Argentina’s Yuan Lifeline Is Sign of Brinkmanship between China, US

ECONOMICS, 24 Jul 2023

Natalie Alcoba | Al Jazeera - TRANSCEND Media Service

Buenos Aires has been looking for ways to safeguard its dwindling dollar reserves and has found a willing partner in Beijing.

The US has sought to exert pressure on Argentina to rein in its ties with China.

File: Jorge Saenz/AP Photo

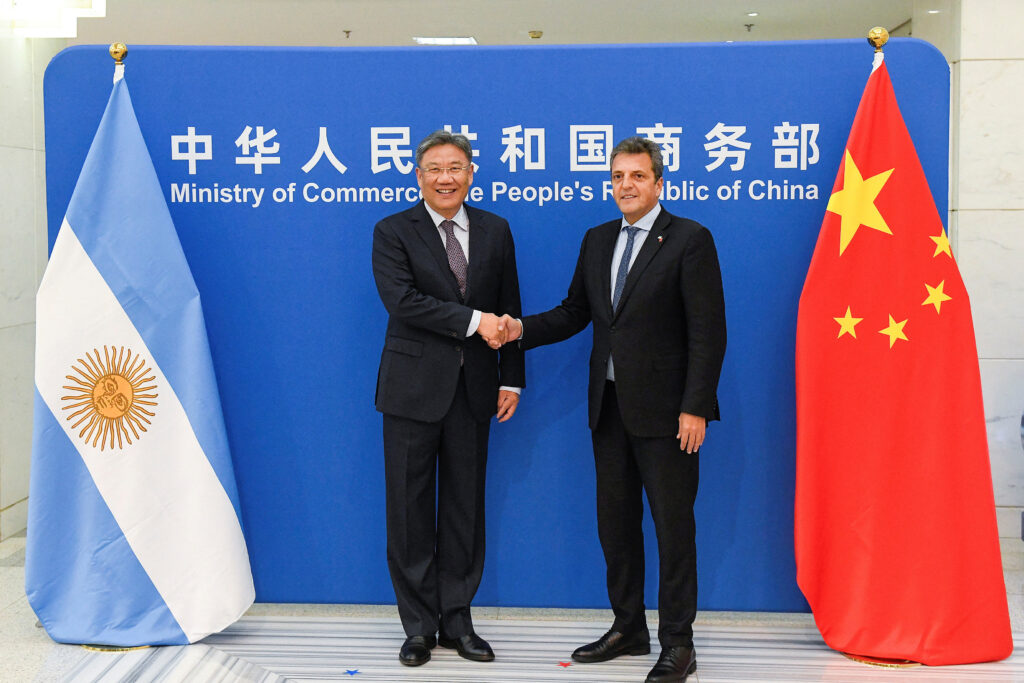

17 Jul 2023 – There were a lot of thumbs-up signs from Argentine Economy Minister Sergio Massa on a recent trip to Beijing.

The packed agenda for one of the most influential politicians in Argentina was another sign of the times.

Massa, who recently announced his bid for president in this year’s election, met with a wide slate of government and business leaders, securing $3.05bn from Chinese institutions to finance railways, power lines, lithium projects and renewable energy in Argentina. He also made inroads in bolstering Argentine exports like poultry and corn to help feed a growing Chinese middle class.

But perhaps the announcement of most consequence came around the currency swap line between the two countries – a yuan lifeline, so to speak, to the beleaguered Latin American economy, which is seeking more financial room to manoeuvre.

In April, China and Argentina announced the swap line had been activated, enabling Argentina to use the equivalent of $1.04bn in yuan to pay for Chinese imports in May. Then in June during Massa’s China trip, that line was extended to up to $18bn over the next three years. The Central Bank of Argentina said this increased the amount available for use from about $5bn to almost $10b.

Last month, Argentina took another step towards strengthening its ties to the yuan, making part of a $2.7bn debt payment to the International Monetary Fund (IMF) in the Chinese currency. The Central Bank of Argentina also announced in June that Argentines are now able to open savings and checking accounts in yuan.

The move carries important significance for Argentina, which has been looking for ways to safeguard its dwindling US dollar reserves and has found in China a willing partner.

But it also speaks to broader geopolitical interests for China as it tries to establish itself as a lender of last resort while a debate around the primacy of the dollar as international currency grows.

“[The swap extension] allows companies from the People’s Republic of China an opportunity to develop an investment flow [to Argentina] based on the yuan,” Massa said in June in Beijing.

“It consolidates the yuan as an investment tool,” he added. “And it enables Argentina to not only use it for commercial and foreign exchange investment flows but also as a mechanism for the central bank in all kinds of investments.”

Since then, about 500 Argentine companies have already started to pay for Chinese imports in yuan, according to Argentina’s customs agency.

China’s growing influence in the region

China’s presence in Latin America dates back centuries, but in the past two decades, it has really taken off, making it now South America’s largest trading partner.

In the 2000s, China’s exploding middle class fuelled the commodities boom that helped turn around several economies in the region. At the start of that decade China accounted for less than 2 percent of exports from the region. But 10 years later, that percentage has more than quadrupled.

In 2022, trade between China and Latin America and the Caribbean was $450bn. Latin America also received 24 percent of the loans issued by official Chinese institutions from 2005 to 2021, behind Asia and ahead of Africa.

Since 2014, China has also been working to position its currency as an alternative to the dollar with a cross-border, interbank payment system known as CIPS, which Beijing hopes will one day rival the SWIFT, or Western, clearinghouses.

In Argentina, Chinese investments run the gamut. In addition to being a major customer of Argentine soy, Chinese companies have poured billions into a wide swath of infrastructure projects. The Chinese military runs a space station in the Patagonia province of Neuquen, and a state-owned coal and chemical company is negotiating to build a port in the southern-most province of Tierre del Fuego. It also provided aid during the COVID-19 pandemic, making Argentina one of the first countries to receive Chinese-developed vaccines.

US tensions

These growing ties have not gone unnoticed by the United States, the traditionally dominant player in the region, which has seen its influence on its so-called back-yard slip. In response, the US has sought to exert pressure on Argentina to rein in its ties with China, advocating privately, and in some cases publicly, against certain projects.

This year, General Laura Richardson, chief of US Southern Command, said the US has to “raise our game” in the region, noting its abundance of natural resources, including crucial minerals, such as lithium. China has already staked an important claim on the mineral that will power the electric car revolution, pouring billions into mines across the so-called Lithium Triangle, comprised of Argentina, Chile and Bolivia.

During an April visit to Buenos Aires, US Deputy Secretary of State Wendy Sherman weighed in on Argentina’s ongoing negotiations to buy Chinese fighter jets versus American ones and a possible deal for nuclear production, all the while warning that China is seeking to “undermine democracy”.

“We are not asking countries to choose between us and the [People’s Republic of China], but I think we have superior products,” online daily Buenos Aires Herald quoted her as saying. “What we are saying is: ‘Buy everywhere. Understand what you are buying.’”

Of course, geopolitics can no longer be reduced to the bipolar terms of the Cold War. The United States and China, while political and military rivals, are large trading partners with economies that are increasingly interdependent.

Still, it’s clear that the US considers any advance by China in the region as a threat to its own security, said Gabriel Merino, an Argentine expert in international politics.

“It’s said that there are 17 Chinese projects that suffered delays or were halted because of pressure from Washington,” Merino said. “There are some who say that’s not the case, that there are also local responsibilities on the part of China. But even if it’s not 100% the cause, it’s true that the pressure plays and played an important role in the governments of both [Presidents Mauricio] Macri and [Alberto] Fernandez.”

‘Trapped between the two world superpowers’

It has been a brutal economic year for Argentina. With inflation now climbing past 114 percent in the past year and the effects of a drought on its important agricultural sector still battering its financial ledger, the government has strained to meet its debt payments to the IMF. In that context, it has turned to China, in a move that Merino says is good for the country, at least in the short term because it diversifies its financial picture.

For Argentine political scientist Luciano Moretti, it is evidence of a vulnerability that is only deepening. “Argentina is a bit trapped between the two world superpowers,” he said.

“I don’t think that the move that Argentina is making should be interpreted as defying the United States, but to the contrary, in a context of profound internal and external weakness,” said Moretti, who is writing his dissertation on China, “it could be seen as a strategy to have more autonomy, or a deepening of our dependency” because Argentina “doesn’t have the autonomy to be able to make strategic decisions for the long term”.

It is important to note, however, that the Chinese loan represents a tiny fraction of what Argentina owes to international creditors. “If Argentina ends up falling into default, it won’t be because of its relationship with China,” Moretti noted.

China, Argentina agree to jointly promote ‘belt and road’ initiative. Released June 2, 2023. Argentine Ministry of Economy/Handout via REUTERS

Debate over de-dollarisation

While the value of the Argentina-China swap does not change things in a quantitative manner, Merino considers it to be an important deal for qualitative reasons, in particular because it comes at a time when debate around the supremacy of the dollar as the international currency of record has returned.

The BRICS nations – Brazil, Russia, India, China and South Africa – are speaking more loudly about currency alternatives. In China this year, Brazilian President Luiz Inacio Lula da Silva openly questioned the need for the dollar’s dominance.

“Why can’t we do trade based on our own currencies?” he asked in April. A month later, he proposed creating a single currency for trade in the Mercosur trade bloc of Argentina, Brazil, Paraguay and Uruguay.

After the Russian invasion of Ukraine and international sanctions against Russia, India has dramatically increased its purchases of Russian oil in currencies other than the greenback, such as the United Arab Emirates dirham and the rouble, the Reuters news agency reported, while Saudi Arabia signalled it is open to accepting payments for its oil in a currency other than the dollar.

Still, this debate, while not new, is just beginning. Although the world’s reserves in dollars have dropped from about 71 percent 20 years ago to 58 percent today, Merino said: “We are still in a world economy that is dollarised.”

Go to Original – aljazeera.com

Tags: Argentina, Asia and the Pacific, BRICS, China, Dollar, Economics, Finance, Latin America Caribbean, South America, Trade, Yuan

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Read more

Click here to go to the current weekly digest or pick another article:

ECONOMICS:

- From Private Profit to Public Power: World’s Richest 1% Increased Wealth by $33.9 Trillion Since 2015

- Eradicating Poverty beyond Growth: Reforming the Global Financial Architecture for Ecological and Social Justice

- Two Hundred Years Ago, France Strangled the Haitian Revolution with an Inhumane Debt By Vijay Prashad