Top 1 Percent Owns Half of All Global Wealth, Per Credit Suisse Report

CAPITALISM, 19 Oct 2015

Owen Davis – International Business Times

13 Oct 2015 – In the past year, global wealth reversed a steady upward climb and fell by $12.4 trillion, largely due to currency fluctuations. But worldwide wealth inequality continued its upward march: The top 1 percent of households “account for half of all assets in the world,” according to the 2015 Credit Suisse Global Wealth Report.

The Shanghai World Financial Center and the Jin Mao Towers rise above low cloud cover. Global wealth inequality in 2015 increased to levels “possibly not seen for almost a century,” according to Credit Suisse. Reuters/Aly Song

That’s a first since the Swiss bank began compiling the data in 2000, and a level “possibly not seen for almost a century,” the researchers write. For those on the other end of the wealth spectrum, meanwhile, the numbers are reversed. The poorest half of the world’s population owns just 1 percent of its assets.

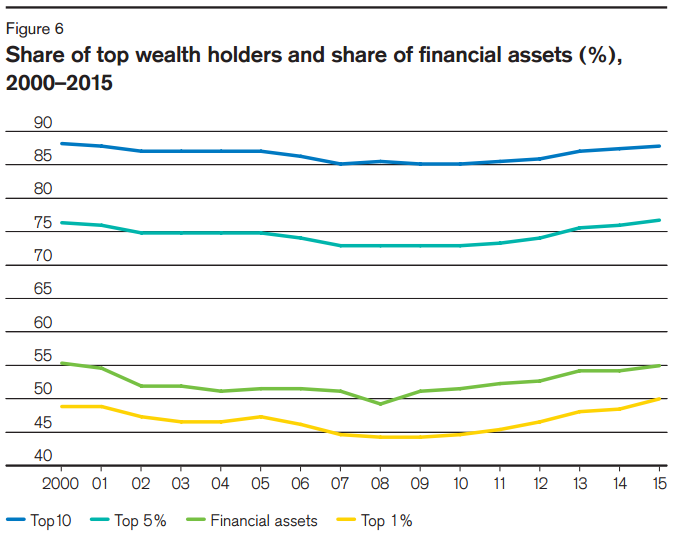

Though these inequality figures fall in line with longer-term trends, they also reflect financial markets that have experienced an uncommonly long bull run, especially in the United States. Financial assets have seen a 6 percent rise in the share of total wealth since 2008, benefiting the wealthy, who hold a disproportionate amount of capital.

The share of global wealth in the top 1 percent mirrored the rise in financial asset values. James Davies, Rodrigo Lluberas and Anthony Shorrocks, Credit Suisse Global Wealth Databook 2015

The overall rise in global wealth continued to be driven in large part by China and the emerging markets, which have doubled their aggregate wealth since 2000. China, whose wealth has grown fivefold since the beginning of the century, was shaken by market turmoil in the middle of the year but still managed to add $1.5 trillion in wealth.

The strengthening dollar accounted for the global contraction in wealth, down to $250.1 trillion, a level near that of 2013. Europe was the most sharply affected by this trend, with total wealth falling $10.7 trillion.

In 2015, a household net worth of $759,000 will put you in the ranks of the global one-percenters. The cutoff for the top 10 percent stood at $68,800.

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.