Luxembourg Tax Files: How Tiny State Rubber-Stamped Tax Avoidance on an Industrial Scale

EUROPE, 10 Nov 2014

Leaked documents show that one of the EU’s smallest states helped multinationals save millions in tax, to the detriment of its neighbours and allies.

- What do you want to know about Luxembourg’s tax secrets?

- Video: The $870m loan company above a stamp shop

- Explore the documents in full

A few of the thousands of documents showing how large companies cooperated with the Luxembourg tax authorities. The results were billions of dollars worth of savings for the companies on their tax bills; taxes which would otherwise have been paid to the exchequers of other countries, including Luxembourg’s fellow EU members. Photograph: Graeme Robertson/Graeme Robertson

An unprecedented international investigation into tax deals struck with Luxembourg has uncovered the multi-billion dollar tax secrets of some of the world’s largest multinational corporations.

A cache of almost 28,000 pages of leaked tax agreements, returns and other sensitive papers relating to over 1,000 businesses paints a damning picture of an EU state which is quietly rubber-stamping tax avoidance on an industrial scale.

The documents show that major companies — including drugs group Shire, City trading firm Icap and vacuum cleaner firm Dyson, who are headquartered in the UK or Ireland — have used complex webs of internal loans and interest payments which have slashed the companies’ tax bills. These arrangements, signed off by the Grand Duchy, are perfectly legal.

The documents also show how some 340 companies from around the world arranged specially-designed corporate structures with the Luxembourg authorities. The businesses include corporations such as Pepsi, Ikea, Accenture, Burberry, Procter & Gamble, Heinz, JP Morgan and FedEx. Leaked papers relating to the Coach handbag firm, drugs group Abbott Laboratories, Amazon, Deutsche Bank and Australian financial group Macquarie are also included.

The Luxembourg tax files

- Introduction

- How it works

- Case study: Shire

- Case study: ICAP

- Case study: Dyson

- Analysis by Richard Brooks

- Find out more

A Guardian analysis has found:

- A Luxembourg unit of Shire, the FTSE-100 drug firm behind attention deficit pill Adderall, received more than $1.9bn in interest income from other group companies in the last five years, paying corporation tax of less than $2m over four of the years despite minimal overheads.

- Vacuum and hand dryer firm Dyson set up companies in the Isle of Man and Luxembourg to pour £300m of internal loans into its UK operations in 2011. Interest payments made on those loans slashed Dyson’s UK tax bill and were instead taxed at only around 1% in Luxembourg, saving Dyson companies millions in tax.

- Icap, the financial trading firm run by leading Conservative party donor Michael Spencer, lent $870m from Luxembourg to its US business for seven years. Interest paid out from US companies on those loans was £247m, which was taxed at a fraction of official corporation tax rates in the US and UK.

Stephen Shay, a Harvard Law School professor who has held senior tax roles in the US Treasury and who last year gave expert testimony on Apple’s tax avoidance structures in a Senate investigation, said: “Clearly the database is evidencing a pervasive enabling by Luxembourg of multinationals’ avoidance of taxes [around the world].” He described the Grand Duchy as being “like a magical fairyland.”

There is growing political pressure in the UK and abroad to stop companies exploiting international tax rules to slash their tax bills. In January last year David Cameron told business leaders gathered at the World Economic Forum in Davos he would not tolerate big multinationals avoiding tax. In particular, he criticised how “companies navigate their way around legitimate tax systems … with an army of clever accountants”.

Chancellor George Osborne has pledged to reveal new measures next month to stop global corporations diverting profits offshore. Barack Obama has condemned tax avoiding companies as “unpatriotic” and the G20 group of nations is working on new rules to rein in aggressive tax planning.

The revelations will be embarrassing for the new president of the European Commission, Jean-Claude Juncker, who was prime minister of Luxembourg between 1995 and 2013. In a speech in Brussels in July, Juncker promised to “try to put some morality, some ethics, into the European tax landscape.” He has insisted that the country is not a tax haven.

Pressure is already building on Luxembourg after the European Commission launched a formal investigation into whether Amazon’s tax arrangements in the Grand Duchy amount to unfair state aid. The Luxembourg tax arrangements of Italian carmaker Fiat’s finance unit are also under official scrutiny by Brussels.

Asked recently if such a crackdown risked damaging the economy of Luxembourg, one senior figure closely involved in the G20 reform programme said: “I don’t care. It is like saying: ‘If you fight drugs there will be no jobs in certain parts of Mexico.’”

Recent scrutiny by politicians and media organisations of aggressive structures used by technology groups such as Apple, Google and Amazon have suggested US digital firms are at the vanguard of cross-border tax avoidance. But today’s revelations show many European multinationals in non-digital industries have also made extensive use of tax engineering.

More than 80 journalists in 26 countries, working in collaboration through the International Consortium of Investigative Journalists, have spent six months scrutinising the leaked papers – after a small number of the documents were first revealed by French TV journalist Edouard Perrin. The papers largely relate to clients of PricewaterhouseCoopers Luxembourg. PwC is one of the largest tax advisory groups in the world.

The leaked papers show Luxembourg acting as a go-between, both enabling and masking tax avoidance, which always takes place beyond its borders. The documents are mainly Advance Tax Agreements – known as comfort letters. The leaked papers include 548 of these private tax rulings. These ATAs are typically schemes put to the Luxembourg tax authorities which, if implemented, reduce tax bills substantially. If the Luxembourg authorities approve the scheme they provide a comfort letter which is a binding agreement.

The EC’s Amazon and Fiat investigations were launched after Brussels officials demanded that Luxembourg hand over certain ATAs.

Less than a third of the tax deals brokered by PwC in the 28,000 pages of documents include a figure for the sums multinationals planned to move into Luxembourg schemes. However, these deals still amounted to more than $215bn of loans and investments using the Grand Duchy between 2002 and 2010, many to massage down tax bills.

Given that many more leaked papers did not disclose sums involved, and that PwC was just one of several accounting firms which secure deals with the Luxembourg tax authorities, the full scale of financial flows through Luxembourg, facilitated by comfort letters from the Grand Duchy’s officials, is likely to be much higher.

PwC said questions put to it by ICIJ journalists were based on “outdated” and “stolen” information, “the theft of which is in the hands of the relevant authorities”.

But analysis of public filings with company registries around the world indicate many of the leaked tax deals remain in force, sapping tax revenues from public coffers today.

The Guardian’s detailed findings were put to Shire, Icap and Dyson. All three declined to answer questions. They issued statements saying that they do not engage in tax avoidance and that they pay tax in the countries where profits are made.

Dyson stressed that its Isle of Man and Luxembourg structure was unwound in 2013. Icap said it had started a process of winding down its Luxembourg financing companies last month as part of a wider reorganisation.

Many papers in the leaked tax correspondence do not reveal enough information to clearly show tax consequences of each group’s corporate structuring. And some corporations will have sought comfort letters from Luxembourg for reasons other than tax avoidance.

Many large private equity investments are also the subject of Luxembourg ATAs. Well known buyout firms such as Blackstone and Carlyle appear in the leaked documents, and Luxembourg investment vehicles are commonplace in such investment firms.

A 2008 joint venture between private equity group Apax Partners and Guardian Media Group, which owns the Guardian, also used a Luxembourg structure after it invested in magazine and events group Emap, now called Top Right.

A spokesman for GMG said: “We partnered with a private equity company which regularly used such structures. A Luxembourg entity was used because Apax already had that structure in place. The fact that the parent company is a Luxembourg company does not give rise to any UK corporation tax savings for GMG.”

How it works

The documents reveal a number of financial structures which were approved by the Luxembourg tax authorities, and which led to substantial tax savings for the companies involved. One of the more common is based on cross-border lending within a group of companies, and a mismatch between the perceptions of Luxembourg and overseas tax authorities.

How Shire’s internal lending cuts its tax bill

A tiny Luxembourg-based unit of Shire, a multinational drug firm specialising in treatments for ADHD, Crohn’s disease and rare genetic disorders, has become one of the most profitable outposts of the pharmaceutical empire. Shire is a £24bn transatlantic drugs group with big operations in the UK town of Basingstoke, and Pennsylvania and Massachusetts in the US. It shifted its corporate head office from the UK to Ireland for tax purposes in 2008 and is registered in the tax-friendly island of Jersey. The majority of its sales are in north America.

One of Shire’s Luxembourg units has made $1.87bn in profits in the last five years, largely from making loans to sister companies, as it charged interest rates of up to 9% on those loans. With what appears to be the consent of the Luxembourg authorities, the enormous profits generated by this unit were taxed at a fraction of 1%.

Shire’s tiny Luxembourg finance company in an office with dozens of other corporate occupants — Shire Holdings Europe No2 Sarl, or SHES2 for short — has lent out a total of more than $10bn.

Away from Luxembourg, more than two-thirds of Shire’s $5bn in annual revenues came from the sale of prescription drugs in the US and Canada last year. But group profits around the world were taxed at an average of 16.4% — less than half the official tax rate for most big businesses in America.

Somehow, the FTSE 100 firm had hit upon the holy grail of tax management: a structure that allowed it to access some of the most profitable healthcare markets in the world while keeping its tax bill low at the same time.

The main factor pushing down its tax bill is explained in the smallprint of the group’s annual report as “intra-group items”. That is, the tax consequences of investments and transactions between Shire group companies around the world.

Leaked letters from PwC, Shire’s tax advisers, reveal how far Shire was prepared to go to conjure up tax advantages through highly artificial tax structures.

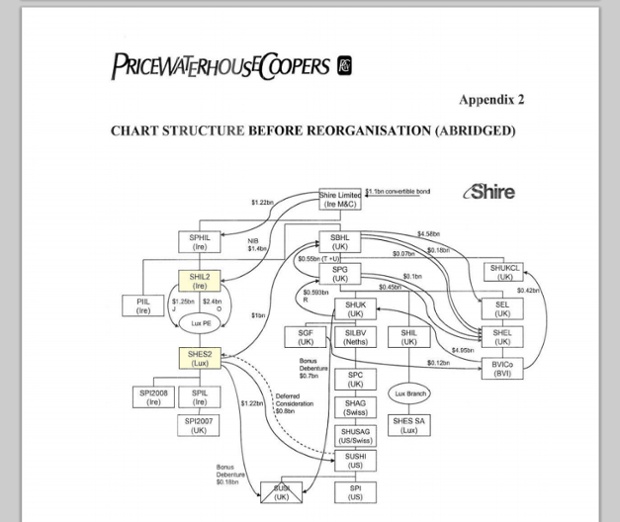

The confidential papers reveal the critical role in group tax planning played by SHES2 — one of seven Shire companies incorporated in Luxembourg.

Over the last five years this business received $1.91bn of interest income from loans it made to other Shire companies, including more than $580m last year alone. By the end of 2013, sister companies within the Shire group owed SHES2 more than $10bn in loans and interest — equivalent to more than two years’ sales for the entire group.

The Guardian asked Shire why it had such large internal loans when the overall group had few borrowing needs. Shire declined to comment.

The borrower companies and where they operate remains unknown. It is likely however that the vast interest payments have created huge tax deductions for these sister units, whose profits are lowered by the cost of paying the interest on the Luxembourg loans.

With minimal operating costs — including staff wage bills of less than $55,000 a year — SHES2 appears to be one of Shire’s most lucrative business units with profits over five years of $1.87bn.

But Shire’s annual report makes mention of SHES2 only once, in an appendix that lists the group’s subsidiaries.

Meanwhile, accounts for SHES2, filed in Luxembourg, show that, despite its towering profits, the company recorded no corporate income tax charge at all.

The Guardian sent a reporter to the offices of SHES2 in Luxembourg but found few of the trappings to be expected of a multi-million-dollar enterprise. Watch footage of Rupert Neate attempting to find a SHES2 employee in Luxembourg.

Video: Guardian reporter Rupert Neate visits the offices of Shire Holdings Europe

Company filings show SHES2 had just four official managers, two of whom were senior figures in Shire’s tax department, working at UK head office in Basingstoke, England. Among them is Fearghas Carruthers, the group’s head of tax.

The key to solving the riddle of how SHES2 appears to have made $1.91bn of interest income almost disappear for tax purposes is found in leaked Luxembourg letters from tax advisers at PwC to the local tax office. They offer a rare glimpse into the group’s labyrinthine corporate structures.

A diagram provided by PwC to help the Luxembourg tax authority to understand the corporate structure of Shire. The Guardian has picked out SHES2 and an Irish company called Shire Holdings Ireland No.2 Limited in yellow. The circle labelled “LuxPE” is the Irish company’s Luxembourg branch.Photograph: Guardian

The answer lies in Ireland, where Shire moved its corporate headquarters from the UK in 2008 after the Labour government had attempted a crackdown on UK multinationals using internal financing companies in aggressive tax planning structures.

Among a cluster of Irish-registered Shire firms is a holding company Shire Holdings Ireland No.2 Limited, or SHIL2 for short. This Irish company has for years been charging itself interest on billions of dollars of loans — to itself. More specifically, the interest has been charged on loans from SHIL2’s head office registered near Dublin to a SHIL2 branch office in Luxembourg. Rupert Neate returned – to the same office block on the outskirts of Luxembourg city – to enquire about SHIL2.

Leaked papers show that Shire’s tax advisers told the Luxembourg tax authorities that this unusual lending within the same legal entity had transformed the drug group’s wider activities in the Grand Duchy into a lending conduit: pushing one large loan from Ireland, through two Luxembourg units (SHIL2 and SHES2), and onwards to Shire companies around the world.

Such a chain of back-to-back lending, advisers from PwC argued, effectively meant Shire’s intra-group loans were only passing through Luxembourg. Therefore, the local taxman did not need to conduct a rigorous assessment of Shire’s tax liabilities. The full Luxembourg corporate tax rate should still apply, but only on a notional amount of profit. In Shire’s case, PwC suggested, the Grand Duchy should be satisfied taxing just “1/64%” — that is 0.0156% — of the billions in loans and interest owing to SHES2.

A letter of consent from the Luxembourg tax office does not appear in the cache of leaked files, but it is clear from publicly available filings elsewhere that the avoidance structure was set up in 2008 and appears to have remained active at least as recently as the end of 2013.

By the end, the complex structure had created a multi-billion-dollar lending chain, bearing no relation to Shire’s overall borrowing needs. The structure appeared to have little commercial benefit other than a tax conjuring trick: tax bills have been lowered for Shire borrower companies around the world while the group’s Luxembourg operations had all but escaped corresponding tax on the interest income.

In a statement, the group said: “Shire Holdings Europe No.2 Sarl, is part of our overall treasury operations. We have a responsibility to all our stakeholders to manage our business responsibly; this includes managing our tax affairs in the interest of all stakeholders.”

Icap’s skeleton-staffed multimillion dollar office

Above a stamp shop, behind closed office blinds, on the first floor of a terrace building overlooking a park on Boulevard Prince Henri in Luxembourg City, the lights appear to be out.

When the Guardian pressed the buzzer one October afternoon a male voice, with what seems a Dutch accent, sounds over the crackly intercom. The speaker confirmed this was, indeed, the Luxembourg offices of Icap, the London-listed financial trading group.

Polite and good humoured, he chuckled and apologised for having to catch his breath, explaining he has just run down some stairs to answer the buzzer. He said little else about Icap’s Luxembourg lending operations, however, and wouldn’t let the Guardian in the building. Watch footage of our reporter, Rupert Neate, trying to make contact.

Official filings show two Icap companies at this address. Together they have sucked hundreds of millions of dollars in interest income out of the high-tax US and, with the help of a third Icap unit, and made them all but disappear for tax purposes.

Together they had lent a total of $870m to Icap operations in America by March 2008. Annual accounts since then show these loans remained on the companies’ books unchanged every year. They were still outstanding at the end of March this year.

Last week the Guardian approached Icap with the findings from its investigation into the broker firm’s Luxembourg activities. In response, Icap explained that the loans had just recently been repaid in full by the group’s US operations, and that a process to wind down its Luxembourg unit had begun only last month.

No such information was relayed by the voice on the intercom, though Icap’s local manager has since explained that Luxembourg secrecy laws meant he could not offer explanations.

Company accounts suggest neither of the two Icap lending firms had much commercial activity – other than the holding of large loans to the US.

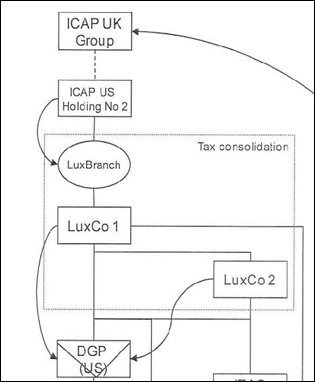

The companies’ names are as long as they are uninformative — Icap Luxembourg Holdings (No.1) Sarl and Icap Luxembourg (No.2) Sarl. In leaked tax correspondence they are abbreviated to generic terms “LuxCo1” and “LuxCo2”.

A detail from one of the documents shows part of Icap’s corporate structure, as it relates to Luxembourg. Photograph: Guardian

Over the last seven years, the two each had just one employee — paid an annual wage of less than $15,000 — while other costs of operating above the stamp shop have also been consistently small.

It is a far cry from Icap’s busy trading desks in New York and London, scenes from which every year appear in the newspapers as a string of celebrities take over the dealing phones as part of a charity day. Last year the Duchess of Cornwall and Strictly Come Dancing’s Craig Revel Horwood manned the lines.

Offering services in many of the busiest financial markets — foreign exchange, credit, interest rates and equities — the group has a busy role at the heart of the City of London, Wall Street and other financial centres.

The chief executive, Michael Spencer, has the best political connections, serving as treasurer of the Conservative party between 2006 an 2010. His donations to the party have totalled nearly £5m.

But no celebrities or cabinet ministers have ties to Icap’s quiet Luxembourg offices. LuxCo1 and LuxCo2 are not mentioned among the 22 main subsidiaries listed in Icap’s annual report. Yet together the two companies received a total of $248m in interest on their loans to the US in the last seven years.

And thanks to modest overheads – the pedestrian office, the single employee – almost all of the interest income converted into profit, making LuxCo1 and LuxCo2 among the most lucrative subsidiaries within the Icap empire.

The tax position on the Luxembourg lending profits is less than clear from company accounts, which record both LuxCo1 and LuxCo2 as having no income tax to pay at all for the seven years reviewed by the Guardian.

The true position, however, is discoverable with the help of leaked tax approvals given to Icap, in private, by the Luxembourg taxman. These show that LuxCo1 and LuxCo2 were treated in their tax returns as part of a lending chain. Although neither company had any borrowings themselves, another ICAP unit, registered to the same address on Boulevard Prince Henri did.

The Icap borrower company in question has an innocuous sounding name — ICAP US Holdings No2 Ltd, or ICAP US2 for short — but it is a truly exotic corporate creature. Despite having just one employee, paid $12,000 in Luxembourg, this UK tax-resident company has three registered addresses: a law firm in Gibraltar; Icap’s international headquarters on Broadgate in the City of London; and the office above the stamp shop on Boulevard Prince Henri.

A clue as to its importance to Icap’s finance and tax affairs comes from the list of directors at Icap US2. These include Stephen Caplen, deputy financial director for the Icap group, and David Ireland, Icap’s head of tax. In the Luxembourg branch office, meanwhile, the sole “représentant permanent” is the non-board member Paul de Haan. Watch the video to learn more about Mr de Haan’s role.

A leaked Luxembourg tax deal, covering all three Icap financing units, shows these units were treated collectively as a the middle link in a lending chain: a conduit rather than a lender.

As a result, the local tax office agreed, the borrowing activities of Icap US2’s Luxembourg branch was generating tax deductions that could be neatly offset against the tax liabilities on almost all interest income earned at LuxCo1 and LuxCo2.

The resulting near-zero tax bill in Luxembourg could hardly be seen as controversial — so long, of course, as the millions paid out in interest by Icap US2 in the Grand Duchy was taxed when it became income for the lending company. And therein lies the twist.

The lender to ICAP US2 was, in fact, ICAP US 2 itself. More precisely, ICAP US2 was lending hundreds of millions of dollars to its Luxembourg branch. In an exotic arrangement — one seen elsewhere repeatedly in the leaked tax files — the group was effectively paying interest to itself.

Meanwhile, in Britain, tax inspectors scrutinising this arrangement recognised there was something unusual afoot. But there was not much they could do to block it, because the UK does not recognise such internal company lending as taxable.

The result was that Icap’s interest payments – paid by Icap US2’s Luxembourg branch to another part of Icap US2 in a different country – almost disappeared, for tax purposes. The saving ran into many tens of million of dollars.

That said, the UK taxman was not entirely without powers to act. HMRC was able to use its anti-avoidance powers, under the so-called “controlled foreign companies” regime, to winkle out a relatively small amount of tax from Icap US2.

Over the last five years for which there are available accounts, Icap US2 appears to have paid an average corporate income tax of $3m a year to HMRC and $83,500 to Luxembourg.

While the precise effective tax rate achieved on Icap’s interest income is hard to calculate, it is clear that it is a fraction of the headline corporate tax rates in the US and UK over the last seven years.

In a statement to the Guardian, Icap said: “Icap is a British company, which has always paid more tax than the UK corporation tax rate, and we do not engage in aggressive tax avoidance. We pay all taxes due on the profits earned in the countries in which we operate. Our Luxembourg financing operation was created to support a series of acquisitions Icap made in the US in the 2000’s, and is now being wound down to reduce costs. Its profits were taxed in the UK. It is an entirely standard financing method and was agreed by HMRC.”

Dyson sweeps away profits from the taxman

Up until 2010 the corporate structure behind Dyson, the hand dryer and vacuum cleaner group, was as functional as its products.

Shares in Dyson James Ltd (DJL), the main business, based in Malmesbury in Wiltshire, were owned by inventor and entrepreneur Sir James Dyson, with the founder’s three children each holding minority stakes.

The billionaire industrial designer, who came up with the bagless vacuum cleaner and built a company with a £1bn turnover, has become a figurehead and spokesman for UK engineering and science.

In the late 2000s a rash of businesses moved their headquarter operations abroad. Shire, UBM and WPP had moved to Ireland. Ineos switched to Switzerland. Dyson did not approve.

“We don’t have any plans to do that [move tax domicile],” he said in 2008. “I think it’s wrong to direct your business for tax reasons. Your business should be where you can do it best.”

However, his company went on to use elaborate tax structures after he made those comments.

At the start of 2010, new tiers of holding and finance companies began sprouting into life above DJL.

Shares in DJL were now owned by a new UK holding company: Dyson James Group Ltd (DJG), which in turn became a subsidiary of Clear Cover Ltd, a parent company incorporated in Malta.

Two group financing companies were also established: one in the Isle of Man called Silver Cyclone, one in Luxembourg called Blue Blade.

Leaked details of tax deals with the Luxembourg tax office show these were to be the vehicles for a £300m injection of loans into DJG in the UK. Like all good corporate manoeuvres it was given a muscular-sounding code name: Project Ajax.

In a matter of months, the simple corporate architecture that existed before had been swept aside. Dyson and his children remained the ultimate owners but their immediate interest was now in a company registered to an address on Tingé Point in the Maltese costal town of Sliema, the site of a former British barracks.

Back in Britain, financial transactions that bore little relation to breaking new ground in product design began to take place. Instead of product engineering, this was financial engineering.

In 2010 DJG had to meet new interest costs of £5.37m that were paid to newly-created sister company Blue Blade, filings in Luxembourg show. These costs are thought to have been largely or entirely tax-deductible – meaning they lowered profits at DJG, and thus its tax bill.

Dyson declined to confirm this, saying only that tax matters were commercially sensitive.

Accounts for Blue Blade show the company’s corporation tax for 2010 was just £55,037 — an effective tax rate of just under 1%. Somehow the business had escaped tax at anything close to the then headline rate of over 28% in Luxembourg.

Only in leaked tax papers is an explanation to be found. In a 2009 letter to Marius Kohl, one of Luxembourg’s top taxmen, Dyson’s tax advisers at PwC argued the case for Blue Blade to be charged tax on only a small fraction of its interest income.

The letter makes clear PwC had met with Kohl to discuss the matter a month earlier.

At the heart of the tax advisers’ case was a claim that Blue Blade should pay almost no tax because although it had lent £300m to DJG, it had also borrowed £299m from Isle of Man-based Silver Cyclone.

PwC make no secret of the fact that the loan from the Isle of Man was interest-free. Nevertheless, it suggests, Blue Blade should properly benefit from a tax deduction as if it had been required to pay interest to Silver Cyclone.

“[Blue Blade] will be allowed to deduct a deemed interest on its interest free debt involved in the financial on-lending activity”, PwC wrote. Rather than taxing all of Blue Blade’s lending profits, Luxembourg should only tax a tiny fraction of the sums borrowed.

The nine-page PwC letter was sent to Kohl on 11 November. On the same day, the Luxembourg taxman sent back a two-paragraph reply: “Further to your letter… relating to the transactions that [the Dyson group] would like to conduct, I find the contents of said letter to be in compliance with the current tax legislation and administrative practice.”

With these words, Kohl provided official sanction for the Dyson scheme to go ahead as PwC had described.

The Guardian asked the Dyson group why Blue Blade should qualify for a tax deduction over “deemed interest” costs when, in reality, this company had almost no borrowing costs thanks to the interest-free loan from Silver Cyclone. Dyson did not answer.

In a statement it said: “Advice a number of years ago was that a non-UK holding structure would aid growth further, however, that has not turned out to be the case and the holding structure of Dyson group is now entirely in the UK.”

For reasons unknown, the £300m loan from Blue Blade was repaid in less than a year. But analysis of Dyson filings in the UK, Luxembourg, Malta and Isle of Man show that in 2011 the group rebuilt a near identical structure. This time, however, millions of pounds in interest payments from UK operations went to a Luxembourg company called Copper Blade. And the payments were higher as the Malmesbury holding company had borrowed £550m.

This large loan was partly repaid in 2011 and again in 2012, with all debts and the entire structure unwound last year.

Dyson told the Guardian: “The Dyson family business paid £330m in UK tax over the past three years, clearly not the act of a company avoiding its fair share of tax. Dyson’s success means that over 85% of its technology is sold overseas … At no time did the [group’s former] non-UK structure deliver any significant tax advantage and, of the entities in question all have been dissolved or are in a liquidation process.”

Analysis: Havens make for a global race to the bottom

Richard Brooks writes: “Occupying a damp 1,000 square miles where the French, German and Belgian borders meet, the Grand Duchy of Luxembourg is a far cry from the palm-fringed tropical island tax haven of popular imagination.

“In fact the country owes its status as the world’s premier corporate tax haven to its position at the heart of Europe. A founding member of the European Economic Community in 1957, Luxembourg enjoys all the freedoms governing investment in what is now the European Union. These and a network of taxation agreements with all the world’s leading economies ensure the Grand Duchy is accepted in a club of leading nations that share basic principles on how to tax corporations operating across national borders.

Office buildings in Luxembourg’s financial district. A far cry from the Caribbean island vision of tax havens.Photograph: Graeme Robertson/Graeme Robertson

“Such a privilege would never be afforded to island-in-the-sun tax havens. Large economies, such as the US and UK, typically block multinationals from shifting profits to low-tax territories by imposing ‘withholding taxes’ on payments leaving their borders. Luxembourg, by contrast, is a respected member of the international economic club, and assumed therefore to tax its companies fully; it even has a corporate income tax system with a 29% rate that is now relatively high by international standards. So money flows into the country tax-free.

“Secretly, however, Luxembourg is a tax haven, offering a range of ways in which payments that reduce a multinational’s taxable profits in a country such as the UK or US can escape tax when received in the Grand Duchy. These include: exempting income diverted to foreign branches of Luxembourg companies in places like Switzerland and Ireland, tax relief for paper investment losses, and the approval of complex ‘hybrid’ financial instruments and corporate structures within its borders. Top FTSE 100 firms like Vodafone and GlaxoSmithKline are known to have exploited these opportunities to channel billions through Luxembourg companies.

“When a multinational approaches the Luxembourg tax authorities with a scheme employing one of these tactics, after a meeting or two to chew over the details a senior official rubber-stamps the plan and the company walks away with a big tax break. In this way the Grand Duchy behaves like the club member who enjoys all the benefits of membership while quietly pilfering from the kitty.

“It might be an underhand way to run a tax system, but it serves Luxembourg well. The country has the highest levels of foreign investment inflows and outflows in the EU, taking a small but valuable tax levy as the money washes through. Corporate income taxes, at 5% of GDP, consequently form a far greater share of Luxembourg’s finances than they do in other EU countries.

“As the world cottons on to Luxembourg’s tax poaching, pressure for reform grows. So does embarrassment for the new president of the European Commission, Jean-Claude Juncker, who as prime minister of the Grand Duchy for 18 years until 2013 presided over the activity. Revelations of precisely how its corporate tax avoidance factory works give the lie to Juncker’s repeated protestations that the country is not a tax haven.

“Investigations by the European Commission into deals offered by Juncker’s government to Amazon and Fiat might or might not conclude that they constituted anti-competitive ‘state aid’. But these inquiries concern the possibility of ‘sweetheart deals’ for favoured companies, when the bigger problem is that Luxembourg offers major tax breaks to all companies – as long as they have enough money.

“Neutering Luxembourg as a tax haven at the heart of Europe requires an overhaul of its corporate tax law and administration. A concerted effort coordinated by the OECD aims to bring many of the tax structures facilitated by Luxembourg to an end. But, even if its proposals are technically sufficient, it will take intense political pressure to force Luxembourg to implement them.

“In the meantime, despite his claims to be spearheading the OECD’s work, George Osborne has enhanced the allure of Luxembourg’s tax breaks. In 2012 he drastically scaled back anti-tax avoidance laws targeted at multinationals’ so-called ‘controlled foreign companies’. These are tax laws that since 1984 have caught profits diverted by UK multinationals into tax havens. In a move specifically aimed at favouring finance companies established in Luxembourg, Osborne reduced the tax on their profits to no more than 5%.

“Osborne’s changes are designed to make the UK an attractive place for multinationals to base themselves. They do so by accommodating predatory tax practices, in response to opportunities provided by countries like the Netherlands and Luxembourg. Other widely publicised tax breaks such as the ‘patent box’ special tax rate for income from intellectual property mimic concessions elsewhere.

“This is the real harm that tax havens like Luxembourg cause. They turn ‘tax competition’ into a global race to the bottom, depleting the contributions of major corporations and leaving citizens to pick up the tab.”

___________________________

Richard Brooks is the author of The Great Tax Robbery – How Britain became a tax haven for fat cats and big business.

Go to Original – theguardian.com

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.