Why Wall Street’s Scandals Keep Coming

CAPITALISM, 24 Oct 2016

Maureen O'Hara | Market Watch – TRANSCEND Media Service

It’s too easy for Wall Street to overlook ethical constraints and only care about the ends, not the means.

17 Oct 2016 – It is human nature to search for the easier way to do things. At Volkswagen, engineers decided it was easier to write code to fool mileage sensors than it was to actually build more fuel-efficient cars. At Wells Fargo, opening new accounts was much easier to do if you skipped that pesky customer step. Both cases illustrate the pitfalls of caring only about the ends and not also the means.

Modern finance shares a similar focus on finding alternative ways to do things. Much of it relies on arbitrage activity to make sure cash flows all line up correctly. Whether in the guise of realigning prices gone astray, or in creating new synthetic versions of particular contracts, or in just devising more efficient ways to optimize against inefficient market structures, arbitrage plays a starring role. The end result of such arbitrage activity is typically an improvement over what came before: prices are more efficient, new ways to invest become available, rigidities are overcome.

But arbitrage can also be used to gut regulatory structures, take advantage of the less sophisticated, and manipulate markets. Looking at the world as just so many cash flows to be organized as ones sees fit can overlook an important missing piece — the ethics of doing so.

Indeed, for perhaps too many, it may not even be apparent that there is an ethical component to consider — let alone determine what it is. As Dilbert creator Scott Adams so artfully described, it can become all too easy to fall into the “weasel zone” — the gray area between good moral behavior and being an outright felon.

Are people attracted to finance just “worse” than everyone else? Is finance as an industry fatally flawed? Why didn’t or doesn’t regulation stop all this?

As bankers and financial firms grapple with scandal after scandal, outsiders are rightly asking some key questions. Are people attracted to finance just “worse” than everyone else? Is finance as an industry fatally flawed? Why didn’t or doesn’t regulation stop all this? My own answer to the first question is no, they are not worse, although Elizabeth Warren might have a different take on this. My work focuses on the latter two questions: what is it about finance and how do we stop these behaviors before they completely undermine trust in the financial markets?

Finance is ends-driven, focusing on how to replicate an outcome but not worrying too much about how we get there. Thus, J.P. Morgan Energy Ventures Corp. perhaps perceived its machinations in the California electricity market as solving an optimization problem against an inefficient allocation algorithm, and not as participating in the price-setting mechanism actually affecting the production and pricing of electricity. Its $410 million settlement with the Federal Energy Regulatory Commission may have been viewed as a cost of doing business with a persnickety regulator, rather than as a fine for actually manipulating the market (a charge the firm denies).

The Libor scandal reflects a similar failing in that traders’ bidding strategies were based on making money by moving one market (the actual Libor rate) to benefit their positions in another market (the Libor derivatives) — and not particularly caring about the impact that phony and manipulative bids had on the operations of the actual Libor market. The slicing and dicing of cash flows in the various mortgage-backed securities scandals set the stage for similar shenanigans.

It simply becomes too easy to miss the ethical constraints of the natural world when you are happily spending your time implementing strategies in the synthetic one.

Does this mean that finance is fatally flawed? Certainly not, but it does suggest that the users of financial techniques have to recognize a basic fact: the means may matter just as much as the ends do. This isn’t typically the way concepts such as arbitrage are taught, or how such techniques are often used in practice. But it is increasingly clear that failing to recognize this is becoming an extremely expensive hobby.

Yet more rules and regulations cannot hope to quell the bad behavior coincident with arbitrage activities in financial markets. This is because rules and regulations give greater specificity to what exactly is precluded, but this just makes it easier to create a more exact replication. The mathematical nature of arbitrage-based activities flourishes when constraints are precise; imprecision is its enemy. This argues for the greater use of standards in policing financial activities, rather than adding more pages to the finance rule book. FERC’s settlement with J.P. Morgan Energy Ventures was facilitated by a much broader and encompassing definition of manipulation in energy markets — a new standard thanks in large part to Enron’s earlier misbehavior there.

Arbitrage-based activities have an important role to play in financial markets. It is not the easy way, but what is finally being realized is that the ethical component cannot be arbitraged out of the process.

________________________________

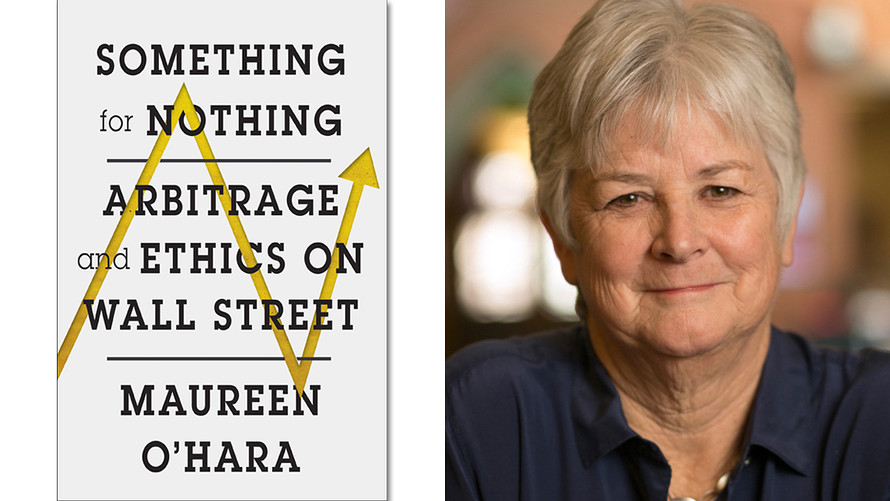

Maureen O’Hara is the Robert W. Purcell Professor of Management at Cornell University and the author of Something for Nothing: Arbitrage and Ethics on Wall Street, which will be published on Oct. 25.

More from MarketWatch’s BookWatch:

Go to Original – marketwatch.com

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.