Trump Adds $4.1 Trillion to National Debt. Here’s Where the Money Went

ANGLO AMERICA, 29 Jul 2019

Sibile Marcellus | Yahoo! – TRANSCEND Media Service

26 Jul 2019 – Once President Trump signs the budget deal that was passed by the House yesterday and is expected to be approved by the Senate in a few days, he will have added $4.1 trillion to the national debt, according to the Committee for a Responsible Federal Budget. The total national debt surpassed $22 trillion in February.

This will mark the third time that a major piece of deficit-financed legislation will get Trump’s stamp of approval. Legislation Trump has so far signed since 2017 has added $2.4 trillion to the national debt through 2029, according to CRFB, a nonpartisan public policy group.

Many investors are worried about the ballooning national debt, with 54% naming the political environment and 47% viewing national debt as their top concerns, according to a UBS second-quarter investor sentiment survey. Tax and spending policy are the main reasons for the national debt expansion from 2017 to 2029, according to CRFB.

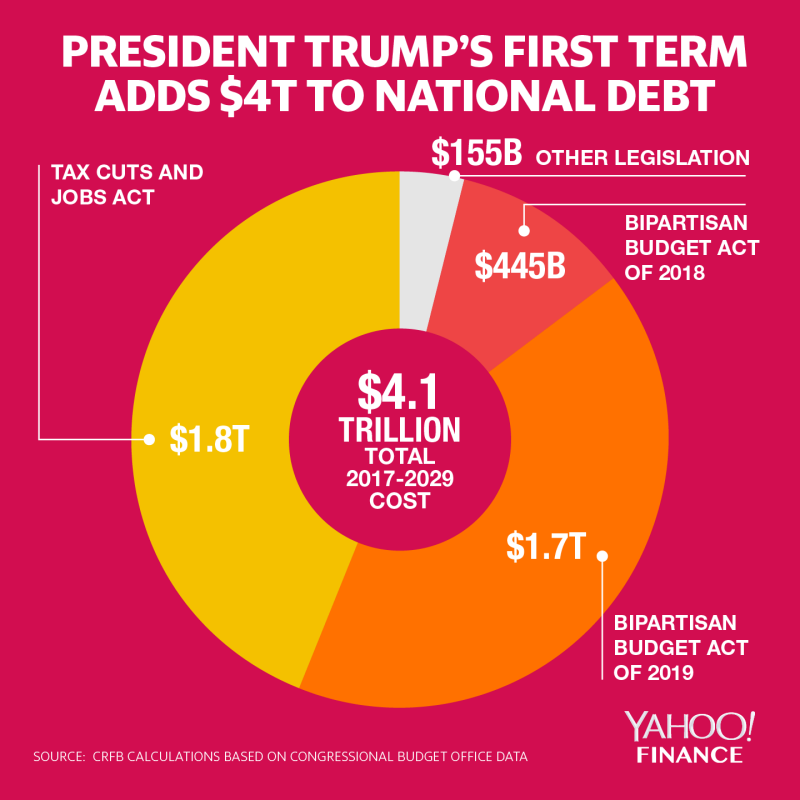

The biggest contributor to the $4.1 trillion that will be added to the national debt through 2029 is the Tax Cuts and Jobs Act. This signature tax cut legislation signed by Trump in 2017 single-handedly increased the debt by $1.8 trillion, according to CRFB.

“If you were to extend all the expiring provisions from the Tax Cuts and Jobs Act, it would be about a trillion more on top of that, so it’s hugely expensive,” says CRFB’s senior vice president Marc Goldwein. “Some of this is done on a partisan basis, some of this is done on a bipartisan basis. But it’s all part of a culture of no longer worrying about how we’re going to pay for things and just assuming that future generations are going to cover the bill.”

The budget deal that was passed last year added $445 billion to the national debt. And when he signs the 2019 Bipartisan Budget Act after it goes to the Senate next week, Trump will make spending increases in the legislation permanent, growing the national debt by $1.7 trillion through 2029.

The remaining $155 billion of debt added during Trump’s first term comes from other legislation, including disaster relief, emergency spending bills, and delays in three Affordable Care Act taxes, according to CRFB.

Impact to GDP

U.S. GDP growth fell to 2.1% in the second quarter. CRFB estimates that the new budget deal will bring debt to 97% of GDP in 2029 once that $4.1 trillion figure is added to the existing $16.2 trillion in debt and $9.8 trillion projected to be borrowed over the next 10 years.

“We are the most powerful economy in the world and we’re the world’s reserve currency and we borrow at our own currency. And for those three reasons we’re not going to default on our debt, but that doesn’t mean that we can borrow without consequences,” says Goldwein.

The ballooning national debt will cause GDP growth to slow down further, he says. “The more we borrow, the more we have to count on capital from abroad, or else no capital at all to fund our investments and the slower growth is going to be over time. We’re already headed towards 2% growth on the current basis, and the higher our debt is, the lower that will be.”

______________________________________________________

Sibile Marcellus is an on-air reporter covering the day’s top stories in business for Yahoo Finance‘s three daily live shows. She previously worked for FOX TV‘s Chasing News as an on-air personality where she covered politics and entertainment.

Sibile Marcellus is an on-air reporter covering the day’s top stories in business for Yahoo Finance‘s three daily live shows. She previously worked for FOX TV‘s Chasing News as an on-air personality where she covered politics and entertainment.

Tags: Capitalism, Economics, Geopolitics, Military, Politics, Power, USA

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.