Towards a New, Green Economy

PARADIGM CHANGES, 21 Nov 2016

Peter A. Victor and Tim Jackson | The Next System Project – TRANSCEND Media Service

3 Nov 2016 – This paper is one of many proposals for a systemic alternative we have published or will be publishing here at the Next System Project. We have commissioned these papers in order to facilitate an informed and comprehensive discussion of “new systems,” and as part of this effort we have also created a comparative framework which provides a basis for evaluating system proposals according to a common set of criteria.

A sustainable, equitable economy is on the horizon

This paper explores what we will call the green economy as a potential solution to the multiple challenges from climate change, biodiversity loss, and resource scarcity to social injustice, and financial instability.1

Green economy is still a contested concept. At its worst, it simply provides cover for business-as-usual—the escalation of unsustainable corporate practices that threaten the integrity of the natural world and undermine the resource base for future prosperity. At its best, green economy offers a positive blueprint for a new economics: firmly anchored in principles of ecological constraint, social justice, and lasting prosperity. A premise of this piece is that such a blueprint is worth articulating. Explorations of the green economy have until now mostly taken place at a national or international level. This paper addresses the implications of the green economy at the local level. It offers analyses on the conceptual foundations for more sustainable, people-friendly community-based economic activities and presents some empirical evidence for successful implementation of these ideas.

A green economy is not an end in itself. Rather, as we argue in section two, it is a means towards a shared and lasting prosperity. But what exactly does prosperity mean? We propose a definition of prosperity in terms of the capabilities that people have to flourish on a finite planet. It is clear that a part of our prosperity depends on material goods and services. Living well clearly means achieving basic levels of material security. But prosperity also has important social and psychological components. Our ability to participate in the life of society is vital. Meaningful employment, satisfying leisure, and a healthy environment also matter. We show how individual prosperity is linked intrinsically to community. Thriving communities are the basis for shared prosperity.

A further premise of this essay is that the principal goal of the green economy is to deliver prosperity. In other words, the green economy must deliver the capabilities for individuals to flourish and communities to thrive. Prosperity demands not only the provision of goods and services but also security in employment and stability in markets. Drawing on emerging understandings of the green economy at the macroeconomic level, we identify four specific aspects which are of primary importance to thriving communities: the role of enterprise, the quality of work, the structure of investment, and the nature of the money economy. These aspects of the green economy are explored below.

We propose a role for enterprise grounded in providing the capabilities for people to flourish in their communities. First and foremost, of course, these capabilities must include the necessities of life: food, clothing, and shelter. But beyond these needs, our prosperity depends on the “human services” that improve the quality of our lives: health, social care, education, leisure, recreation, and the maintenance, renovation, and protection of physical assets and natural systems. We also explore forms of company structure and organization set up specifically in the interests of community: cooperatives, B corporations, and community and social interest enterprises.

The role of work and employment is fundamental to the success of the green economy. Work is more than just the means to a livelihood. It is also a vital ingredient in our connection to each other—part of the “glue” of society. Good work offers respect, motivation, fulfilment, involvement in community, and, in the best case, a sense of meaning and purpose in life. We outline a two-fold strategy for achieving high levels of employment within the green economy. On the one hand, we illustrate the expansion of employment through a “service-enterprise” economy. On the other, we explore the role of reduced working hours in achieving a just distribution of working time.

Investment is one of the most important functions for any economy. Protecting the assets on which future well-being depends is an integral component of prosperity. We identify a number of essential targets for investment at the local level. The portfolio of green investment must include: improving energy efficiency and resource productivity, increasing the capacity for a local service enterprise sector, building and maintaining community assets, protecting and enhancing social and natural systems, and developing local renewable energy opportunities.

A key finding from our own macroeconomic work on the green economy is that the money economy (the creation, maintenance, and stability of the money supply) is a vital component of sustainability. The unconstrained creation of money through commercial debt stimulates unsustainability in investment and instability in financial markets. In the wake of the financial crisis of 2008/09, with wider capital markets still in disarray, lending constraints hinder green investment and undermine the prosperity of communities. We explore community responses to this dilemma and outline a range of potential institutional innovations, including: community banking, peer-to-peer lending, community bonds, local exchange trading schemes, and the role of sovereign money in directing social investment.

The final section of the essay draws together our findings and identifies positive steps towards the creation of green local economies. We explore the opportunities for communities to take independent positive action in pursuit of a green local economy. It would be a mistake, however, to suggest that transformation is possible without wider institutional and infrastructural changes. So, we explore the wider role of governance in stimulating and enabling change and propose an inventory of policy levers that could aid the transition to a green economy.

- Introduction

In our view, the contest over the meaning of the green economy has not yet been decided.2 As ecological economists, our work is anchored in the view that economies are subsystems of the biosphere, mediated by the values and institutions of society. For several decades we have worked individually and together to understand the many dimensions of these relationships.3 Most recently, we have begun to collaborate on the development of what we call “ecological macroeconomics.”

Responding to the dilemma of remaining within ecological limits in a growth-based economy has often been construed primarily as a microeconomic task— one that governments can address with conventional fiscal instruments of tax and subsidy. By these means the “external” costs associated with environmental and social factors would be “internalized” in market prices, according to familiar axioms. More specifically, these conventional arguments claim that incorporating “shadow prices” for environmental goods into market prices will send a clear signal to consumers and investors about the real costs of resource consumption and ecological damage, and incentivize investment in alternatives.

But this long-standing prescription has been hard to implement over the last several decades. Even before the crisis, it proved difficult either to forge agreement on fiscal measures to internalize environmental costs or, indeed, to stimulate appropriate levels of private investment in alternative technologies. The financial crisis has certainly made both of these tasks harder. Despite an early focus on “green stimulus” as a way of invigorating the global economy, subsequent responses have failed consistently to address ecological challenges.

Fears of damaging economic growth prevent politicians from responding effectively on either ecological taxation or green investment. In fact, fragile private and public sector balance sheets have slowed down investment in the real economy generally, to say nothing of the additional (and less familiar) investment needed to make a transition to a low-carbon economy. Conventional responses focus instead on cutting public spending (austerity) and stimulating consumption growth (consumer spending) as the basis for economic recovery. Unfortunately, these responses tend to ignore the structural problems of the conventional paradigm and delay the investment needed in the green economy.

The scale and nature of this dilemma suggest that the combined challenges of climate change and resource scarcity require macroeconomic as well as microeconomic responses. In fact, we believe, there is a need to develop a fully consistent ecological macroeconomics, in which it is possible to maintain economic stability, ensure full employment, address inequality, and yet remain within the ecological constraints and resource limits of a finite planet.4

This task—to develop an ecological macroeconomics—is the one we set ourselves to in the aftermath of the crisis.5 The fundamental building blocks of our approach are three-fold.

First, we wanted our model to reflect accurately the structure of the real economy—that is, to provide an account of incomes, spending, investment, taxation, demography, and the structure of industry consistent with the United Nations System of National Accounts for any given country. Second, we wanted our framework to make a full and proper account of the ecological and resource constraints on the global economy—as they applied at the scale of the national economy. Finally, we wanted our model to incorporate a consistent description of the financial economy, including the supply of money from and to economic actors, and the effect of the money supply on both nominal and real demand. An ecological macroeconomics must show us not only how much investment is needed—for instance, to reach ecological goals—but also how that investment is to be financed.

This last objective was particularly important in the wake of the financial crisis. One of the main shortcomings of conventional economics was its failure to anticipate the impact of fragile balance sheets on the stability of the economy. In fact, most conventional economic models virtually ignore the balance sheet structure of the national economy, in spite of warnings by some far-sighted economists of its importance for economic stability.

Our intention here is to explore the implications of the green economy at community scale. We draw substantially in what follows on the understandings we have gleaned from working at the national scale. But we also explore the lessons to be learned for the green economy from numerous small-scale, community based initiatives for social and ecological change.6 Our aim has been to tease out the cross-cutting organizational dimensions of the green economy. The kinds of questions that orient our inquiry include:

- How is enterprise to be organized?

- How is labor to be employed?

- What is the structure of investment?

- What kind of financial systems are appropriate?

- What sort of governance structures are relevant?

These more foundational questions are, in our view, logically prior to questions about specific industrial sectors like food, energy, transport, or waste. They also speak more closely to the first principles of system change at the economic level. Of course, the results of changes in these cross-cutting dimensions will often reveal themselves at the sectoral level.

Most conventional economic models virtually ignore the balance sheet structure of the national economy, in spite of warnings by some economists of its importance.

It seems clear that the strength and character of communities lie less in the technologies they employ and more in the social relations they engender. The green economy is not just about resource efficient technology—“treading lightly on the earth”–though this is clearly important. It also encompasses matters of democratization and voice, of social inclusion and justice, and of policy, power, and governance. These questions also lie at the heart of community. Perhaps the most fundamental point of all concerns the ends or purpose our economies are supposed to serve. What is the nature of prosperity itself and how should the economy attempt to deliver this? This question has motivated our own wider work on the green economy and is the starting point for our exploration of the green economy at community scale in this essay.

- Shared Prosperity

The green economy is not an end in itself; rather, it is a means towards a shared and lasting prosperity. The economy must deliver the capabilities for people to thrive and for communities to flourish. Beyond simply delivering goods and services, this task involves maintaining and enhancing social and environmentalwell-being. Stability in markets, security in employment, ecological integrity, sustainability in supply chains, fairness, and economic justice: these are some of the conditions on which present and future prosperity depends.

In the following sections of this essay we will explore in more detail how it might be possible to shape the economic institutions that support these conditions. First, however, we must address a more basic question: what is the nature of prosperity? What does it mean for people and communities to prosper? What exactly are the end goals of the green economy?

In defining prosperity as a social and psychological condition, as much as a material one, we have opened up an intriguing possibility: that material bounds do not in themselves constrain prosperity itself; that with appropriate attention to material limits, it may be possible to improve quality of life for everyone, even as we reduce our combined impact on the environment. Though it is clearly essential for the poorest to attain a decent quality of living, the richest may also live better while consuming less.

The idea that humans can flourish and at the same time consume less is clearly tantalizing. It would be foolish to think that it is easy to achieve. But equally, it should not be given up lightly. It may well offer the best underlying vision we have for the green economy: prosperity is the art of living well on a finite planet.

This broader understanding of prosperity has recently begun to inform a more sophisticated approach to progress—and to the measurement of progress—in practice, even amongst policy-makers. An example of this new approach is a report published in 2012 entitled simply “How are Canadians Really Doing?” The Canadian Index of Well-being (CIW) identifies eight key domains of well-being in Canada:

- community vitality;

- democratic engagement;

- education;

- environment;

- healthy populations;

- leisure and culture;

- living standards;

- time use.7

The Index sets out to measure the quality of life in Canada, using a mixture of subjective and objective indicators in each of these eight domains. Living standards are measured through a selection of relatively conventional economic indicators, including: the post-tax median income of Canadian families, the Royal Bank of Canada’s housing affordability index, and the ratio between the richest and poorest sectors of society.

Non-financial measurements are equally important to the index. Community vitality is assessed using indicators of membership in voluntary organizations, time spent in unpaid care of other people, and the rate of violent crimes in the community, for instance. Environmental measures include the level of emissions of greenhouse gases, the consumption of finite resources, local air quality, and the population levels of local species.

Making sense of such disparate measurements can sometimes be difficult and combining them into a single index of well-being entails assigning weights that may seem arbitrary. But subjective and objective indicators of prosperity can still provide a useful complement to the more conventional measure of economic consumption or gross value added across the economy. They can also offer important perspectives on the long-term health of the community, beyond the state of the formal economy.

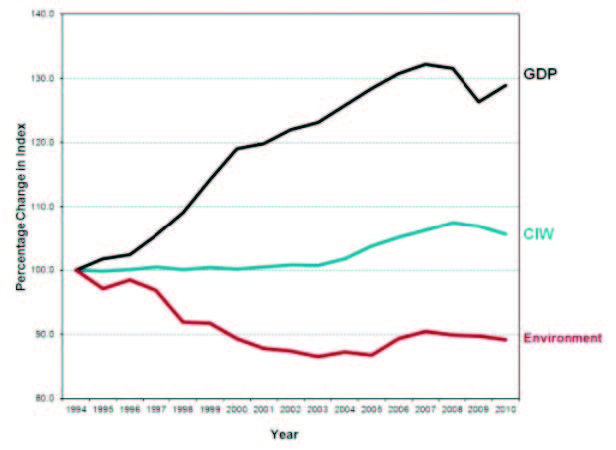

Figure 1: Trends in GDP, Wellbeing and Environment in Canada between 1994 and 2010. Source: Canadian Index of Wellbeing 2012

Figure 1 illustrates how living standards across Canada, as measured by the CIW, continued to fall, for example, even as the formal economy began to recover in the aftermath of the financial crisis. The graph also illustrates how growth in the CIW as a whole was much slower than growth in the gross domestic product (GDP) in the years between 1994 and 2010—a finding mirrored fairly consistently across similar attempts to measure well-being in other countries.8

Canadian GDP increased 28.9 percent between 1994 and 2010, whereas the Canadian Index of Well-being only increased 5.7 percent. Figure 1 also shows that in several years the indices moved in opposite directions. The CIW is a composite of eight sub-indices, including living standards, community vitality, and environment. Living standards (not shown) dropped precipitously after the 2008/2009 financial crisis, but still remained above the 1994 level. But the subindex for environment was 11 percent lower in 2010 than it had been in 1994.

The CIW framework is not just a measurement tool. It can also be a useful input to policy at the community level. For instance, the Resilience Collaborative in Simcoe County, Ontario, has developed a questionnaire based around the CIW indicator set, which they use to identify troubling issues in the community and take proactive steps to resolve them.

The key point that emerges from these considerations is that prosperity is more than production and income. Nor is it definable in terms of material abundance. Prosperity transcends material concerns. Rather, it resides in the quality of our lives and in the health and happiness of our families. It is present in the strength of our relationships and our trust in the community. It is evidenced by our satisfaction at work and our sense of shared meaning and purpose. It hangs on our potential to participate fully in the life of society.

Prosperity consists in our ability to flourish as human beings on a finite planet. The challenge for the green economy is to create the conditions under which this is possible.

- Foundations for the Green Economy

A green economy is an economy “that results in improved human well-being and social equity,” argues the United Nations Environment Programme (UNEP), “while significantly reducing environmental risks and ecological scarcities.” In simple terms, UNEP goes on to say, the green economy is “low-carbon, resource efficient and socially inclusive.”9

From the perspective of our previous discussion, we can identify three core concepts which form the foundations for the green economy. The first is prosperity itself. The pursuit of human well-being lies at the heart of the green economy; it motivates economic activity and justifies economic output. The second is the set of biophysical boundaries within which economic activity must take place, not just for human well-being but also for the well-being of other species with whom humans share the planet. Economic activity which undermines ecological and mineral assets and other natural systems on which prosperity tomorrow depends is unsustainable. The final concept is social justice. Prosperity which provides only for the few and fails to alleviate the plight of the poor and disadvantaged, where there is a clear mismatch between effort and reward, or where the opportunities for advancement are restricted unfairly, diminishes the quality of society and leads eventually to social instability. To put things even more simply, the objective of the green economy is to achieve a shared (socially just) and a lasting (environmentally sustainable) prosperity.

The objective of the green economy is to achieve a shared (socially just) and a lasting (environmentally sustainable) prosperity.

Though easy enough to articulate conceptually, this vision does not yet define unambiguously the dimensions of the green economy. Nor does it offer a clear macroeconomic framework, distinct from conventional economic thinking and practice. The task of this section is to describe these dimensions more clearly and to suggest how the macroeconomic framework for a green economy differs from the framework for a conventional economy.10 In subsequent sections we shall draw on these macroeconomic principles in order to articulate community-level responses.

Economic activity which undermines ecological assets and other natural systems on which prosperity tomorrow depends is unsustainable.

Most current thinking assigns the distinctiveness of the green economy to the role of investment. “In a green economy,” claims UNEP, “growth in income and employment are driven by public and private sector investments that reduce carbon emissions and pollution, enhance energy and resource efficiency, and prevent the loss of biodiversity and ecosystem services.” The key aim for transition to a green economy in this view is to “enable economic growth and investment while increasing environmental quality and social inclusiveness.”11

The focus on investment as a fundamental element in the green economy is easily justified. Investment plays a crucial role in any economy. Investment is the way in which economics handles the relationship between present and future. There is an Important distinction to be made here between “real investment”—the building of infrastructures, homes, and other physical assets–and “financial investment” in commodities or in property.12 For now, we focus mainly on real investment: the setting aside of resources today in order to build, protect, and enhance the physical assets on which tomorrow’s prosperity depends.

So far so good. Investment is as important at the community level as it is at the national level. But how does investment in the green economy differ from investment in the conventional economy? The portfolio of real investment in the green economy highlights low-carbon technologies, resource productivity, and protecting ecological systems (biodiversity and ecosystem services). In the conventional economy, by contrast, investment is aimed at building up and improving the stock of produced assets. Investment today is justified, in the conventional view, on the basis of the economic returns to be gained from these produced assets tomorrow. Returns on investment are expected to flow partly from improvements in productivity—particularly in labor productivity—but also from the development and sale of new consumer products.

Capitalism progresses, in the well-known words of the economist Joseph Schumpeter, through a process of “creative destruction”—the continual throwing over of the old in favor of the new.13 Though there are some clear incentives in the existing framework for firms to invest in improved energy efficiency, or increased material productivity along the way, the main objective is to expand the markets for existing products and to build markets for new ones.

The end result of the conventional framework is an economic system with several defining characteristics. On a positive note, the economy does become more efficient; the energy and material use per dollar of output often declines over time, due to better equipment and infrastructure as well as an increasing proportion of expenditures on services rather than manufactured products. But paradoxically, these efficiency improvements tend to be overwhelmed by expansions in the scale and diversity of consumer products and services. Historically at least, the overall impact of conventional investment has been to increase material throughput, energy consumption, and environmental impact.14 Finally, and perhaps most importantly for our discussion, such a system relies on continually expanding the demand for consumer commodities.

Seen in this light, it becomes clear that achieving a green economy simply through changes in the pattern and focus of investment is far from straightforward. In the first place, the new “green” investments in the protection of ecological systems must be sufficient to offset the expansion of environmental impact associated with conventional investments. This is, of course, easier to achieve the more conventional investment is given over instead to green investment. But, for this shift to take place green investment must be at least as attractive as conventional investment to investors.

In purely financial terms, this is a demanding task. Improvements in energy efficiency can be very cost-effective, particularly in the face of rising fuel costs, as many community-based initiatives (see section four) are beginning to show. Some investments in ecological systems, such as protected coasts rather than constructed seawalls, also demonstrate attractive financial returns, even under conventional assumptions. But we must expect that there are also many cases in which green investments have lower, even negative rates of financial return over longer timescales than their counterparts in the resource-intensive, speculative investments of the conventional economy. As long as expected profitability guides most investment decisions, investments with high environmental or social returns but low financial returns will be neglected.

To reiterate, green investment is without doubt an essential foundation for the green economy. Making green investment more attractive is something that ca be influenced, in part at least, by the policy landscape. And we address this issue in what follows. But, it also depends crucially on the way in which the money supply works and the financial sector is organized.

For now though, the important point to emphasize is that the green economy cannot simply consist of “adding in” a component of green investment to the existing recipe for development and hoping that it will repair the environmental damages of the past and offset all the negative impacts of growth. Something more profound is needed.

In fact, the starting point for a more profound reinvention of the economy is clear. It begins with the primary purpose of the green economy: to deliver a shared and lasting prosperity. Our potential to prosper—our ability to flourish as human beings in a thriving community—depends on having the means to a livelihood, the wherewithal to meet our needs and pursue our aspirations. It also demands a degree of security, a sense of belonging, the ability to participate in the community, and the opportunity both to share in a common endeavour and to pursue our potential as individuals.

As regards the kind of economy needed to support these goals, we can already identify some of the desirable characteristics. We know, for example, that economic stability matters. When economies collapse, bad things happen. Businesses go bust and people lose their livelihood. These events pose a direct threat to our quality of life. We know too that equity matters. Unequal societies drive unproductive status competition and undermine well-being not only directly, but also by eroding our sense of shared citizenship.15

Meaningful work—not just paid employment—is an important component of any economy, for all sorts of reasons. Apart from the obvious contribution of work to the provision of society’s goods and services and of paid employment to people’s livelihoods, work is one of the ways in which we participate in society. This participation contributes directly to our prosperity. These advantages of work are not well described as a source of disutility requiring financial compensation as is assumed in conventional economics. Through our work we “create and recreate the social world and find a credible place in it.”16

With a little thought we can also begin to characterize the specific economic activities from which the green economy needs to be built. First of all, of course, such activities need to provide the goods and services that contribute to prosperity. To be clear, this is not just about producing and consuming material stuff, but about providing the capabilities for people to flourish in their communities, socially and psychologically, as well as materially. Second, these economic activities must provide decent, satisfying livelihoods for people. Finally, the activities of the green economy need to be low in carbon, efficient in resource use and “tread lightly” on the earth. They must provide the ability for people to flourish and communities to thrive without destroying the ecological systems on which our future prosperity depends.

In the next section, we will see how these characteristics provide the basis for a new vision of enterprise: not as a speculative, profit-maximizing division of labor, but as a form of social organization embedded in the community, engaged in delivering the services that improve our quality of life. In the green economy, enterprise must provide real opportunities for meaningful employment; it must be materially light and ecologically sustainable, and yet deliver the capabilities we need in order to prosper: nutrition, health, education, renovation and maintenance, care, craft, culture, and ecological restoration.

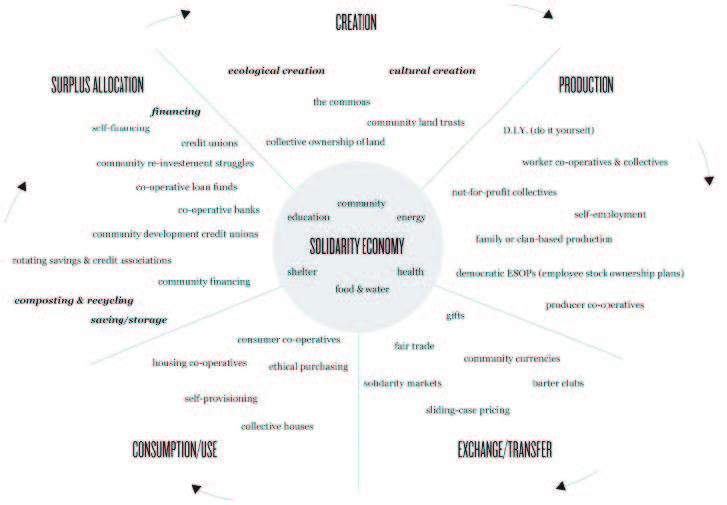

This vision of community-based, service-oriented enterprise is as important to the green economy as is the concept of green investment. Interestingly, it has much in common with the emerging focus on the “solidarity economy” (Figure 2), a concept finding a surprising support base, from local initiatives such as Solidarity NYC to a programme of research supported by the United Nations Research Institute for Social Development and the International Labour Organisation.17 A key point emphasized by solidarity economy supporters is that the new economy has as much to do with alternative forms of social organizations as it does with the sectoral focus of enterprise. Again, this is something we return to in later sections.

Figure 2: Elements of the Solidarity Economy

Source: Solidarity NYC, http://solidaritynyc.org/#/resources/the-basics/economyegg_web-3/

In short, the discussion in this section has identified four elements essential to the emergence of a green economy; namely, the role of enterprise, the quality of employment, the structure of investment, and the nature of the money economy. All of these interconnected elements are essential to a shared and lasting prosperity at community scale. In the following pages we explore each of them in more detail, offering both conceptual frameworks for success and some pragmatic examples of the green economy from local communities.

The aim of this section is to establish a vision for enterprise on which the green economy can be built. In the broadest sense, we can define the role of enterprise as providing the capabilities for people to prosper and for communities to thrive. From what we know already and have covered in the previous sections, it is possible to identify a number of clear operational principles that enterprise should fulfil in the green economy. They should:

- provide an equitable distribution of the goods and services needed

- for prosperity;

- use as little as possible in the way of materials and energy;

- cause as little damage as possible to ecosystems;

- offer people meaningful employment and the opportunity to

- participate in society; and,

- contribute to the vitality of the community.

Guided by these criteria, it is instructive to ask two important questions about enterprise in the green economy:

- Are there specific sectors of economic activity which should be encouraged in the green economy?

- What organizational form should enterprise take in the green economy?

It is not uncommon to find answers to the first of these questions couched in terms of very specific technological sectors, related to energy efficiency, renewable energy, and resource productivity more generally. This response accords with the technological view of the green economy discussed in the previous section: an economy more or less like the existing one, but in which investment transforms the energy infrastructure to low-carbon alternatives. Clearly, in such an economy we would need new energy companies to produce and supply green electricity, energy efficient lights and appliances, and so on.

We have already explained why this view of the green economy is incomplete. Nonetheless, the green technology sector is one obvious place to locate a vision of enterprise for the green economy. There are numerous examples of such companies in Canada and abroad, particularly in the energy sector. Bullfrog Power is a Canadian company offering green electricity and natural gas to households and businesses across the country.18 Good Energy is a similar provider in the UK.19

One of the characteristics of these new energy companies is that they tend to be smaller—and often more embedded in the community—than conventional providers. There are several reasons for this. In the first place, many of the green energy companies are recent start-ups, developing new approaches to energy supply and energy efficiency more or less from scratch, unencumbered by sunk capital or entrenched mind-sets. But there is another important reason for this difference. Renewable, sustainable energy sources tend to be local in nature, as do the solutions that will make people’s homes and businesses more energy efficient.

Renewable, sustainable energy sources tend to be local in nature, as do the solutions that will make people’s homes and businesses more energy efficient.

Financing for community-based energy is critical. It is vital to get the economic conditions right for communities to be able to invest in local solutions to energy needs. We will return to this point in later sections of this essay and explore in more detail the innovations in community-based financing that make such developments possible. Here it is useful to point out another specific feature of these local, community-based energy enterprises. They tend to adopt organizational structures like cooperatives, which differ from the conventional shareholder model of mainstream companies.

Equally important, when communities participate more fully in the development of local infrastructure and resources, it strengthens community trust and offers people more control over their own lives. This kind of participation contributes directly to prosperity, in the sense we have defined it.20

A focus on community-based energy raises another crucial distinction between conventional enterprise and our vision of enterprise in the green economy. Many community power companies are established as “energy service companies” or ESCOs. Here, the focus is not simply on supplying megawatts, but on delivering the energy services that households and businesses need: heat, light, and motive power. Though at first sight the distinction between energy and energy services might seem opaque, it turns out to be a vital element in the reinvention of enterprise for the green economy.

The critical point is this: it is the services that energy can provide–thermal comfort, visual comfort, access–that contribute to our prosperity; rather than oil, gas, or electricity for their own sake. It is entirely possible, for instance, to achieve the same level of thermal comfort in all sorts of ways. Wearing thin clothes in a drafty house and burning lots of gas is one way. Wearing warm clothes in a well insulated house and installing an air source heat pump powered by renewable energy is another. In terms of prosperity, these options may well be equivalent. In terms of resource intensity and environmental impact, they are completely different.

Unfortunately, for the most part, the predominant model of energy companies is to maximize the revenues (and subsequent profits) from the sale of energy supplies, rather than to optimize the energy services that contribute to prosperity.

What is true for energy companies is also true elsewhere in the green economy. In fact, this distinction between the throughput of material commodities and the delivery of services mirrors precisely the distinction we introduced earlier between material affluence and our ability to flourish—not just in material ways. The fundamental question is this: what would enterprise look like if it were oriented towards providing the capabilities for people to flourish rather than being built around maximizing profits from the sale of material commodities? The example of energy opens up a whole new field of possibilities for the role of enterprise in the community more generally.

The idea of enterprise as service has a surprising applicability when it comes to thinking creatively about the green economy. Beyond our material needs, prosperity is as much about social and psychological functioning—identity, affiliation, participation, creativity, and experience—as it is about material stuff.

Often, of course, we try to employ material artifacts to satisfy these needs, with greater and lesser degrees of success.21 But the needs themselves are not inherently material, and it is a mistake to cast enterprise solely in terms of the throughput of material products. Rather, we should construe enterprise in the green economy in terms of delivering the “human services” that improve the quality of our lives: health, social care, education, leisure, recreation, and the maintenance and protection of physical and natural assets.

As we have indicated, the seeds for this new economy already exist in local, community-based social enterprise: community energy projects, local farmer’s markets, cooperatives of many types, sports clubs, libraries, community health and fitness centers, local repair and maintenance services, craft workshops, writing centers, outdoor pursuits, music and drama, yoga, martial arts, meditation, hairdressing, gardening, and the restoration of parks and open spaces.

As we have indicated, the seeds for this new economy already exist in local, community-based social enterprise.

Perhaps the most telling point of all is that people often achieve a greater sense of well-being and fulfilment both as producers and as consumers of these activities than they do in the time-poor, materialistic, supermarket economy in which much of our lives is spent.22 Nor is it simply the outputs from these activities that make a positive contribution to flourishing. As we’ve seen above, the form and organization of our systems of provision also matter. Economic organization needs to work with the grain of community and the long-term social good, rather than against it.

In summary, this vision of enterprise really does offer a kind of blueprint for a different kind of economy. Enterprise provides for our ability to flourish. It offers the means to a livelihood and to participation in the life of society. It provides security, a sense of belonging, the ability to share in a common endeavour and yet to pursue our potential as individual human beings. And at the same time it offers a decent chance of remaining within ecological scale.

- Jobs worth having

Insights into the role and nature of work are not new. Drawing on insights from Buddhist philosophy, the Indian philosopher Kumarappa argued that when the nature of work is properly appreciated, “it will stand in the same relation to the higher faculties as food is to the physical body. It nourishes and enlivens the higher [self].”23 Picking up on the same theme, the economist E. F. Schumacher argued that “properly conducted in conditions of human dignity and freedom, work blesses those who do it and equally their products.”24

By contrast, the conventional economic view sees work as a sacrifice of our time, leisure, and comfort, and wages are “compensation” for that sacrifice. This leads to perverse outcomes for both workers and entrepreneurs. As Schumacher points out, “the ideal from the point of view of the employer is to have output without employees, and the ideal from the point of view of the employee is to have income without employment.”25

This perverse dynamic is internalized in the modern economy through the pursuit of increasing labor productivity: the desire continually to increase the output delivered by each hour of working time. Rising labor productivity is often viewed as the engine of progress in modern capitalist economies. But the relentless pursuit of increased labor productivity also presents society with a profound dilemma. As each hour of working time becomes more “productive,” fewer and fewer people are needed to deliver any given level of economic output.

Put simply, ever-increasing labor productivity means that if our economies do not also continue to expand, we risk putting people out of work. Higher unemployment reduces spending power in the economy and generates rising welfare costs. Higher welfare costs lead to unwieldy levels of government debt. Higher sovereign debt can only be serviced, at least within the current financial system, by increasing tax revenues from future income.26 Increased tax revenues depress spending power even further and so the cycle goes on. When economic growth is hard to come by, for whatever reason, the dynamic of rising labor productivity is a harsh mistress.27

When economic growth is hard to come by, for whatever reason, the dynamic of rising labor productivity is a harsh mistress.

There are, broadly speaking, two avenues of intervention through which to escape from this “productivity trap.”28 One is to accept productivity growth in the economy and reap the rewards in terms of reduced hours worked per employee—or, in other words, to share the available work amongst the workforce. The second strategy is to ease up on the gas pedal of ever-increasing productivity—to shift economic activity to more labor-intensive sectors. Interestingly, both these avenues have some precedence in the history of economic ideas. Proposals to shorten the working week are enjoying something of a revival as a way of maintaining full employment with declining or static output. But the idea has a surprisingly long pedigree. In an essay entitled “Economic Possibilities for our Grandchildren” published in 1930, John Maynard Keynes foresaw a time when we would all work less and spend more time with our family, our friends, and our community.

As it turns out, societies have often taken some of the economy’s labor productivity gains in the form of increased leisure time—a trend usually taken to represent a positive contribution to our quality of life (Figure 3). Paid working hours in the United States have declined by 8 percent since 1961. In France it’s over 30 percent; in Sweden, 15 percent; and in Canada the average paid working hours have fallen by around 17 percent since 1961.29 In the absence of these declines, the rate of unemployment in these countries would have been much higher.30 It may not be the workaholic’s choice to continue this trend even further. But as many recent commentators have pointed out, sharing the available working time by reducing working hours is an important strategy for ensuring that everyone has access to a livelihood, particularly when growth is hard to come by.31

Work share makes good sense for both employees and employers. On the other hand, simple arithmetic suggests a second avenue for keeping people in work when demand is rising less quickly. Reining back on the relentless increase in labor productivity offers a compelling option. If labor productivity is no longer continually increasing, and possibly even declining, then the pressure on jobs is considerably lower. By shifting to a lower productivity economy, we have within our grasp the arithmetical means to maintain or increase employment, even as the economy ceases to grow.

If this option sounds perverse at first, it is largely because we have become so conditioned by the language of efficiency. Output is everything. Time is money. The drive for increased labor productivity occupies reams of academic literature and haunts the waking hours of CEOs and finance ministers around the world. Quite apart from this ideological tenacity, it’s our ability to generate more output with fewer people that’s lifted our lives out of drudgery and delivered us the cornucopia of material wealth—iPhones, hybrid cars, cheap holiday flights, plasma screen TVs—to which we in the rich world have become accustomed, and to which those in the poor world aspire.

Leaving aside here momentarily the environmental impacts of this massive expansion in material throughput, it is clear that rising labor productivity has in some cases made our lives definitively better. At least in the short term. Who now would rather keep their accounts in longhand, wash hotel sheets by hand, or mix concrete with a spade? Between the backbreaking, the demeaning, and the downright boring, increased labor productivity has a lot to commend itself.

But there are places too where chasing labor productivity growth makes much less sense. Certain kinds of tasks rely inherently on the allocation of people’s time and attention. The care and concern of one human being for another, for instance, is a peculiar “commodity.” It cannot be stockpiled. It cannot be degraded through trade. You cannot substitute away from it. It is not deliverable by machines. Its quality rests primarily on the attention paid by one person to another.32

Even to speak of reducing the time involved in caretaking is to misunderstand its value. Yet this is what the conventional economy continually seeks to do, even in those sectors which rely inherently on human care and attention to achieve their goals. In seeking to make care work more “efficient,” we undermine not only the value of the care but also the experience of the carer. Compassion fatigue is a rising scourge in a health sector hounded by meaningless productivity targets. Health services are often delivered locally but the conditions under which community health operates are invariably framed at the national level.

The caring professions are not the only ones to suffer at the hands of productivity goals. Craft is another. It is the accuracy and detail inherent in crafted goods that endows them with lasting value. It is the attention paid by the carpenter, the tailor, and the designer that makes this detail possible. Likewise, it is the time spent practicing, rehearsing, and performing that gives art its enduring appeal.

What—aside from meaningless noise—is to be gained by asking the New York Philharmonic to reduce their rehearsal time and play Beethoven’s 9th Symphony faster and faster each year?33 It is true of course, that technological advances have made the appreciation of musical performances more accessible to more people. Yet the performance of music itself and the appreciation of that performance through various media, rely inherently on the musician’s time and dedication to their art. It may not have escaped the reader’s attention that the sectors we are describing here—care, craft, culture—are basically the same “human services” that sit at he heart of the vision of enterprise set out in the previous section. The service enterprise economy inherently resists the productivity trap precisely because the value of the services provided by this sector is tied intimately to the contribution of people’s time, skill, and labor. It is a naturally employment-rich sector which contributes immensely both to individual well-being and to the vibrancy of our communities.

Here perhaps is the most remarkable thing of all: since these activities are built around the value of human services rather than the relentless throughput of material stuff, they offer a half decent chance of making the economy more sustainable. In short, achieving full employment in the green economy may have less to do with chasing after endless productivity growth and more to do with building local economies based around care, craft, and culture; and in doing so, restoring the value of decent work to its rightful place at the heart of society.

- Investing in the future

Investment may be the single most important element in the green economy: it embodies the relationship between the present and the future. The fact that people set aside a proportion of their income for investment at all reflects a fundamentally prudential aspect of human nature. We care not just about our present happiness but also about our future well-being.34 Prosperity today means little, as we have already suggested, if it undermines prosperity tomorrow. Investment is the vehicle through which we build, protect, and maintain the assets on which tomorrow’s prosperity depends.

Of course it is always possible for this relationship between present and future to become distorted. We can become too short sighted—both as individuals and as a society. We sometimes privilege risky speculation—practices which are fundamentally a form of gambling—over the investments that create and maintain solid, long-lasting physical, social, and environmental assets. We may create rules that privilege existing asset holders at the expense of the poorest in society. Our investment architectures are sometimes so complex that it becomes impossible for individuals and communities to manage their own long-term financial security. We often set aside too little to protect the most important long-term assets of all: those provided by natural ecosystems.

It is important to understand both how these mistakes can become institutionalized and also how to correct them. Corrective measures at a federal or provincial level need to be complemented by workable alternatives that can return a measure of resilience to local communities. The green economy needs not just a coherent vision of sustainable investment, but a way of translating this vision into practice at community scale.

Corrective measures at a federal or provincial level need to be complemented by workable alternatives that can return a measure of resilience to local communities.

These reflections lead us towards two specific tasks. One is to articulate an appropriate portfolio for investment in the green economy. The second is to outline an appropriate financial framework to support this kind of investment. The current section is primarily addressed towards the former task, while the latter task is the subject of the next section. But before engaging in the job of developing an “investment portfolio” for the green economy—and illustrating it with examples at community scale—we outline very briefly the driving dynamic of investment in the conventional economy.

In simple terms, we can characterize “real investment” in the conventional economy as pursuing three main objectives.35 First, it aims to maintain (and, where necessary, replace or expand) the existing stock of fixed assets. Second, it attempts to improve the productivity of those assets—most often, as we have noted, through the pursuit of increased labor productivity. Finally, investment is directed towards the process of “creative destruction” identified earlier—the creation and re-creation of new markets for new products, the continual throwing over of the old in favor of the new.

In short, conventional investment strategy is a crucial part of the architecture of the unsustainable economy and offers little in the way of a reliable basis for the green economy.36 To reiterate a point we made earlier, the green economy cannot simply be characterized as more of the same with a smattering of cleantech investments thrown in. Certainly investments in low-carbon, resource light technologies rightly belong in a green investment portfolio. But a more thorough rethink of the portfolio as a whole is also needed.

The starting point for this rethink is to marry the simple idea articulated at the beginning of this section with the insights from previous sections. The overarching vision emerges in the form of three simple principles:

- Prosperity consists in our ability to flourish as human beings—now and in the future.

- Enterprise concerns the organization of economic services which deliver the capabilities we need to flourish.

- Investment is the process of setting aside income in the present in order to maintain, protect, and enhance the assets from which future prosperity will flow.

This vision allows us first and foremost to identify the kinds of assets (and the kinds of enterprises) towards which we need investment funds to flow. The provision of our basic material needs is the baseline for prosperity. Beyond this baseline we should invest, for example, in health, in education, in social care, in leisure and recreation; in green spaces, lakes and rivers, parks and gardens; in community halls, concert halls, theatres, museums and libraries. The broad aim of this portfolio is to build and maintain the physical assets and natural systems through which individuals can flourish and communities can thrive–with as little in the way of material throughput as possible.

There’s an interesting feature of this kind of investment target. Many of the underlying needs are best articulated—and most effectively delivered—at the local level. Consequently, this investment strategy works best at community scale. Of course, it also requires appropriate financial vehicles to enable it to work effectively. We return to this point in the following section. We note here only that the rewards of engaging in such a strategy at community scale can include lasting benefits in terms of community regeneration, local self-reliance, and community resilience, over and above the prudential rewards of building and maintaining community assets.

Investment in the green economy needs to be focused on the protection and maintenance of the assets on which future prosperity depends.

Investment in the green economy needs to be focused on the protection and maintenance of the assets on which future prosperity depends. The portfolio of green investment must of course include the low-carbon technology and infrastructure typically associated with the green economy. But it must also include wider investments in resource productivity, in building human and social capital, in the protection of ecological systems, in the building of community infrastructures, and in the maintenance of public spaces. Investment is also essential to support the economic activities which deliver meaningful human services to society.

What emerges from this exploration is that the conventional view of a straightforward relationship between investment expenditure and the productivity of the economy no longer holds in the same way for green investment. Simplistic prescriptions in which investment contributes to future productivity won’t work here. The ecology of investment will itself have to change in the green economy. Investment in long-term, public goods will have to be judged against criteria other than financial market success. This may also mean rethinking the ownership of assets and the distribution of surpluses from them.

Thomas Piketty has drawn attention to the increasing proportion of national income going to owners of capital and the declining proportion going to labor, a situation resulting in levels of inequality last seen a century ago, at the outbreak of World War I. Out of a concern for social justice, and fear of grave social instability if it be denied, Piketty proposes the imposition of a progressive global tax on capital, returns from which could be channelled into investment in the green economy.37

In summary, the biggest challenge for this new portfolio of investment is the question of financing. It is to this subject that we now turn.

- Making money work

So far, our essay has concerned itself mainly with what is sometimes called the “real economy.” This term is often used to describe the patterns of employment, production, consumption, government spending, and investment in the economy.The measure of overall activity in the real economy is the well-known GDP.38 At the local or regional level, this number is usually called the Gross Value Added. The system of national accounts measures GDP in monetary units. But it is useful to distinguish the real economy from the financial or “money economy.”

The money economy is a term used to describe the wider set of financial flows on which the real economy depends. This wider set of financial accounts includes the flow of money into and out of different economic sectors, the processes of borrowing, lending, creating money (the money supply), and the changes in the financial assets and liabilities of different economic actors. These money flows are essential to the financing of investments in the real economy.

The money economy is far less familiar, even to politicians and mainstream economists, than the real economy and the GDP. However, the system of national accounts already includes vital information about these financial flows and even provides a full account of the balance sheets—the financial assets and liabilities—of each major sector, on an annual basis. Ignoring the information contained in these accounts was one of the decisive errors contributing to the financial crisis and subsequent global recession. The real economy appeared to be doing well and GDP growth looked strong in the run up to the crisis. But the weakening of company balance sheets and the over-indebtedness of households in many OECD countries were a contributing cause of the fragility and eventual instability in the financial system.39

It became apparent through the crisis that sustainability—indeed, basic economic security—depends on a healthy financial system. Prosperity itself depends on a properly functioning money system. Restoring stability to the financial system has to be an element in the green economy. Paradoxically, in the wake of the crisis, with wider financial markets still in disarray, prosperity becomes even more difficult to achieve. Lending constraints hinder green investment and undermine the quality of our lives and the resilience of our communities.

Later in this section we explore potential community-level responses to this dilemma. Before doing so, however, it is useful to highlight some salient features of the current organization of the money economy and tease out the implications for communities. A full exploration of the money economy must remain beyond the scope of this essay. For non-economists, the real economy is complicated enough. The workings of the money economy sometimes elude the understanding even of professional economists.40

Few economists foresaw, for instance, how the massive expansion of commercial debt-based money (Figure 5) could destabilize the money system as a whole. To many non-economists, the existence of a debt-based money system itself comes as a complete surprise. We tend to think of money as something printed by the central bank more or less under the control of the government. The reality is that in most advanced economies, less than 5 percent of the money supply is created in this way. Most money circulating in the economy today is created as “credit”—loans advanced to companies and households by commercial banks, almost literally “out of nothing.”

Most economic textbooks suggest that banks make loans based on deposits they have received from savers. But the reality is that when a bank agrees to create a loan to a business or a household it simply enters the amount as a loan on the asset side of its balance sheet and the same amount as a deposit on the liability side of its balance sheet. This deposit is then available to spend on goods and services in the economy. In other words, directly contrary to the textbook view, banks create money by making loans.

This process is said to “expand the balance sheet,” but it doesn’t in itself change the financial net worth (the difference between assets and liabilities) of the bank. Any change in the financial worth of the bank from making a loan depends on what happens after the loan is created: how much interest is charged on it, whether and when the loan is repaid, how much of the deposit is spent, where it is spent, where that money ends up in the economy. If the loan is repaid in good time at an interest rate favorable to the bank, it increases bank profits and boosts its financial worth. If the borrower defaults on the loan, the transaction will leave the bank with “toxic” assets—loans that are non-recoverable—which will reduce its financial worth.

Figure 5: Expansion of private credit in the US: 1955 – 2015

Source: Adapted from Jackson, Prosperity without Growth 2016, Figure 2.41

There are a number of important implications of this debt-based money system. One of them is that the investments that are needed for the green economy must generally prove their creditworthiness on entirely commercial grounds and must compete for capital with all sorts of commercial investments. Potential green investments may have high social and environmental returns, but unless they also have attractive financial returns—an unlikely case—they typically won’t be funded through commercial channels.

Some of these competing investments will offer highly attractive rates of return in the short term, even though in the longer term they are entirely unsustainable. So, for example, green investments must compete with financial speculation (a form of legalised gambling) in commodities, property or financial assets. They must compete with unsustainable consumer lending—in which repayment (and punishment for non-payment) is reinforced by legal institutions. They must compete with investments in dirty, extractive industries that degrade the environment, and operate through supply chains profitable only because they involve child labor.

The social benefits of green investment are rarely factored into the commercial market. Neither are the social costs of unsustainable investment (including the huge cost of unrestrained speculative trading). Worse still, these social costs are often ultimately borne by the taxpayer rather than by the investors. The ethical basis of green investment only rarely attracts a premium. There are examples of banks who have sought out this premium or who are even prepared to lend at lower than market rates of return specifically to green or sustainable projects, but this is a very small proportion of contemporary banking activity.

Seeking funding from the ethical banking sector is one way in which communities can begin to finance the investments needed for a green economy. They might also look to attract public funding from community development financial institutions and credit unions, as well as federal, provincial, or municipal governments. The benefits to the nation as a whole from having strong, resilient, and sustainable communities are self-evident, and there are indeed federal and provincial government schemes to offer finance. A prime example of this kind of funder is Sustainable Development Technology Canada (SDTC), a not-for-profit organization funded by the federal government which aims to support innovative green technologies for climate change, clean air, water quality, and soils.

Inevitably though, the ability of government to engage in community financing is dependent on its own fiscal position; and this in turn depends, in part, on the performance of the national economy. When economic growth is harder to come by, for whatever reason, government tax receipts are lower, and social security and employment insurance costs tend to be higher. Deficit spending is likely to rise; the national debt increases and, under the existing system in which government itself must also compete for funding on commercial money markets, the interest payments on the debt further constrain government spending.

This leads us towards another important aspect of the current financial system: the inextricable interrelatedness between public sector and private sector finances. For all its complexity, the money economy is bound by some surprisingly simple rules. The most important (and perhaps surprising) of these is that the sum of net private lending, net public sector lending, and net overseas lending is equal to zero.42

This rule—sometimes called the fundamental national accounting identity—flows directly from the understanding that every financial asset has a corresponding financial liability somewhere in the economy. And every change in a financial asset in one place has a corresponding change in a liability somewhere else. Any increase in the net financial wealth of the private sector must be accompanied by a corresponding decrease, either in the net financial wealth of government or in the net financial wealth of the overseas sector.

To be clear, this rule applies to the financial position of the sectors as a whole. It does not rule out changes in indebtedness within a sector. So households can become increasingly indebted to private corporations without affecting the net indebtedness of the private sector, which includes households and private corporations.

Such accounting identities are surprisingly informative about the available responses to fiscal constraint and the potential for green investment. For example, when exports and imports are about equal, so that there is no net overseas lending or borrowing, the national accounting identity informs us that net private lending is equal to the government deficit. Political calls to increase private net lending (for instance, by encouraging private firms and households to save more) and simultaneously to reduce the government deficit are contradictory and misinformed. An improvement in the private sector’s position can only be achieved through a worsening of the public sector’s position and vice versa.

Political calls to increase private net lending (for instance, by encouraging private firms and households to save more) and simultaneously to reduce the government deficit are contradictory and misinformed.

One of the reasons that the UK, for example, has suffered from what was effectively a triple dip recession, is that the government attempted a radical program of fiscal consolidation (mainly through spending cuts), at the same time as private sector institutions were trying to shore up their balance sheets (i.e. increase net savings). Not only did the strategy backfire in terms of sovereign debt reduction, it withdrew vital social investment from communities just when it was most needed. In a country such as Germany, with a strong export sector and a significant trade surplus, this strategy might indeed work. In a country with a long-running trade deficit, such as the UK (or worse still, Greece), it is simply impossible for both the private and the public sector simultaneously to improve their net financial positions.

Surprisingly, these understandings about the monetary rules that govern the macro-economy have only recently (and then only partially) made their way into mainstream thinking—too late for some countries to avoid severe economic hardship, possibly for decades. The implications at the community level have barely yet been touched on—aside from a realization that when social investment is withdrawn by government in a misguided attempt to manage sovereign (national) debt, it is the poorest communities which often suffer first.

Beyond this realization, there are, nonetheless, some things that can usefully be learned here about community finance. Put simply, the national accounting identity reinforces the interdependency of financial actors in the economy. One sector’s net assets are another sector’s net liabilities. This realization has led some economists to criticize the economic behavior of countries that develop and maintain consistent trade surpluses. Since a trade surplus in one place leads to a trade deficit in another, economic strength in one economy depends on and risks perpetuating economic weakness in another. Long-term stability is best maintained through a relatively balanced global economy in which no single country or region accumulates high surpluses or deficits, at least over the long term.43

Though there is no formal equivalent to the national accounting identity at the local level, the same broad principle might be said to hold—namely that regions and communities should aim for balanced trade positions: to buy from other regions, taken as a group, about as much as they sell to them. This principle would certainly accord with one of our core principles for the green economy. Social justice—an equitable and fair distribution of access to goods and services—is the basis for shared prosperity. Prosperity in one region at the expense of high levels of indebtedness in another region flies in the face of social justice, and has no place in a green economy.

Beyond this “rule of thumb” for balanced trade at community scale, we can also say something about the balance between private and public finances. Once trade is more or less balanced, the accounting identity informs us that net private sector savings are more or less equal to the net public sector deficit. The only way to avoid a rising public sector debt (i.e. consistent public sector deficits) is to avoid excessive accumulation of private financial assets (i.e. consistent positive private net lending).

Again, this point is reinforced by considerations of social justice. It is almost tautological to say that it is the richest in society who are most easily capable of achieving high levels of net financial lending and accumulating net financial worth. Public debts (and the interest on them), on the other hand, are paid by every single taxpayer, rich and poor alike. The possibility that private net financial wealth can only be achieved at the expense of net public financial debt puts an uncomfortable moral frame around the accumulation of private financial wealth.

The possibility that private net financial wealth can only be achieved at the expense of net public financial debt puts an uncomfortable moral frame around the accumulation of private financial wealth.

This is particularly true in a monetary system in which sovereign (national) debt must be financed from open money markets at commercial interest rates. There is a clear risk that the costs to the taxpayer of maintaining the public debt are paid to precisely the people who benefit most from its existence. The combination of a debt-based money supply and an accumulation of private financial assets is deeply regressive. It also makes financing green investment very difficult.

On the other hand, there are some clear signals about the appropriate direction to turn to improve the situation. Here we highlight three particularly important social innovations that are supported strongly by this analysis. The first is impact investing—the reinvestment of private net savings into the green economy. The second is community banking and credit unions—the implementation of local savings and investment vehicles that plough benefits directly back into the community. The third is the reconfiguring of the money supply itself, reclaiming control of the money supply from commercial interests and returning it to either the public sector (government) or the community, giving them access to debt-free money.

The good news is that there are positive examples in support of each of these innovations. Impact investing—the channelling of investment funds towards ethical, social, and sustainable companies, technologies, and processes—is an increasingly important element in the architecture of the green economy. This kind of investment was in the past seen more as a form of philanthropy. But as the Capital Institute has remarked, it should be seen as a vital complement both to philanthropy and to government funding: “a way to leverage secure philanthropic and public sector dollars, while harnessing the power of social entrepreneurs and market-based solutions to solve some of the world’s most intractable problems.” The Patient Capital Collaborative is an innovative US-based initiative to help “angel investors” nurture and fund start-up companies aiming to have a positive social and environmental impact in the world.44

Perhaps the most popular model for community investment is the credit union— financial institutions in which individual members pool their savings to provide loans to other members. Though subject to many of the same regulations as banks, credit unions are typically smaller, more local, and designed specifically to be nonprofit institutions. They therefore offer a particularly appropriate vehicle for green investment at community scale and are beginning to be adopted for this purpose.

Our final suggestion for leveraging finance towards green investment at community scale concerns the money supply itself. This might seem at first sight a rather intractable aspect of the existing money system. However, there are some rather strong arguments in favor of changing the existing debt-based money system and returning a greater degree of control to the government. Some of these arguments have a surprising pedigree.

The so-called Chicago plan—which calls for 100 percent backing of deposits with government-issued money—was first put forward in the 1930s and was supported most notably by the Nobel laureate Irving Fisher. The idea has been revived in a working paper from the International Monetary Fund which points to several advantages of the plan, including its ability to better control credit cycles, eliminate bank runs, and dramatically reduce both government debt and private debt. In addition, the paper argues that returning control of the money supply to the state would allow the government to invest directly in communities in exactly the way highlighted in section six, without punitive interest payments.45

Obviously this strategy lies outside the capacity of individual communities to achieve. It would require brave political leadership at the federal level, to regain public control of the money supply. Nonetheless, it is clearly a strategy that requires public support, which could quite reasonably be gathered first at the community level. Versions of the same idea—a return to sovereign control of the money supply—have been put forward recently in a variety of places at the federal level. In Switzerland, such a proposal is to be the subject of a popular referendum, to be held in 2018.46

The question of loosening the grip of profit-making institutions on the supply of money suggests another strategy for financing innovations in the green economy with a rather long pedigree: the creation of local currencies. Local exchange and trading systems (LETS) have emerged over the last few decades as an alternative to mainstream currencies. There are now over one thousand five hundred LETS schemes worldwide. One example is the Berkshares scheme providing local currency to the Berkshire region in Canada.47

Peterborough LETS was established in 1994 to provide a currency basis for the exchange of local goods and services in the Peterborough area. The currency of the scheme is called the “green dollar” and can be used in part of full payment for local services. When participants trade in the scheme they are recorded as being either “in credit” or “in commitment.” When they are in credit they have green dollars to spend in the community. Being “in commitment” means making a pledge to provide goods or services equivalent in value to those that have been used. Commitments are not debts in the conventional sense, however, since no interest is ever charged.48

It is an open question whether LETS can leverage sufficient levels of capital to create green economies at community scale. There are certainly some people who regard these local currencies as offering the potential to build more independent, resilient, and sustainable communities, particularly in the face of difficult—and potentially unstable—conditions in financial markets. But it would be foolish to be led by romantic notions of local self-reliance away from the need to reform institutions at the wider structural level.

It would be foolish to be led by romantic notions of local self-reliance away from the need to reform institutions at the wider structural level.

What is also unclear is the extent to which such examples can be scaled up (either in scope or in number) to form the basis of a genuine transformation of the larger financial system. What we have attempted to show here is that these kinds of local initiatives are clearly consistent with our findings about financial architecture from the macroeconomic level. They point the way towards more far-reaching changes. For instance, they highlight the need to redirect investment away from commodity price speculation and investment in extractive industries towards those that reduce our impact on the planet and strengthen local community.But, they also depend to some extent on broader system-level change for their success. Thus, we have also stressed here the legitimate role for community in campaigning for such change.

Irrespective of these considerations, it should be clear from the discussion in this section that the green economy demands a different financial landscape from the one that led to the financial crisis of 2008/9. Fiscal, sectoral, and trade imbalances impede green investment and stand in the way of shared prosperity. Reforming this system is vital. Long-term security has to be prioritized over short-term gain. Social and ecological returns must be factored into investment decisions alongside conventional financial returns. Improving the ability of people to invest their savings locally, to the benefit of their own community, is paramount. In short, reforming capital markets is not just the most obvious response to the financial crisis, it is also an essential foundation for a new green economy at community scale.

- Building sustainable communities