

| Subtotal planned | 22 units | 21,300 MWe | ||||

| Kudankulam 7&8 | Tamil Nadu | PWR – AES 92 or AES-2006 | 1050-1200 | NPCIL | ||

| Gorakhpur 3&4 | Haryana (Fatehabad district) | PHWR x 2 | 700 | NPCIL | 2019 | |

| Rajouli, Nawada | Bihar | PHWR x 2 | 700 | NPCIL | ||

| ? | PWR x 2 | 1000 | NPCIL/NTPC | |||

| Jaitapur 3&4 | Ratnagiri, Maharashtra | PWR – EPR | 1700 | NPCIL | 2016 | 2021-22 |

| ? | ? | FBR x 2 | 500 | Bhavini | 2017 | |

| ? | AHWR | 300 | NPCIL | 2016-17 | 2022 | |

| Jaitapur 5&6 | Ratnagiri, Maharashtra | PWR – EPR | 1600 | NPCIL | ||

| Markandi (Pati Sonapur) | Orissa | PWR 6000 MWe | ||||

| Mithi Virdi 3&4 | Bhavnagar, Gujarat | 2 x AP1000 | 1250 | NPCIL | 2015 | 2020-21 |

| Kovvada 3&4 | Srikakulam, Andhra Pradesh | 2 x ESBWR | 1600 | NPCIL | ||

| Nizampatnam 1-6 | Guntur, Andhra Pradesh | 6x? | 1400 | NPCIL | ||

| Haripur 1&2 | West Bengal (but likely relocated, maybe to Orissa) | PWR x 4 VVER-1200 | 1200 | 2014? | 2019-21 | |

| Haripur 3&4 | West Bengal | PWR x 4 VVER1200 | 1200 | 2017 | 2022-23 | |

| Pulivendula | Kadapa, Andhra Pradesh | PWR? PHWR? | 1000? 700? | NPCIL 51%, AP Genco 49% | ||

| Chutka 3&4 | Madhya Pradesh | PHWR x 2 | 1400 | BHEL-NPCIL-GE? | ||

| Mithi Virdi 5&6 | Bhavnagar, Gujarat | AP1000 x 2 | 1250 | 2023-24 | ||

| Kovvada 5&6 | Srikakulam, Andhra Pradesh | ESBWR x 2 | 1600 | |||

| Subtotal proposed | approx 35 | 40,000 MWe approx | ||||

For WNA reactor table: first 22 units ‘planned’, next (estimated) 35 ‘proposed’.

Nuclear Energy Parks

In line with past practice such as at the eight-unit Rajasthan nuclear plant, NPCIL intends to set up five further “Nuclear Energy Parks”, each with a capacity for up to eight new-generation reactors of 1,000 MWe, six reactors of 1600 MWe or simply 10,000 MWe at a single location. By 2032, 40-45 GWe would be provided from these five. NPCIL was hoping to be able to start work by 2012 on at least four new reactors at all four sites designated for imported plants, but this did not happen.

The new energy parks are to be:

Kudankulam (KKNPP) in Tamil Nadu: three more pairs of Russian VVER units, making 9200 MWe. Environmental approval has been given for the first four. A general framework agreement for construction of units 3 & 4 was to be signed in mid-2010, with equipment supply and service contracts soon after, but these were delayed on account of supplier liability questions, with India wanting the units to come under its 2010 vendor liability law. In July 2012 Russia agreed to $3.5 billion in export financing for units 3&4, to cover 85% of their cost. A further credit line of $800 million is available to cover fuel supplies. The credit lines carry interest at 4% pa and would be repayable over 14 years and 4 years respectively, from one year after the start of power generation. The Indian government said it expected to take up the credit offers to the value of $3.06 billion, about 53% of the $5.78 billion estimated total project cost.

In July 2012 coastal regulation zone clearance was obtained for units 3-6 of 1000 MWe each from the Ministry of Environment & Forests, mainly related to seawater cooling. Environmental approval for units 3-6 had been obtained earlier. In March 2013 cabinet approved construction of units 3&4, and site work began. In April 2014 NPCIL signed a Rs 33,000 crore ($ 5.47 billion) agreement with Rosatom for units 3&4, having apparently resolved the liability question (but see section below). In May a general framework agreement to build the plants was signed, and in December contracts with Rosatom for the supply of major components for the two units were signed. DAE said that “all efforts are being made to launch these reactors” in FY 2014-15. Major site works are now scheduled for March 2015, with construction start early in 2016, and 72-month construction period under NIAEP-ASE supervision.

Jaitapur (JNPP) in Maharashtra’s Ratnagiri district: A €7 billion framework agreement with Areva was signed in December 2010 for the first two EPR reactors, along with 25 years supply of fuel. Environmental approval has been given for these, with coastal zone clearances, and site work was to start in 2011 with a view to 2013 construction start, but early in 2014 the application for siting consent was still under review by AERB. In July 2009 Areva submitted a bid to NPCIL to build the first two EPR units, which will have Alstom turbine-generators, accounting for about 30% of the total EUR 7 billion plant cost. The site will host six units, providing 9600 MWe. Areva now hopes to obtain export credit financing and sign a contract by the end of 2012, which would put the first two units on line in 2020 and 2021. In 2013 negotiations continued and the government said it expected the cost of the first two units to be 1,20,000 crore ($21 billion). France has agreed to a 25-year loan for the project at 4.8%.

In March 2014 Areva and DAE with NPCIL were reported to have agreed on a power price of Rs 6.5/kWh (10.6 US cents, $106/MWh), though Areva had been aiming for Rs 9.18. However, in June 2014 it was reported that there was as yet no agreement and that DAE was adamant that the cost could not be more than Rs 6.5/kWh. Areva was holding out for the higher price.

Gorakhpur Haryana Anu Vidyut Pariyojana (GHAVP) in the Fatehabad district of Haryana is a project with four indigenous 700 MWe PHWR units in two phases, and the AEC has approved the state’s proposal for the 2800 MWe plant. The inland northern state of Haryana is one of the country’s most industrialized and has a demand of 8900 MWe, but currently generates less than 2000 MWe and imports 4000 MWe. The Gorakhpur plant may be paid for by the state government or the Haryana Power Generation Corp.

NPCIL is undertaking site infrastructure works near the villages of Kumharia and Gorakhpur, and the official groundbreaking was in January 2014. A final environmental assessment for the project was approved in December 2013, and government approval for Gorakhpur phase 1 was in February 2014. Construction is due to begin in June 2015, with the first unit on line in 2021 after 63 months’ construction. Cost of the first two units is put at INR 210 or 235 billion ($3.4 or 3.8 billion).

Chhaya-Mithi Virdi in Gujarat’s Bhavnagar distirct will host up to six Westinghouse AP1000 units built in three stages on the coast. NPCIL says it has initiated pre-project activities here, with groundbreaking in 2012. A preliminary environmental assessment for the whole project was completed in January 2013. State and local government and coastal zone clearances have been obtained. Westinghouse signed an agreement with NPCIL in June 2012 to launch negotiations for an early works agreement which was expected in a few months. A preliminary commercial contract between NPCIL and Westinghouse was signed in September 2013 along with an agreement to carry out a two-year preliminary safety analysis for the project. NPCIL said that it “must lay emphasis on strong public acceptance outreach and project planning.” In October 2014 the Ministry of Environment & Forests asked NPCIL for further assessment of environmental and land acquisition matters in its environment impact assessment (EIA). NPCIL was then in the process of obtaining site clearance form the Atomic Energy Regulatory Board (AERB). The first stage of two units is due on line in 2019-20, the others to 2024.

Kovvada in Andhra Pradesh’s northern coastal Srikakulam district will host six GE Hitachi ESBWR units. GE Hitachi said in June 2012 that it expected soon to complete an early works agreement with NPCIL to set terms for obtaining approval from the Government for the project. Site preparation is under way, and a preliminary environmental assessment is being prepared. In February 2014 NPCIL said it hoped to pour first concrete by early 2015 for the first 1594 MWe reactor. Compensation for land acquisition was being organised.

In addition to the original five energy parks:

Chutka (CNPP) in inland Madhya Pradesh is also designated for two indigenous 700 MWe PHWR units. NPCIL has initiated pre-project activities here, and a public hearing at Chutka was in February 2014. A preliminary environmental assessment is being prepared.

Mahi Banswara in Rajasthan is a new site for 700 MWe PHWRs. Land acquisition, government approval and environmental assessment are in train.

Haripur in West Bengal: to host four or six further Russian VVER-1200 units, making 4800 MWe. NPCIL has initiated pre-project activities here, and groundbreaking was planned for 2012. However, strong local opposition led the West Bengal government to reject the proposal in August 2011, and change of site to Orissa state has been suggested. Certainly Rosatom expects to build six further Russian VVER reactors at a further site, not yet identified.

At Markandi (Pati Sonapur) in Orissa there are plans for up to 6000 MWe of PWR capacity. Major industrial developments are planned in that area and Orissa was the first Indian state to privatise electricity generation and transmission. State demand is expected to reach 20 billion kWh/yr by 2010.

Bhimpur in Madhya Pradesh has in-principle government approval for two 700 MWe PHWRs, according to the DAE annual report 2013-14.

The AEC has also mentioned possible new nuclear power plants in Bihar and Jharkhand.

In 2014 the Chinese president initiated discussions with his Indian counterpart about building nuclear power plants, raising he possibility that China could compete with France, Russia, Japan and the USA.

NTPC Plans

India’s largest power company, National Thermal Power Corporation (NTPC) in 2007 proposed building a 2000 MWe nuclear power plant to be in operation by 2017. It would be the utility’s first nuclear plant and also the first conventional nuclear plant not built by the government-owned NPCIL. This proposal became a joint venture set up in April 2010 with NPCIL holding 51%, and possibly extending to multiple projects utilising local and imported technology. One of the sites earmarked for a pair of 700 MWe PHWR units in Haryana or Madhya Pradesh may be allocated to the joint venture.

NTPC said it aimed by 2014 to have demonstrated progress in “setting up nuclear power generation capacity”, and that the initial “planned nuclear portfolio of 2000 MWe by 2017” may be greater. However in 2012 it indicated a downgrading of its nuclear plans. NTPC, now 89.5% government-owned, planned to increase its total installed capacity from 30 GWe in about 2007 to 50 GWe by 2012 (72% of it coal) and 75 GWe by 2017. It is also forming joint ventures in heavy engineering.

NTPC is reported to be establishing a joint venture with NPCIL and BHEL to sell India’s largely indigenous 220 MWe heavy water power reactor units abroad, possibly in contra deals involving uranium supply from countries such as Namibia and Mongolia.

Other indigenous arrangements

The 87% state-owned National Aluminium Company (Nalco) has signed an agreement with NPCIL relevant to its hopes of building a 1400 MWe nuclear power plant on the east coast, in Orissa’s Ganjam district. A more specific agreement was signed in November 2011 to set up a joint venture with NPCIL – NPCIL Nalco Power Co Ltd – giving it 29% equity in Kakrapar 3 & 4 (total 1300 MWe net) under construction in Gujarat on the west coast for Rs 1700 crore ($285 million). The total project size is Rs 11,500 crore with the total debt requirement at Rs 7,000 crore.Nalco is seeking government permission to increase this share to 49%. It is also seeking to buy uranium assets in Africa. Nalco already has its own 1200 MWe coal-fired power plant in Orissa state at Angul, being expanded to 1200 MWe, to serve its refinery and its Angul smelter of 345,000 tpa, being expanded to 460,000 tpa (requiring about 1 GWe of constant supply).

India’s national oil company, Indian Oil Corporation Ltd (IOC), in November 2009 joined with NPCIL in an agreement “for partnership in setting up nuclear power plants in India.” The initial plant envisaged was to be at least 1000 MWe, and NPCIL would be the operator and at least 51% owner. In November 2010 IOC agreed to take a 26% stake in Rajasthan 7 & 8 (2×700 MWe) as a joint venture, with the option to increase this to 49%. The estimated project cost is Rs 12,320 crore (123 billion rupees, $2.1 billion), and the 26% will represent only 2% of IOC’s capital budget in the 11th plan to 2012. The formal JV agreement was signed in January 2011.

The cash-rich Oil and Natural Gas Corporation (ONGC), which (upstream of IOC) provides some 80% of the country’s crude oil and natural gas and is 84% government-owned, is having formal talks with AEC about becoming a minority partner with NPCIL on present or planned 700 MWe PHWR projects. It was later reported that ONGC intended to build 2000 MWe in joint venture with NPCIL (51%).

Indian Railways, with power requirement of 3000 MWe now and rising to 5000 MWe about 2022, has also approached NPCIL to set up a joint venture to build two 500 MWe PHWR nuclear plants on railway land or existing nuclear sites for its own power requirements. The Railways already has a joint venture with NTPC – Bhartiya Rail Bijlee Company – to build a 1000 MWe coal-fired power plant at Nabi Nagar in Aurangabad district of Bihar, with the 250 MWe units coming on line 2014-15. The Railways also plans to set up another 2 x 660 MWe supercritical thermal power plant at Adra in Purulia district of West Bengal for traction supply at economical tariff. Some 23,500 km of its 65,000 km lines are electrified, and it spends 8000 crore ($1.34 billion) per year on power, at INR 5.4/kWh which it expects to reduce to INR 4.0/kWh (9 cents to 6.6 c).

The Steel Authority of India Ltd (SAIL) and NPCIL are discussing a joint venture to build a 700 MWe PHWR plant. The site will be chosen by NPCIL, in Gujarat of elsewhere in western India.

The government has announced that it intends to amend the law to allow private companies to be involved in nuclear power generation and possibly other aspects of the fuel cycle, but without direct foreign investment. In anticipation of this, Reliance Power Ltd, GVK Power & Infrastructure Ltd and GMR Energy Ltd are reported to be in discussion with overseas nuclear vendors including Areva, GE-Hitachi, Westinghouse and Atomstroyexport.

In September 2009 the AEC announced a version of its planned Advanced Heavy Water Reactor (the AHWR-300 LEU) designed for export.

In August and September 2009 the AEC reaffirmed its commitment to the thorium fuel cycle, particularly thorium-based FBRs, to make the country a technological leader.

Overseas reactor vendors

As described above, there have been a succession of agreements with Russia’s Atomstroyexport to build further VVER reactors. In March 2010 a ‘roadmap’ for building six more reactors at Kudankulam by 2017 and four more at Haripur after 2017 was agreed, bringing the total to 12. The number may be increased after 2017, in India’s 13th five-year plan. Associate company Atomenergomash (AEM) is setting up an office in India with a view to bidding for future work there and in Vietnam, and finalizing a partnership with an Indian heavy manufacturer, either L&T (see below) or another. A Russian fuel fabrication plant is also under consideration.

In February 2009 Areva signed a memorandum of understanding with NPCIL to build two, and later four more, EPR units at Jaitapur, and a formal contract was expected. This followed the government signing a nuclear cooperation agreement with France in September 2008. Areva says that the EPR has achieved Design Acceptance Certification in India.

In March 2009 GE Hitachi Nuclear Energy signed agreements with NPCIL and Bharat Heavy Electricals Ltd (BHEL) to begin planning to build a multi-unit power plant using 1350 MWe Advanced Boiling Water Reactors (ABWR). In May 2009 L&T was brought into the picture. In April 2010 it was announced that the BHEL-NPCIL joint venture was still in discussion with an unnamed technology partner to build a 1400 MWe nuclear plant at Chutka in Madhya Pradesh state, with Madhya Pradesh Power Generating Company Limited (MPPGCL) the nodal agency to facilitate the execution of the project.

In May 2009 Westinghouse signed a memorandum of understanding with NPCIL regarding deployment of its AP1000 reactors, using local components (probably from L&T).

After a break of three decades, Atomic Energy of Canada Ltd (AECL) was keen to resume technical cooperation, especially in relation to servicing India’s PHWRs (though this would now be undertaken by Candu Energy), and there were preliminary discussions regarding the sale of an ACR-1000.

In August 2009 NPCIL signed agreements with Korea Electric Power Co (KEPCO) to study the prospects for building Korean APR-1400 reactors in India. This could proceed following bilateral nuclear cooperation agreements signed in October 2010 and July 2011.

The LWRs to be set up by these foreign companies are reported to have a lifetime guarantee of fuel supply.

Fast neutron reactors

Longer term, the AEC envisages its fast reactor program being 30 to 40 times bigger than the PHWR program, and initially at least, largely in the military sphere until its “synchronised working” with the reprocessing plant is proven on an 18- to 24-month cycle. This will be linked with up to 40,000 MWe of light water reactor capacity, the used fuel feeding ten times that fast breeder capacity, thus “deriving much larger benefit out of the external acquisition in terms of light water reactors and their associated fuel”. This 40 GWe of imported LWR capacity multiplied to 400 GWe via FBR would complement 200-250 GWe based on the indigenous three-stage program of PHWR-FBR-AHWR (see Thorium cycle section below). Thus AEC is “talking about 500 to 600 GWe nuclear over the next 50 years or so” in India, plus export opportunities.

In 2002 the regulatory authority issued approval to start construction of a 500 MWe prototype fast breeder reactor (PFBR) at Kalpakkam and this has been built by BHAVINI (Bharatiya Nabhikiya Vidyut Nigam Ltd), a government enterprise set up under DAE to focus on FBRs. It was expected to start up in September 2014, fuelled with MOX (mixed uranium-plutonium oxide, the 30% of reactor-grade Pu being from its existing PHWRs) made at Tarapur by BARC. It has a blanket with uranium and thorium to breed fissile plutonium and U-233 respectively, taking the thorium program to stage two, and setting the scene for eventual full utilisation of the country’s abundant thorium to fuel reactors. It is a sodium-cooled pool-type reactor having two primary and two secondary loops, with four steam generators per loop. It is designed for a 40-year operating life at 75% load factor. Two more such 500 MWe fast reactors have been announced for construction at Kalpakkam, but slightly redesigned by the Indira Gandhi Centre to reduce capital cost. Then four more are planned at another site.

Initial FBRs will have mixed oxide fuel or carbide fuel, but these will be followed by metallic fuelled ones to enable shorter doubling time. One of the last of the above six, or possibly the fourth one overall, is to have the flexibility to convert from MOX to metallic fuel (ie a dual fuel unit), and it is planned to convert the small FBTR to metallic fuel about 2013 (see R&D section below). With metal fuel, a 500 MWe unit is expected to produce 2 tonnes of reactor-grade plutonium in 8-10 years.

Following these will be a 1000 MWe fast reactor using metallic fuel, and construction of the first is expected to start about 2020. This design is intended to be the main part of the Indian nuclear fleet from the 2020s. A fuel fabrication plant and a reprocessing plant for metal fuels are planned for Kalpakkam, as the Fast Reactor Fuel Cycle Facility approved for construction in 2013.

A December 2010 scientific and technical cooperation agreement between AEC and Rosatom is focused on “joint development of a new generation of fast reactors”.

Heavy engineering in India

India’s largest engineering group, Larsen & Toubro (L&T) announced in July 2008 that it was preparing to venture into international markets for supply of heavy engineering components for nuclear reactors. It formed a 20 billion rupee (US$ 463 million) venture with NPCIL to build a new plant for domestic and export nuclear forgings at its Hazira, Surat coastal site in Gujarat state. This is now under construction. It will produce 600-tonne ingots in its steel melt shop and have a very large forging press to supply finished forgings for nuclear reactors, pressurizers and steam generators, and also heavy forgings for critical equipment in the hydrocarbon sector and for thermal power plants.

In the context of India’s trade isolation over three decades L&T has produced heavy components for 17 of India’s pressurized heavy water reactors (PHWRs) and has also secured contracts for 80% of the components for the fast breeder reactor at Kalpakkam. It is qualified by the American Society of Mechanical Engineers to fabricate nuclear-grade pressure vessels and core support structures, achieving this internationally recognised quality standard in 2007, and further ASME accreditation in 2010. It is one of about ten major nuclear-qualified heavy engineering enterprises worldwide.

Early in 2009, L&T signed four agreements with foreign nuclear power reactor vendors. The first, with Westinghouse, sets up L&T to produce component modules for Westinghouse’s AP1000 reactor. The second agreement was with Atomic Energy of Canada Ltd (AECL) “to develop a competitive cost/scope model for the ACR-1000” (though this would have lapsed). In April it signed an agreement with Atomstroyexport primarily focused on components for the next four VVER reactors at Kudankulam, but extending beyond that to other Russian VVER plants in India and internationally. Then in May 2009 it signed an agreement with GE Hitachi to produce major components for ABWRs from its new Hazira JV plant. The two companies hope to utilize indigenous Indian capabilities for the complete construction of nuclear power plants including the supply of reactor equipment and systems, valves, electrical and instrumentation products for ABWR plants to be built in India. L&T “will collaborate with GEH to engineer, manufacture, construct and provide certain construction management services” for the ABWR project. Early in 2010 L&T signed an agreement with Rolls Royce to produce technology and components for light water reactors in India and internationally.

Following the 2008 removal of trade restrictions, Indian companies led by Reliance Power (RPower), NPCIL, and Bharat Heavy Electricals Ltd (BHEL) said that they plan to invest over US$ 50 billion in the next five years to expand their manufacturing base in the nuclear energy sector. BHEL planned to spend $7.5 billion in two years building plants to supply components for reactors of 1,600 MWe. It also plans to set up a tripartite joint venture with NPCIL and Alstom to supply turbines for nuclear plants of 700 MWe, 1,000 MWe and 1,600 MWe. In June 2010 Alstom confirmed that the equal joint venture with NPCIL and BHEL would be capitalized to EUR 25 million, to provide turbines initially for eight 700 MWe PHWR units, then for imported large units. Another joint venture is with NPCIL and a foreign partner to make steam generators for 1000-1600 MWe plants.

Two contracts awarded by NPCIL to a consortium of BHEL and Alstom cover the supply and installation of turbogenerator packages for Kakrapar 3 and 4, the first indigenously designed 700 MWe pressurised heavy water reactors. The contracts are worth over INR 16,000 million ($360 million), with BHEL’s share representing around INR 8000 million ($198 million). The first contract covers the supply of the actual turbine generator packages, while the second covers associated services. BHEL and Alstom will jointly manufacture and supply the steam turbines, while BHEL will manufacture and supply the generator, moisture separator reheater and condenser, as well as undertaking the complete erection and commissioning of the turbine generator package. In August 2012 NPCIL awarded an INR 19,060 million ($343 million) contract to BHEL-Alstom for turbine generators for Rajasthan 7 & 8. Under the contract, BHEL and Alstom will together manufacture and supply the steam turbines, while the manufacture and supply of the complete generator, moisture separator reheater and condenser – including the erection and commissioning of the turbine generator package – will be undertaken by BHEL.

BHEL is also supplying steam generators for one Kakrapar unit and Rajasthan 7&8. It will also supply and install the instrumentation and controls for the turbine island secondary circuit for Rajasthan 7&8. BHEL is also supplying, constructing and commissioning the complete conventional island for the 500 MWe prototype fast breeder reactor being built at Kalpakkam.

HCC (Hindustan Construction Co.) has built more than half of India’s nuclear power capacity, notably all 6 units of the Rajasthan Atomic Power Project and also Kudankulam. It has an INR 8880 million ($160 million) contract for the main civil works for Rajasthan 7 & 8. It specializes in prestressed containment structures for reactor buildings. In September 2009 it formed a joint venture with UK-based engineering and project management firm AMEC PLC to undertake consulting services and nuclear power plant construction. HCC has an order backlog worth 10.5 billion rupees ($220 million) for nuclear projects from NPCIL and expects six nuclear reactors to be tendered by the end of 2010.

Areva signed an agreement with Bharat Forge in January 2009 to set up a joint venture in casting and forging nuclear components for both export and the domestic market, by 2012. BHEL expects to join this, and in June 2010 the UK’s Sheffield Forgemasters became a technical partner with BHEL in a £30 million deal. The partners have shortlisted Dahej in Gujarat, and Krishnapatnam and Visakhapatnam in Andhra Pradesh as possible sites.

In August 2010 GE Hitachi Nuclear Energy (GEH) signed a preliminary agreement with India’s Tata Consulting Engineers, Ltd. to explore potential project design and workforce development opportunities in support of GEH’s future nuclear projects in India – notably the proposals for six ESBWR units – and around the world.

In April 2012 Atomenergomash was negotiating with potential Indian partners on localization of some productions and design of equipment for nuclear power plants being built to the Russian technology both in India and other Asian countries such as Bangladesh and Vietnam. In 2010 a Memorandum of Understanding with Walchandnagar Industries Ltd (India) was signed by Atomenergomash.

See also India section of Heavy Manufacturing paper.

Uranium resources and mining in India

India’s uranium resources are modest, with 102,600 tonnes U as reasonably assured resources (RAR) and 37,200 tonnes as inferred resources in situ (to $260/kgU) at January 2011. In December 2014, 181,600 tU ‘resources’ was claimed by DAE. Accordingly, India expects to import an increasing proportion of its uranium fuel needs. In 2013 it was importing about 40% of uranium requirements.

* 38% vein-type deposits, 12% sandstone (Meghalaya), 12% unconformity (Lambapur-Peddagattu in AP), and 37% other – ‘strata-bound’ (Cuddapah basin, including Tummalapalle).

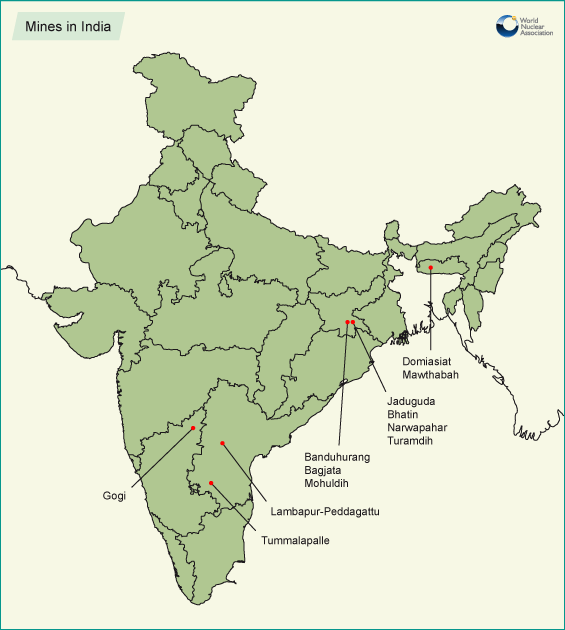

Exploration is carried out by the Atomic Minerals Directorate for Exploration and Research (AMD). Mining and processing of uranium is carried out by Uranium Corporation of India Ltd (UCIL), also a subsidiary of the Department of Atomic Energy (DAE), in Jharkhand near Calcutta. Common mills are near Jaduguda (2500 t/day) and Turamdih (3000 t/day, expanding to 4500 t/day). Jaduguda ore is reported to grade 0.05-0.06%U. All Jharkhand mines are underground except Banduhurang. Another mill is at Tummalapalle in AP, expanding from 3000 to 4500 t/day.

In 2005 and 2006 plans were announced to invest almost US$ 700 million to open further mines: in Jharkand at Banduhurang, Bagjata and Mohuldih; in Meghalaya at Domiasiat-Mawthabah (with a mill); and in Telengana at Lambapur-Peddagattu (with mill 50km away at Seripally), both in Nalgonda district.

The Jaduguda/Jadugora mine was closed in September 2014 due to expiry of its mining licence, but this was renewed a few weeks later by the state government, and in December the East Singhbhum government gave approval to resume mining. AMD quotes resources as 6816 tU (March 2014).

In Jharkand, Banduhurang is India’s first open cut mine and was commissioned in 2007. Bagjata is underground and was opened in December 2008, though there had been earlier small operations 1986-91. The Mohuldih underground mine was commissioned in April 2012. The new mill at Turamdih serving these mines was commissioned in 2008. It is 7 km from Mohuldih.

In Andhra Pradesh and Telengana there are three kinds of uranium mineralisation in the Cuddapah Basin, including unconformity-related deposits in the north of it. The Tummalapalle belt with low-grade strata-bound uranium mineralisation is 160 km long, and appears increasingly prospective – AMD reports 37,000 tU in 15 km of it.

In Telengana, the new northern inland state subdivided from Andhra Pradesh in 2013, the Lambapur-Peddagattu project in Nalgonda district 110 km southeast of Hyderabad has environmental clearance for one open cut and three small underground mines (based on some 6000 tU resources at about 0.1%U) but faces local opposition. The central government had approved Rs 637 crore for the project, with processing to be at Seripally, 54 km away in Nalgonda district. In 2014 UCIL was preparing to approach the state government and renew its federal approvals for the project. A further deposit near Lambapur-Peddagattu is Koppunuru, in Guntur district of AP, now under evaluation, and Chitrial.

In August 2007 the government approved a new US$ 270 million underground mine and mill at Tummalapalle near Pulivendula in Kadapa district of Andhra Pradesh, at the south end of the Basin and 300 km south of Hyderabad. Its resources have been revised upwards by AMD to 71,690 tU (March 2014) and its cost to Rs 19 billion ($430 million), and to the end of 2012 expenditure was Rs 11 billion ($202 million). The project was opened in April and first commercial production was in June 2012, using an innovative pressurised alkaline leaching process (this being the first time alkaline leaching is used in India). Production is expected to reach 220 tU/yr, and in 2013 mill capacity was being doubled at a cost of Rs 8 billion ($147 million). An expansion of or from the Tummalapalle project is the Kanampalle U project, with 38,000 tU reserves. Further southern mineralisation near Tummalapalle are Motuntulapalle, Muthanapalle, and Rachakuntapalle.

In Karnataka, UCIL is planning a small uranium mine in the Bhima basin at Gogiin Gulbarga area from 2014, after undertaking a feasibility study, and getting central government approval in mid-2011, state approval in November 2011 and explicit state support in June 2012. A portable mill is planned for Diggi or Saidpur nearby, using conventional alkaline leaching. Total cost is about $135 million. Resources are 4250 tU at 0.1% (seen as relatively high-grade) including 2600 tU reserves, sufficient for 15 years mine life, at 127 tU/yr, from fracture/fault-controlled uranium mineralisation. UCIL plans also to utilise the uranium deposits in the Bhima belt from Sedam in Gulbarga to Muddebihal in Bijapur.

In Meghalaya, close to the Bangladesh border in the West Khasi Hills, the Domiasiat-Mawthabah mine project (near Nongbah-Jynrin) is in a high rainfall area and has also faced longstanding local opposition partly related to land acquisition issues but also fanned by a campaign of fearmongering. For this reason, and despite clear state government support in principle, UCIL does not yet have approval from the state government for the open cut mine at Kylleng-Pyndengsohiong-Mawthabah – KPM – (formerly known as Domiasiat) though pre-project development has been authorised on 422 ha. However, federal environmental approval in December 2007 for a proposed uranium mine and processing plant here and for the Nongstin mine has been reported. There is sometimes violent opposition by NGOs to uranium mine development in the West Khasi Hills, including at KPM/ Domiasiat and Wakhyn, which have estimated resources of 9500 tU and 8000 tU respectively. Tyrnai is a smaller deposit in the area. The status and geography of all these is not known, beyond AMD being reported as saying that UCIL is “unable to mine them because of socio-economic problems”. Mining is not expected before 2017.

Fracture/fault-controlled uranium mineralisation similar to that in Karnataka is reported in the 130 km long Rohil belt in Sikar district in Rajasthan, with 6133 tU identified (March 2014).

AMD reports further uranium resources in Chattisgarh state (3380 tU), Himachal Pradesh (665 tU), Maharashtra (300 tU), and Uttar Pradesh (750 tU).

India’s uranium mines and mills – existing and planned

| State, district | Mine | Mill | Operating from | tU per year |

| Jharkhand | Jaduguda | Jaduguda | 1967 (mine)1968 (mill) | 200 total from mill |

| Bhatin | Jaduguda | 1967 | ||

| Narwapahar | Jaduguda | 1995 | ||

| Bagjata | Jaduguda | 2008 | ||

| Jharkhand, East Singhbum dist. | Turamdih | Turamdih | 2003 (u/g mine)2008 (mill) | 190 total from mill |

| Banduhurang | Turamdih | 2007 (open pit) | ||

| Mohuldih | Turamdih | 2012 | ||

| Andhra Pradesh, Kadapa/ YSR district | Tummalapalle | Tummalapalle | 2012 | 220 increasing to 330 |

| Andhra Pradesh, Kadapa/ YSR district | Kanampalle | Kanampalle? | 2017 | |

| Telengana, Nalgonda dist. | Lambapur-Peddagattu | Seripally/Mallapuram | 2016? | 130 |

| Karnataka, Gulbarga dist. | Gogi | Diggi/Saidpur | 2014 | 130 |

| Meghalaya | Kylleng-Pyndeng-Sohiong-Mawthabah (KPM), (Domiasiat), Wakhyn | Mawthabah | 2017 (open pit) | 340 |

However, India has reasonably assured resouirces of 319,000 tonnes of thorium – about 13% of the world total, and these are intended to fuel its nuclear power program longer-term (see below). AMD claims almost 12 million tonnes of monazite which might contain 700,000 tonnes of thorium.

In September 2009 largely state-owned Oil & Natural Gas Corporation ONCC proposed to form a joint venture with UCIL to explore for uranium in Assam, and was later reported to be mining uranium in partnership with UCIL in the Cauvery area of Tamil Nadu.

Uranium imports

Following an IAEA safeguards agreement, an NSG resolution and finally US Congress approval of a bilateral trade agreement in October 2008, two months later Russia’s Rosatom and Areva from France had contracted to supply uranium for power generation, while Kazakhstan, Brazil and South Africa were preparing to do so. The Russian agreement was to provide fuel for PHWRs as well as the two small Tarapur reactors.

In February 2009 the actual Russian contract was signed with TVEL to supply 2000 tonnes of natural uranium fuel pellets for PHWRs over ten years, costing $780 million, and 58 tonnes of low-enriched fuel pellets for the Tarapur reactors. The 300 tU Areva shipment arrived in June 2009. RAPS 2 became the first PHWR to be fuelled with imported uranium, followed by units 5&6 there.

In January 2009 NPCIL signed a memorandum of understanding with Kazatomprom for supply of 2100 tonnes of uranium concentrate over six years and a feasibility study on building Indian PHWR reactors in Kazakhstan. NPCIL said that it represented “a mutual commitment to begin thorough discussions on long-term strategic relationship.” The actual agreement in April 2011 covered 2100 tonnes by 2014. In March 2013 both countries agreed to extend the civil nuclear cooperation agreement past 2014.

In September 2009 India signed uranium supply and nuclear cooperation agreements with Namibia and Mongolia. In March 2010 Russia offered India a stake in the Elkon uranium mining development in its Sakha Republic, and agreed on a joint venture with ARMZ Uranium Holding Co. In August 2014 Navoi Mining and Metallurgical Combine (NMMC) in Uzbekistan signed a contract for supply of 2000 tonnes of U3O8 to India during the four years to 2018, its first export to India. In September 2014 a bilateral safeguards agreement with Australia was signed, enabling supply from there.

In August 2014 Navoi Mining and Metallurgical Combine (NMMC) in Uzbekistan signed a contract for supply of 2000 tonnes of U3O8 to India during the four years to 2018, its first export to India.

As of August 2010 the DAE said that seven reactors (1400 MWe) were using imported fuel and working at full power, nine reactors (2630 MWe) used domestic uranium.

In 2014 the DAE reported that India had imported 4458 tonnes of uranium since 2008, 2058 t from TVEL, 2100 t from Kazatomprom, and 300 t from Areva.

Uranium fuel cycle

India’s main nuclear fuel cycle complex is at Hyderabad in Telengana, established in 1971. It plans to set up three more to serve the planned expansion of nuclear power and bring relevant activities under international safeguards. The first of the three will be at Kota in Rajasthan, supplying fuel for the 700 MWe PHWRs at Rawatbhata and Kakrapar by 2016. Capacity will be 500 t/yr plus 65 t of zirconium cladding. The second new complex will supply fuel to ten 700 MWe PHWRs planned in Haryana, Karnataka and Madhya Pradesh, but its site is not announced. The third will be at Chitradurga in the south of Karnataka state on a site with other science-based establishments, starting with a BARC enrichment plant, to supply fuel for light water reactors (see below).

DAE’s Nuclear Fuel Complex (NFC) at Hyderabad has six facilities under safeguards, listed in the Annex to India’s Additional Protocol with IAEA. This includes several facilities related to fuel fabrication, as part of the civil-military separation.

The NFC undertakes refining and conversion of uranium, which is received as magnesium diuranate (yellowcake) and refined to UO2. The main 600 t/yr plant fabricates PHWR fuel (which is unenriched). A small (25 t/yr) fabrication plant makes fuel for the Tarapur BWRs from imported enriched (2.66% U-235) uranium. Depleted uranium oxide fuel pellets (from reprocessed uranium) and thorium oxide pellets are also made for PHWR fuel bundles. Mixed carbide fuel for FBTR was first fabricated by Bhabha Atomic Research Centre (BARC) in 1979.

Heavy water is supplied by DAE’s Heavy Water Board, and the seven plants have been working at capacity due to the current building program. Some $16 million worth of heavy water was exported to USA and France in 2013-14.

A very small centrifuge enrichment plant – insufficient even for the Tarapur reactors – is operated by DAE’s Rare Materials Plant (RMP) at Ratnahalli near Mysore, primarily for military purposes including submarine fuel, but also supplying research reactors. It started up about 1992 as a unit of BARC, and is apparently being expanded to some 25,000 SWU/yr. A conversion plant is also being built there at RMP.

DAE in 2011 announced that it would build an industrial-scale centrifuge complex, the Special Material Enrichment Facility (SMEF), in Chitradurga district, Karnataka, also as part of BARC and having both civil and naval purposes. Construction had not started in mid 2014. India’s enrichment plants are not under international safeguards. Some centrifuge R&D is undertaken by BARC at Trombay.

Fuel fabrication at up to 900 t/yr is by DAE’s Nuclear Fuel Complex in Hyderabad. DAE is setting up a second Nuclear Fuel Complex (NFC) – a PHWR fuel plant at Kota in Rajasthan, next to the Rawatbhata power plant – to serve the larger new reactors and those in northern India. It will have 500 t/yr capacity, from 2017, and government approval of Rs 2400 crore (24 billion rupees, $393 million) for this was in March 2014. Each 700 MWe reactor is said to need 125 t/yr of fuel. A third fuel fabrication plant is planned, with 1250 t/yr capacity, in Telengana, Rajasthan or Madhya Pradesh. The company is proposing joint ventures with US, French and Russian companies to produce fuel for those reactors.

Reprocessing: Used fuel from the civil PHWRs is reprocessed by Bhabha Atomic Research Centre (BARC) at Trombay, Tarapur and Kalpakkam to extract reactor-grade plutonium for use in the fast breeder reactors. The first ‘plutonium plant’ was commissioned in 1964. Small plants at each site were supplemented by a new Kalpakkam plant of some 100 t/yr commissioned in 1998 in connection with Indira Gandhi Centre for Atomic Research (IGCAR), and this is being extended to reprocess FBTR carbide fuel. Apart from this all reprocessing uses the Purex process. A new 100 t/yr plant at Tarapur was opened in January 2011, and further capacity is being built at Kalpakkam.

Partitioning of Purex product in a multi-step solvent extraction process is being undertaken in a demonstration facility at Tarapur.

Reprocessing capacity early in 2011 was understood to be 200 t/yr at Tarapur, 100 t/yr at Kalpakkam and 30 t/yr at Trombay, total 330 t/yr, all related to the indigenous PHWR program and not under international safeguards. An away-from-reactor (AFR) fuel storage and another store at Tarapur are under safeguards from 2012 and 2014 and are listed in the AP Annex.

The Power Reactor Thoria Reprocessing Facility (PRTRF) was under construction at BARC in October 2013, and is designed to cope with high gamma levels from U-232. The recovered U-233 will be used in the AHWR Critical Facility.

India will reprocess the used PWR fuel from the Kudankulam and other imported reactors and will keep the plutonium. This will be under IAEA safeguards, in new plants.

In April 2010 it was announced that 18 months of negotiations with the USA had resulted in agreement to build two new reprocessing plants to be under IAEA safeguards, likely located near Kalpakkam and near Mumbai – possibly Trombay. In July 2010 an agreement was signed with the USA to allow reprocessing of US-origin fuel at one of these facilities. Later in 2010 the AEC said that India has commenced engineering activities for setting up of an Integrated Nuclear Recycle Plant with facilities for both reprocessing of used light water reactor fuel of foreign origin, and waste management.

Fast Reactor Fuel Cycle Facility (FRFCF)

To close the FBR fuel cycle a Fast Reactor Fuel Cycle Facility has long been planned, with construction originally to begin in 2008 and operation to coincide with the need to reprocess the first PFBR fuel. The PFBR and the next four FBRs to be commissioned by 2020 will use oxide fuel. After that it is expected that metal fuel with higher breeding capability will be introduced and burn-up is intended to increase from 100 to 200 GWd/t.

In 2003 a facility was commissioned at Kalpakkam to reprocess mixed carbide fuel using an advanced Purex process. In 2010 the AEC said that used mixed carbide fuel from the Fast Breeder Test Reactor (FBTR) with a burn-up of 155 GWd/t was reprocessed in the Compact Reprocessing facility for Advanced fuels in Lead cells (CORAL). Thereafter, the fissile material was re-fabricated as fuel and loaded back into the reactor, thus ‘closing’ the fast reactor fuel cycle.

In July 2013 the government approved construction of the Rs 9,600 crore (96 billion rupees, $1.61 billion) FRFCF at Kalpakkam. Work was expected to start in 2013, initially under the auspices of the Indira Gandhi Centre for Atomic Research (IGCAR). It will serve the PFBR nearby, and will have capacity to cater for three such reactors.

Thorium fuel cycle development in India

The long-term goal of India’s nuclear program has been to develop an advanced heavy-water thorium cycle.The first stage of this employs the PHWRs fuelled by natural uranium, and light water reactors, which produce plutonium incidentally to their prime purpose of electricity generation.

Stage 2 uses fast neutron reactors burning the plutonium with the blanket around the core having uranium as well as thorium, so that further plutonium (ideally high-fissile Pu) is produced as well as U-233.

AMD has identified almost 12 million tonnes of monazite resources (typically with 6-7% thorium) and 33.7 million tonnes of zircon.

Then in stage 3, Advanced Heavy Water Reactors (AHWRs) will burn thorium-plutonium fuels in such a manner that breeds U-233 which can eventually be used as a self-sustaining fissile driver for a fleet of breeding AHWRs. An alternative stage 3 is molten salt breeder reactors (MSBR), which are firming up as an option for eventual large-scale deployment. See R&D section under IGCAR.

In 2002 the regulatory authority issued approval to start construction of a 500 MWe prototype fast breeder reactor at Kalpakkam and this is now under construction by BHAVINI. It is expected to be operating in 2015, fuelled with uranium-plutonium oxide (MOX, the reactor-grade Pu being from its existing PHWRs). It will have a blanket with thorium and uranium to breed fissile U-233 and plutonium respectively. This will take India’s ambitious thorium program to stage 2, and set the scene for eventual full utilisation of the country’s abundant thorium to fuel reactors. Six more such 500 MWe fast reactors have been announced for construction, four of them by 2020. This fleet of fast reactors will breed the required plutonium which is the key to unlocking the energy potential of thorium in AHWRs. This will take another 15-20 years, and so it will still be some time before India is using thorium energy to any extent.

So far about one tonne of thorium oxide fuel has been irradiated experimentally in PHWR reactors* and has reprocessed and some of this has been reprocessed, according to BARC. A reprocessing centre for thorium fuels is being set up at Kalpakkam in connection with Indira Gandhi Centre for Atomic Research (IGCAR).

* Notably Kakrapar 1&2, Rajasthan 2-4, Kaiga 1&2 have irradiated 232 fuel bundles to maximum burn-up of 14 GWd/t.

In October 2013 BARC said that premature deployment of thorium would lead to sub-optimal use of indigenous energy resources, and that it would be necessary to build up a significant amount of fissile material before launching the thorium cycle in a big way for the third stage (though the demonstration AHWR should be operating by 2022). Incorporation of thorium in the blankets of metal-fuelled fast breeder reactors would be after significant FBR capacity was operating. Hence thorium-based reactor deployment is expected to be “beyond 2070”. Surplus U-233 from FBR blankets could be used in HTRs including molten salt breeder reactors. See R&D section under IGCAR.

Design of the first 300 MWe AHWR (920 MWt, 284 MWe net) was completed early in 2014 at BARC. It is mainly a thorium-fuelled reactor but is versatile regarding fuel. Construction of the first one is due to start in the 12th plan period to 2017, possibly 2016, for operation about 2022, though no site has yet been announced. By mid-2010 a pre-licensing safety appraisal had been completed by the AERB and site selection was in progress. The AHWR can be configured to accept a range of fuel types including U-Pu MOX, Th-Pu MOX, and Th-U-233 MOX in full core, the U-233 coming from reprocessing in closed fuel cycle. A co-located fuel cycle facility is planned, with remote handling for the highly-radioactive fresh fuel.*

* In 2008 an AHWR critical facility was commissioned at BARC “to conduct a wide range of experiments, to help validate the reactor physics of the AHWR through computer codes and in generating nuclear data about materials, such as thorium/uranium-233 based fuel, which have not been extensively used in the past.” It has all the components of the AHWR’s core including fuel and heavy water moderator, and can be operated in different modes with various kinds of fuel in different configurations.