Budget 2019: India’s Super-Rich Peak Tax Rate at 42.7%

BRICS, 15 Jul 2019

Moneycontrol News – TRANSCEND Media Service

Finance Minister Nirmala Sitharaman announced that individuals earning more than Rs 5 crore [approx. € 630,000 or US$ 740,000] a year would pay a surcharge of 37.5 percent on their tax, over above their 30 percent marginal tax.

5 Jul 2019 – Finance Minister Nirmala Sitharaman today announced that the tax rate on the super-rich would go up, with a peak effective tax rate of 42.7 percent being higher than the US’ 40 percent.

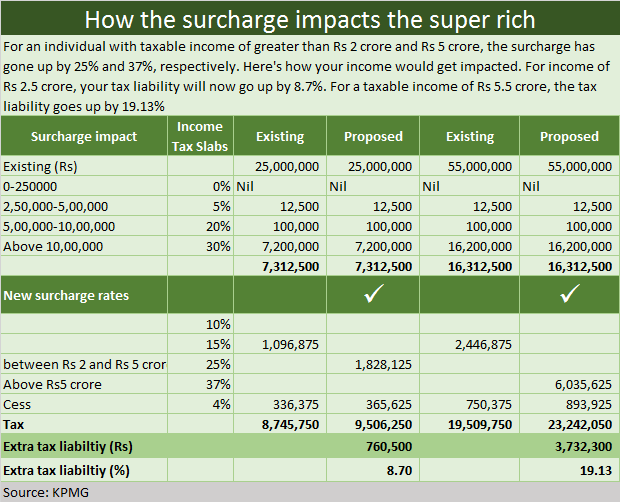

Presenting her maiden Budget, Sitharaman said that individuals earning more than Rs 5 crore a year would pay a surcharge of 37.5 percent on their tax, over above their 30 percent marginal tax. This comes up to an effective rate of 41.1 percent rate (Rs 30 tax on every Rs 100 earned, plus another 37 percent on Rs 30, which is Rs 11.1). Add to that various cess, and the peak tax rate comes up to 42.7 percent.

The surcharge on those earning between Rs 2 and Rs 5 crore increased to 25 percent, bringing their effective tax rate to about 39 percent.

The measures are in lieu of the rising income levels, announced Finance Minister Nirmala Sitharaman, during her maiden Union Budget on Friday.

The timing of the announcement could potentially pose another problem for taxpayers.

“The significant increase in taxation for those earning above Rs 2 crore means that the advance tax installment paid for the first quarter in June 2019 would be lower than the actual tax installment post the Budget announcements. Hence, these high-income earners would be required to pay interest on the additional amount of tax as well for the first quarter,” chartered accountant Paras Savla points out, unless clarity is issued on this later.

Note: A previous version of this story said the peak income tax rate is 38 percent. This has been corrected.

Go to Original – moneycontrol.com

Tags: BRICS, Capitalism, Economics, India, Justice, Social justice, Super rich

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.