Revisiting the Lessons of the Battle of Seattle and Its Aftermath

IN FOCUS, 5 Sep 2016

Walden Bello | Transnational Institute – TRANSCEND Media Service

Speech delivered at the opening plenary session of the 111th Meeting of the American Sociological Association, Washington State Convention Center, August 19, 2016

Speech delivered at the opening plenary session of the 111th Meeting of the American Sociological Association, Washington State Convention Center, August 19, 2016

I had many lessons from the Battle of Seattle, and one of them is that policewomen can deal it out as good as any policeman. I got beaten up, badly but obviously not fatally by one of Seattle’s Best. Yesterday, I decided go down memory lane and visit the scene of the crime. I remember seeing Medea Benjamin of Code Pink being treated fairly roughly and I rushed forward to try to get the police to stop it. At that point, a policewoman rushed me and started beating me with her baton while dragging me and dumping me on the street, with the coup de grace being a well planted kick to my derriere. But that was not the biggest blow of all. The biggest was to my ego: I was beaten and kicked but was seen as not fit to be arrested.

Like Caesar, I will divide my talk into three parts. First, some reflections on the meaning of Seattle for change in knowledge systems. Second, a discussion of how despite the deep crisis of neoliberalism, finance capital has managed to retain tremendous power. Third, an appeal for a new comprehensive vision of the desirable society.

Seattle and the Crisis of Neoliberalism

We are all familiar with Thomas Kuhn’s theory of how change takes place in the physical sciences. Dissonant data can no longer be accommodated in the old paradigm until someone comes out with a new one where they can be explained. Social scientists have appropriated Kuhn in their efforts to explain the displacement and replacement of hegemonic thinking in politics, economics, and sociology. I think that while, as in the case of the displacement of Keynesianism in the late seventies and of the rational choice and efficient market hypothesis during the recent financial crisis, the role of dissonant data has been exhaustively studied, explanations of change in knowledge systems have failed to adequately take into account the role of collective action.

The Battle of Seattle underlines in my view the very critical, if not decisive role of collective mass action in displacing knowledge systems. Let me explain.

It is now generally accepted that globalization has been a failure in terms of delivering on its triple promise of lifting countries from stagnation, eliminating poverty, and reducing inequality. The ongoing global economic crisis, which is rooted in corporate-driven globalization and financial liberalization, has driven the last nail into the ideology of neoliberalism.

But things were very different over two decades ago. I still remember the note of triumphalism surrounding the first ministerial meeting of the World Trade Organization in Singapore in November 1996. There, we were told by representatives of the U.S. and other developed countries that corporate-driven globalization was inevitable, that it was the wave of the future, and that the sole remaining task was to make the policies of the World Bank, International Monetary Fund, and the WTO more “coherent” in order to more swiftly get to the neoliberal utopia of an integrated global economy.

Indeed, the momentum of globalization seemed to sweep everything in front of it, including the truth. In the decade prior to Seattle, there were a lot of studies, including United Nations reports, that questioned the claim that globalization and free market policies were leading to sustained growth and prosperity. Indeed, the data showed that globalization and pro-market policies were promoting more inequality and more poverty and consolidating economic stagnation, especially in the global South. However, these figures remained “factoids” rather than facts in the eyes of academics, the press, and policymakers, who dutifully repeated the neoliberal mantra that economic liberalization promoted growth and prosperity. The orthodox view, repeated ad nauseam in the classroom, the media, and policy circles was that the critics of globalization were modern-day incarnations of Luddites or, as Thomas Friedman disdainfully branded us, believers in a flat earth.

Then came Seattle in 1999. After those tumultuous days in this city, the press began to talk about the “dark side of globalization,” about the inequalities and poverty being created by globalization. After that, we had the spectacular defections from the camp of neoliberal globalization, such as those of the financier George Soros, the Nobel laureate Joseph Stiglitz, and the star economist Jeffery Sachs. The intellectual retreat from globalization probably reached its high point of sorts in 2007 in a comprehensive report by a panel of neoclassical economists headed by Princeton’s Angus Deaton and former IMF chief economist Ken Rogoff, which sternly asserted that the World Bank Research Department—the source of most assertions that globalization and trade liberalization were leading to lower rates of poverty, sustained economic growth, and less inequality—had been deliberately distorting the data and/or making unwarranted claims.

True, neoliberalism continues to be the default discourse among many economists and technocrats. But even before the recent global financial collapse, it had already lost much of its credibility and legitimacy. What made the difference? Not so much research or debate but action. It took the anti-globalization actions of masses of people in the streets of Seattle, which interacted in synergistic fashion with the resistance of developing country representatives here in the Sheraton Convention Center and a police riot, to bring about the spectacular collapse of a WTO ministerial meeting and translate those factoids into facts, into truth. And the intellectual debacle inflicted on globalization by Seattle had very real consequences. Today, the Economist, the prime avatar of neoliberal globalization, admits that the “integration of the world economy is in retreat on almost every front,” and a process of “deglobalization” that it once considered unthinkable is actually unfolding.

Seattle was what Hegel called a “world-historic event.” Its enduring lesson is that truth is not just out there, existing objectively and eternally. Truth is completed, made real, and ratified by action. In Seattle, ordinary women and men made truth real with collective action that discredited an intellectual paradigm that had served as the ideological warden of corporate control.

I would not say that neoliberalism was defeated in Seattle. But, to use a war metaphor, Seattle was certainly the Stalingrad of neoliberalism. It would take another decade before it would be definitively rolled back, and it took the global financial crisis to do this, with its sweeping away of the Rational Choice Theory and the Efficient Markets hypothesis that had been the cutting edge of the globalization of finance.

WTO protests in Seattle, November 30, 1999 Pepper spray is applied to the crowd. / Photo credit Steve Kaiser @Wikicommons

Finance Capital’s Persistent Structural Power

But the rollback of the neoliberal paradigm is only half the story. Even with its ideational crisis, the forces of global capital have waged a fierce rearguard battle. As an example of this let me just take the case of finance capital’s successful effort to resist any change in the face of the naked necessity and social consensus for comprehensive reform.

When the ground from under Wall Street opened up in autumn 2008, there was much talk of letting the banks get their just desserts, jailing the “banksters”, and imposing draconian regulation. The newly elected Barack Obama came to power promising banking reform, warning Wall Street, “My administration is the only thing that stands between you and the pitchforks”.

Yet nearly eight years after the outbreak of the global financial crisis, it is evident that those who were responsible for bringing it about have managed to go completely scot-free. Not only that, they have been able to get governments to stick the costs of the crisis and the burden of the recovery on their victims.

How did they succeed? The first line of defense for the banks was to get the government to rescue the banks from the financial mess they had created. The banks flatly refused Washington’s pressure on them to mount a collective defense with their own resources. Using the massive collapse of stock prices triggered by Lehman Brothers going under, finance capital’s representatives were able to blackmail both liberals and the far-right in Congress to approve the US$700 billion Troubled Asset Relief Program (TARP). Nationalization of the banks was dismissed as being inconsistent with “American” values.

Then by engaging in the defensive anti-regulatory war that they had mastered in Congress over decades, the banks were able, in 2009 and 2010, to gut the Dodd–Frank Wall Street Reform and Consumer Protection Act of three key items that were seen as necessary for genuine reform: downsizing the banks; institutionally separating commercial from investment banking; and banning most derivatives and effectively regulating the so-called “shadow banking system” that had brought on the crisis.

They did this by using what Cornelia Woll termed finance capital’s “structural power”. One dimension of this power was the US$344 million the industry spent lobbying the U.S. Congress in the first nine months of 2009, when legislators were taking up financial reform. Senator Chris Dodd, the chairman of the Senate Banking Committee, alone received US$2.8 million in contributions from Wall Street in 2007–2008. But perhaps equally powerful as Wall Street’s entrenched congressional lobby were powerful voices in the new Obama Administration who were sympathetic to the bankers, notably Treasury Secretary Tim Geithner and Council of Economic Advisors’ head Larry Summers, both of whom had served as close associates of Robert Rubin, who had successive incarnations as co-chairman of Goldman Sachs, Bill Clinton’s Treasury chief, and chairman and senior counsellor of Citigroup.

Finally, the financial sector succeeded by hitching the defense of its interests to one of the few remaining resonant assumptions of an otherwise crumbling neoliberal ideology: that the state is the source of all things bad that happens in the economy. While benefiting from the government bailout, Wall Street was able to change the narrative about the causes of the financial crisis, throwing the blame entirely on the state.

This is best illustrated in the case of Europe. As in the U.S., the financial crisis in Europe was a supply-driven crisis, as the big European banks sought high-profit, quick-return substitutes for the low returns on investment in industry and agriculture, such as real-estate lending and speculation in financial derivatives, or placed their surplus funds in high-yield bonds sold by governments. Indeed, in their drive to raise more and more profits from lending to governments, local banks, and property developers, Europe’s banks poured US$2.5 trillion into Ireland, Greece, Portugal and Spain.

The result was that Greece’s debt-to-GDP ratio rose to 148 percent in 2010, bringing the country to the brink of a sovereign debt crisis. Focused on protecting the banks, the European authorities’ approach to stabilizing Greece’s finances was not to penalize the creditors for irresponsible lending but to get citizens to shoulder all the costs of adjustment.

The changed narrative, focusing on the “profligate state” rather than unregulated private finance as the cause of the financial crisis, quickly made its way to the USA, where it was used not only to derail real banking reform but also to prevent the enactment of an effective stimulus programme in 2010. Christina Romer, the former head of Barack Obama’s Council of Economic Advisers, estimated that it would take a US$1.8 trillion to reverse the recession. Obama approved only less than half, or US$787 billion, placating the Republican opposition but preventing an early recovery. Thus the cost of the follies of Wall Street fell not on banks but on ordinary Americans, with the unemployed reaching nearly 10 percent of the workforce in 2011 and youth unemployment reaching over 20 percent.

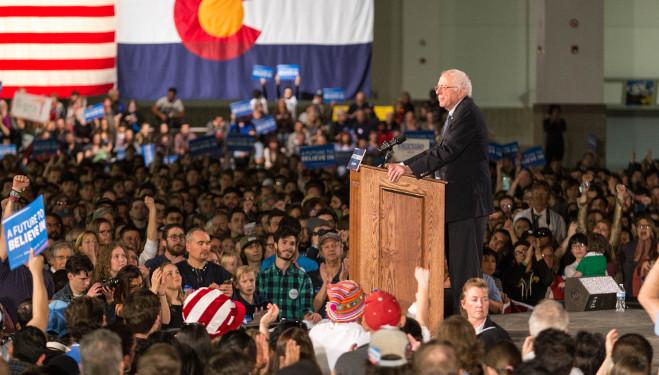

The triumph of Wall Street in reversing the popular surge against it following the outbreak of the financial crisis is evident in the run-up to the 2016 presidential elections. The U.S. statistics are clear: 95 percent of income gains from 2009 to 2012 went to the top 1 percent; median income was US$4,000 lower in 2014 than in 2000; concentration of financial assets increased after 2009, with the four largest banks owning assets that came to nearly 50 percent of GDP. Yet regulating Wall Street has not been an issue in the Republican primary debates while in the Democratic debates, it has been a side issue, despite the valiant efforts of candidate Bernie Sanders to make it the centerpiece.

Bernie Sanders Rally in Denver, Colorado at the Colorado Convention Center. / Photo credit Hans Watson @Flickr

The political institutions of one of the world’s most advanced liberal democracies were no match for the entrenched structural power of the financial establishment. As Cornelia Woll writes, “For the administration and Congress, the main lesson from the financial crisis in 2008 and 2009 was that they had only very limited means to pressure the financial industry into behavior that appeared urgently necessary for the survival of the entire sector and the economy as a whole”.

In Greece, the austerity policies provoked a popular revolt – expressed in the June 2015 referendum on the bailout in which over 60 percent of the Greek people rejected the deal – but in the end their will was trampled on as the German government forced Tsipras into a humiliating surrender. It is clear that the key motives were to save the European financial elite from the consequences of their irresponsible policies, enforcing the iron principle of full debt repayment, and crucifying Greece to dissuade others, such as the Spaniards, Irish, and Portuguese, from revolting against debt slavery. As Karl Otto Pöhl, a former head of Germany’s Bundesbank, admitted some time back, the draconian exercise in Greece was about “protecting German banks, but especially the French banks, from debt write-offs”.

Yet, the victory of the banks is likely in the end to be pyrrhic. The combination of deep austerity-induced recession or stagnation that grips much of Europe and the U.S. and the absence of financial reform is deadly. The resulting prolonged stagnation and the prospect of deflation have discouraged investment in the real economy to expand goods and services.

With the move to re-regulate finance halted, the financial institutions have all the more reason to do what they did prior to 2008 that triggered the current crisis: engage in intense speculative operations designed to make super-profits from the difference between the inflated price of assets and derivatives based on assets and the real value of these assets before the law of gravity causes the inevitable crash.

The non-transparent derivatives market is now estimated to total US$707 trillion, or significantly higher than the US$548 billion in 2008. According to one analyst, “The market has grown so unfathomably vast, the global economy is at risk of massive damage should even a small percentage of contracts go sour. Its size and potential influence are difficult just to comprehend, let alone assess.” Former U.S. Securities and Exchange Commission Chairman Arthur Levitt, the former chairman of the SEC, agreed, telling one writer that none of the post-2008 reforms has “significantly diminished the likelihood of financial crises”.

The question then is not if another bubble will burst but when. And for us here, the key lesson is that in spite of the ideological discrediting of neoliberalism and popular anger at the depredations of the banks, the structural power of capital remains immense and has prevented any significant financial figure from being jailed, much less allowed significant reform.

The Need for a New Comprehensive Vision

My sense is that the persistence of Capital’s structural power is related to the fact that while the combination of objective developments, intellectual critique, and collective action eroded the legitimacy of neoliberalism, we have had a signal failure to articulate the bold alternative that can match the depth of the crisis of capitalism that we are in.

There is great, seething discontent out there, at the multiple crises triggered by capitalism. I wish, however, one could say, as one great revolutionary did at another time and place, “There is great tumult under heaven, the situation is excellent.” Unfortunately, the situation is not excellent, since many of those who have been run over by corporate-driven globalization are turning to demagogues and ideologues of the right such as Donald Trump, Marin Le Pen, and, in my own country, President Rodrigo Duterte, who has managed to convince a large section of the citizenry that crime and drugs are the root of the country’s problems and that the main cure for the ills of the country is to kill ‘em all, pushers and users alike. In this regard, let me say that the US and Europe have no monopoly on dangerous right wing demagogues with a heated, angry mass base, a great many of them resentful people from the suffering middle classes, who want simple solutions and are willing to countenance violence to bring about the leader’s version of heaven on earth. The key difference at this point is that your demagogues are still on the sidelines chopping at the bit to grab power while ours has already come to power by electoral means.

Undoubtedly, part of the problem is the failure of the traditional forces of the left to educate their core bases of support, such as the white working class. Another part has been the inability to integrate minority populations into the ranks of the left, which has traditionally been the home of the disenfranchised and marginalized, forcing some to turn to radical fundamentalist groups such as ISIS. Thus the very real hurts imposed on so many sectors by corporate-driven globalization have been successfully joined to myths about displacement and crime by immigrants, on the one hand, and to the very real failures of immigrant integration, on the other. Donald Trump, Marin Le Pen, and ISIS have been very astute in taking advantage of the openings that were made by the left, by those who brought about the Seattle debacle of neoliberalism, by those who had been in the forefront of the anti-globalization and the Occupy Movement. These people have been eating our lunch.

I will not go further into the sociological reasons for their success and our failure, since many others have done that, but I do want to raise one question, and that is whether it is not overdue for us to take on the super-ambitious task of creating that overarching vision, language, and program to spell out the alternative and flesh it out. Bernie Sanders started this brave task by calling for “democratic socialism,” something that has resonated in the Philippines and the global South. I think it is urgent that we flesh it out since the other side is already fleshing out their alternative in the form of Trumpism or National Frontism or Brexitism, a task which marries some of our intellectual critique of capitalism with the highly charged emotional appeal to return to an idealized past of white homogeneity, cultural purity, or religious uniformity. I think it is urgent that we overcome our fears of articulating Grand Narratives and lay out a vision that lays out the overcoming of the present world blighted by Capital through common struggle, with the end being the construction of societies that harness men and women’s deepest instinct–to use a loaded word—and that is, cooperation. Needless to say, such an endeavor must also be one that acknowledges the limitations, failures, and distortions of past efforts at building post-capitalist societies, especially when it came to dealing with issues of democracy, gender, and the environment.

I am not usually a bible quoting speaker, but there is definitely something profound in that passage in Proverbs 29:18: “Where there is no vision, the people perish.” It would be tragic if people were left to the phlegmatic alternatives posed by the historically bypassed Social Democrats in Europe, the tiresome Clintons in the United States, and uninspiring elite-run reform movements in the global South. Such political alternatives are no much for the counterrevolutionary movements that are on the march.

__________________________________

Walden Bello was, until recently, a member of the House of Representatives of the Philippines. He is the author of many books and articles on U.S. political, military, and economic relations with Asia. Bello is an expert on the World Trade Organization and global trade, senior analyst at the Philippine think-tank Focus on the Global South, and TNI fellow. He was the principal author of A Siamese Tragedy: Development and Disintegration in Modern Thailand (London: Zed Press, 1998).

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.