Celebrating the Fifth of May

TRANSCEND MEMBERS, 24 Apr 2017

Howard Richards – TRANSCEND Media Service

24 Apr 2017 – If you have successfully freed your twenty-first century mind from enslavement to the jurisprudence of the eighteenth century, you will have no trouble accepting the cancellation of debts. If you are a realist about the evolution of the human species on the planet earth, you will see necessary or desirable debt cancellation as just another adjustment of culture to its physical functions. It will be obvious to you that the ancient Hebrews were not violating eternal and universal principles when they declared the cancellation of debts every seventh year.[i] On the contrary they were asserting eternal and universal principles more fundamental than those of the civil law. Nor was the legendary Athenian legislator Solon unethical when he relieved the poor from debt bondage.[ii]

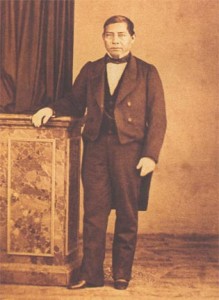

You will happily join the Mexicans in celebrating their cinco de mayo. It is a holiday that honours the announcement made in 1861 by El Presidente Benito Juarez that Mexico had no money and would exercise its right as a sovereign nation to suspend payment on its debts. When Mexico announced default, its creditors summoned to their aid armed forces of the United States, Great Britain, and France who landed in Veracruz in January of 1862. The French marched inland. On May 5, 1862, they were defeated by the Mexican army at Puebla. President Juarez declared May 5 “el cinco de mayo” Mexico´s national holiday and it has been celebrated ever since. (A year later the French marched on Mexico City with a larger force and installed Maximilian, an Austrian nobleman, as Emperor of Mexico.)

A realist viewpoint does not imply adopting a generally hostile attitude toward creditors –certainly not when the creditor happens to be a pension fund on which old ladies rely for their monthly sustenance. It does not imply hostility to anybody. It does imply including debt cancellation among the options when looking for justice. “Justice” is a wonderful word. Aristotle declared justice to be more beautiful than the evening or the morning star. More recently Carlos Amigo, the Archbishop of Seville, declared that peace is a table with four legs, and its four legs are justice, justice, justice, and justice. It is only by mistake that justice has been confused with inflexible enforcement of debts, indifferent alike to human suffering and to practical realities.

A truly “pragmatic” solution in the best sense of the word is a solution that works. It works for everybody. Those who still remember what Plato meant by “justice” two and a half millennia ago, will not be surprised when reasonable compromises when debts become unpayable are identified with justice. They do what is best for the good of the whole. Unbounded organization can be thought of as pragmatic in this sense, being not only a creative approach, but also an approach that builds social cohesion. By definition, it is what works in the short, medium, and long term. It is what works for Mother Earth.

A “pragmatic” solution to a debt crisis in the worst sense of the word is one that surrenders to power. Debts are paid not because human flourishing is enhanced by paying them, and not from respect for norms that have proven on the whole to be life-enhancing. Debts are paid because the creditors are more powerful than the debtors. Africa and Latin America in the 1980s were compelled to accept structural adjustment of their economies in order to pay their external debts, sacrificing human welfare as measured by any reasonable measure of human welfare.[iii] In today’s ongoing drama about the unpayable debts of Greece, Greece is sometimes urged to pay its creditors not on any humanitarian ground, but on the “pragmatic” ground that if it does not pay it will be punished. Mexico was punished by military force in 1862 and 1863. In India in 1991[iv] the world’s largest democracy was brought to its knees simply by creditors threatening to refuse short term credit needed to finance essential imports.

Seeking to be pragmatic in the best sense of the term while resisting being compelled to be pragmatic in the worst sense of the term, we must strive to be aware that what is at stake. When mountains of debt rise so high that they are unpayable[v] it is not just the economic stability of debtors that is at stake. What is at stake is also the economic stability of creditors. In the Greek case, the Eurozone and with it Germany might collapse.

Greece is far from being the only country in Europe, or the only country in the world, with a debt burden so heavy that it cannot be paid. In Greece Japan sees its future. In Greece, the United States sees its future. The economic collapse that can result from a badly handled debt crisis could happen not only to Greece, but to any country, and it could happen to the world economy as a whole.

Just what is meant by “collapse?” As a first approximation, here the word “collapse” refers to the evaporation of what the great economists John Maynard Keynes and Michael Kalecki called “confidence.” Actors in a system motivated by expectations of payment cease to have confidence that they will be paid. They normally advance funds expecting to make a profit. When people who advance funds lose confidence, they cease to advance funds. Most people get money to pay their bills from employment. Most employment is generated by firms in business for profit. Unless someone advances funds so firms can spend money in order to make more money, the system does not work. The system collapses when people who advance funds (investors or lenders) are afraid to advance funds from fear that they will not be paid. “Collapse” also refers to the consequences of dispelling illusions of solvency, also known as houses of cards. It is called a “collapse” when it becomes clear that creditors are demanding to be paid and that liabilities far exceed assets.

There are reasonable and unreasonable ways to make the best of a bad situation when the rightful claims of the creditors exceed by far the value of the assets available to pay them. Some of the most reasonable ways are found in the Bankruptcy Code of the United States. They were even more reasonable than they are now before their 2005 amendments, but even now they are in many ways exemplary. Every year more than a million Americans write off most of their debts and get a fresh start, comparable to the fresh starts of ancient Hebrew debtors in the years of Jubilee. Every year heavily indebted businesses stay in business and preserve going concern value by writing down their debts under judicial supervision.[vi] Nobody knows this better than Donald Trump. As a businessman, he made it a practice to buy heavily indebted companies, and then to reorganize them under the bankruptcy laws. The companies became more viable by shedding debt. Some creditors went unpaid, but that does not necessarily mean they were cheated. The reason why they extended credit in the first place was to collect interest, and interest is a reward for taking risks. Right?

Unfortunately, in this respect the United States has been very little followed by the rest of the world. No comparable system exists in many countries, and there is none at an international level.

Greece and the ongoing conflict of Greece with Germany present the world with a sordid spectacle showing how not to be humane and how not to be reasonable when debts cannot be paid. Similar dramas on a larger scale are likely to occur in the near future. Ironically, at an international level a classic case of pragmatism in the best sense of the word was the cancellation of most of Germany´s debt in 1953. On the 27th of February of 1953 Germany´s creditors (including Greece) meeting in London “took a haircut” by reducing the amount owed by sixty percent. Germany was granted a five-year moratorium without any payments, and a total of thirty years to pay off the reduced amount. Debt payments in any given year were to be no more than one twentieth of Germany´s export earnings.[vii]

Unpayable public debts have historically been cancelled by inflation, by repudiation, by taxation of the creditors offsetting the debts owed them, by voluntary forgiveness, and/or by printing new money, sometimes retiring the old currency altogether and issuing new money. The unpayable debt run up by the U.S. government fighting World War II was mostly cancelled by several decades of inflation.[viii]

Debt restructuring can be regarded as a particular application of the more general idea of inventing and re-inventing institutions to improve their performance. It is the general idea that Karl Popper called the “open society,” John Dewey called the “experimental society,” that Bronislaw Malinowski called “functionalism” and that Pope Francis never ceases to remind us of when he repeats over and over that economies are supposed to serve persons and not the other way about. It is a general idea that is constantly in conflict on two levels. On the level of ideology, it is constantly in conflict with the rigidity of partisans of 18th century liberalism who live and die proclaiming that the true meaning of freedom is that property rights must never be modified and that all contracts must be enforced. On a practical level, flexible compromises are constantly in conflict with the necessity to do whatever it takes to please investors, because as the world is now organized life physically depends on their decisions to invest or divest.

Let us look in a little more detail at the opening scenes of the ongoing drama of Greece, back in the times when the voters of Greece had just elected a government pledged to defend Greece’s economic sovereignty. At that time the new finance minister, Yanis Varoufakis, represented Greece in a series of negotiations in Brussels. The overall objective was to compromise with creditors to reach a workable solution. The immediate issue was the terms of a new emergency loan to make it possible for Greece to keep making payments on its old loans.

Varoufakis truly asserted what everybody knew. Greece’s debt –like many other debts—was unpayable. That it would never be paid was a fact nobody could change. A high rate of inflation might make it possible to pay its nominal amount, but that would not be the same as really paying it. In this context, it was misleading to speak of taking out a new loan. Normally a new loan on top of old loans is thought of as increasing the total amount owed. That was in a sense true here; Greece would indeed owe more after the new loan. But it is misleading to treat this case as a normal case. When Greece took out more loans it would in all probability[ix] not pay the new larger amount, given that it certainly would not pay the smaller but still unpayable amount it already owed. It might go through the motions of signing the papers, but the number defining the new larger total debt will not have the meaning it would have in the case of a solvent debtor who could be expected to repay the sums borrowed.

Further, when Greece takes out a new loan –which in the end it did—Greece does not get money. Most of the money returns to the banks (mostly the same banks) that make the new loan. The purpose of the new loan is to make payments on old loans. Money moves from one account to another in Berlin, but little or none of it moves to Athens.

It does not follow, nevertheless, that its creditors do not want to lend Greece more money. On the contrary, they wanted to compel Greece to take out new loans, and not only because that would be the only way for Greece to make the payments due on the old loans. There are more reasons why creditors wanted to increase Greece’s total debt, in full knowledge that it would never be paid. There are in today’s world, as there were in Jane Austen’s world,[x] people who live by clipping the coupons of government bonds. As public debt rises a larger portion of the taxpayers’ money goes to pay interest on public debt. By the same token a larger portion of society’s wealth flows into the coffers of the people who receive interest. Collecting interest on government bonds is especially prized by investors because it is usually tax free income –which means a lot to people in high tax brackets. Even when everybody knows the debt will never be paid, the same rate of interest on a larger principal yields larger incomes to creditors.

But even this is not all. It must also be considered that when Greece is in the position of a defaulting debtor while the banks it owes are in the position of foreclosing creditors, Greece loses its sovereignty. The banks exercise the creditors’ remedies specified in the fine print of the loan documents. The creditors call the shots, not the voters. In today’s world, the fine print –and sometimes the large print in italics—requires shrinking the public sector. It means the creditors can foreclose on the airports and the turnpikes. In today’s world, technical neoliberal economics speciously “proves” that public spending is not as efficient as private spending. Such pseudo-science can be used to rationalize imposing austerity, privatization, and other neoliberal policies as a condition of the new loans. Neoliberalism is bad science, but as things stand today in the world, for a nation in default neoliberalism is the law.

Yanis Varoufakis’ proposals in Brussels were more than reasonable: (1) Restructure an unpayable debt to make it payable, (2) Expand the Greek economy to maximize its ability to pay. But in the end, as the world now knows, the creditors preferred a shrinking Greece firmly under their control to an expanding Greece under Greek control. As the world now knows, the solution they imposed was no solution. From then until now, the Greek people have suffered from what is euphemistically called austerity, while finding a workable solution has only been postponed. Morals can be drawn for other countries in similar situations, including those countries that are not in similar situations yet but soon will be.

A basic moral is that the ancient wisdom of Deuteronomy and Solon, and the ancient wisdom of non-western cultures studied by anthropologists like Malinowski, is not to be despised. Pope Francis is not an economist, but he is a steward of two thousand years of lessons learned from experience. The Roman Catholic church, like many another church, may be old, but she is not stupid. More recently, in the 19th century, Benito Juarez was not mistaken to declare a national holiday to be celebrated forever after to commemorate the day when Mexico (temporarily) succeeded in defending its sovereign right to suspend payments on its unpayable debt.

Yanis Varoufakis, an economics professor who became a cabinet minister, once wrote, “In economics error is not what one can expect until one gets it right. It is all one can expect.”[xi] Such remarks lead me to think he might sympathize with proposals like mine and my co-authors. We believe that at this point in history it is time for humanity to step outside standard economics altogether. Standard economic thinking leads to standard economic results, and those results do not favour the ordinary hard-working people Varoufakis sometimes calls “the ants.” [xii] To rescue Greece, or Europe, or the world from a morass of dysfunctional economies, it is necessary to move beyond a bogus science that presupposes that nothing, or not much, moves without capital accumulation.

Coming from a different direction, this time considering the problems posed by unpayable debts, I end with the same conclusions I have reached in other commentaries on current events. The human species should not be physically dependent on a system that collapses in the absence of favourable conditions for capital accumulation. A plural and caring economy would be more governable; it would be more resilient; more self-sufficient; more inclusive; and more democratic. It would be more mission-driven and less profit-driven. People would be motivated more by vocation and less by money. Goods and services would be produced more because they are good and more because they serve, and less because they are an unwanted detour on the road that leads from money to more money. Stronger communities and stronger households would make it easier to meet human needs in harmony with nature; and harder for cold-blooded creditors to impose austerity. More intelligent and more open-minded heterodox forms of economic science would make the production of the necessities and comforts of life more compatible with ethics.

NOTES:

[i] Deuteronomy 15. See also Matthew 6:12, Leviticus 25. It is sometimes said that debt cancellation was every 49 years in the year of Jubilee announced in Leviticus. Deuteronomy says every seven years.

[ii] Both Aristotle and Plutarch say that Solon cancelled all debts. Other sources suggest that although he relieved the poor from debt-bondage his measures were less sweeping. See A. French, The Economic Background to Solon´s Reforms, The Classical Quarterly. Volume 6 (1956) pp. 11-25. (http://philpapers.org/rec/FRETEB – accessed March 2015).

[iii] See for example John Loxley, Structural Adjustment in Africa, Review of African Political Economy. Volume 47 (1990) pp. 8-27. (http://www.tandfonline.com/doi/pdf/10.1080/03056249008703845#. VPYSFo1yaP9 – accessed March 2015).

[iv] The famous reforms of 1991 were forced on India because it was in default on international obligations. See the discussion of them in Howard Richards and Joanna Swanger, Gandhi and the Future of Economics. Lake Oswego OR: Dignity Press, 2013. p. 251 et. seq. and in the several works of Sen and Dreze on contemporary India. (http://schelri.vitebooks.eu/?id=gandhi_and_the_future_of_economics_howard _richards _joanna_swanger_ivo_coelho_editor_/ – accessed March 2015).

[v] Some examples of debt that may be unpayable: At the end of 2011 total debt (public and private) in the Eurozone was 23.78 trillion euros, while the total amount of money (euros, M3) was 9.6 trillion. Total promises to pay were about two and a half times the total of money then existing. Total private debt in the USA was nearly 25 trillion dollars and total public debt 12 trillion dollars with a money supply around ten and a half trillion, making total debt three and a half times total money. In South Africa, total debt was about one and a half times total money. In Sweden, it was more than four times. The world´s fifty biggest banks had 67.6 trillion in assets (measured in dollars) but only 772 billion in reserves. In other words, the assets of the big banks consist almost entirely in promises. Thorpe cites the websites from which he compiled this information for his blog notably www.accuity.com. (Thorpe, S. 2010, TGlobal Debt and Money Supply : Twice as much debt as there is Money). (http://simonthorpesideas.blogspot.co.uk/2013/04/total-global-debt-and-money-supply.html – accessed March 2015).

[vi] The author of these lines speaks from personal experience, having been a practicing lawyer specializing in bankruptcy and reorganization in California from 1989 to 2004.

[vii] Le Monde Diplomatique. Chilean edition for June 2013. Front page.

[viii] These matters are discussed in the fourth part of Thomas Pikkety, Capital in the Twenty-first Century. (op. cit.)

[ix] It would not be logically impossible for the new loan to be used to create so much new productivity that in the end the whole debt would be paid off, but while not logically impossible it is not likely.

[x] Thomas Piketty cites cases from Austen’s novels to give examples of rentier life in the late 18th and early 19th century. Capital in the Twenty-First Century. Cambridge MA: Harvard University Press, 2014. (op cit).

[xi]Yanis Varoufakis in his introduction to Yanis Varoufakis, Joseph Halevi, and Nicholas J. Theocarakis, Modern Political Economics: Making Sense of the post-2008 World. London: Routledge, 2012. Each of the three authors wrote a separate introduction. ( http://yanisvaroufakis.eu/books/modern-political-economics/ – accessed March 2015).

[xii] See his blog Yanis Varoufakis (www.yanisvaroufakis.eu).

___________________________________________

Prof. Howard Richards is a member of the TRANSCEND Network for Peace, Development and Environment. He was born in Pasadena, California but since 1966 has lived in Chile when not teaching in other places. Professor of Peace and Global Studies Emeritus, Earlham College, a school in Richmond Indiana affiliated with the Society of Friends (Quakers) known for its peace and social justice commitments. Stanford Law School, MA and PhD in Philosophy from UC Santa Barbara, Advanced Certificate in Education-Oxford, PhD in Educational Planning from University of Toronto. Books: Dilemmas of Social Democracies with Joanna Swanger, Gandhi and the Future of Economics with Joanna Swanger, The Nurturing of Time Future, Understanding the Global Economy (available as e-books), The Evaluation of Cultural Action (not an e book). Hacia otras Economias with Raul Gonzalez, free download available at www.repensar.cl. Solidaridad, Participacion, Transparencia: conversaciones sobre el socialismo en Rosario, Argentina. Available free on the blogspot lahoradelaetica.

Prof. Howard Richards is a member of the TRANSCEND Network for Peace, Development and Environment. He was born in Pasadena, California but since 1966 has lived in Chile when not teaching in other places. Professor of Peace and Global Studies Emeritus, Earlham College, a school in Richmond Indiana affiliated with the Society of Friends (Quakers) known for its peace and social justice commitments. Stanford Law School, MA and PhD in Philosophy from UC Santa Barbara, Advanced Certificate in Education-Oxford, PhD in Educational Planning from University of Toronto. Books: Dilemmas of Social Democracies with Joanna Swanger, Gandhi and the Future of Economics with Joanna Swanger, The Nurturing of Time Future, Understanding the Global Economy (available as e-books), The Evaluation of Cultural Action (not an e book). Hacia otras Economias with Raul Gonzalez, free download available at www.repensar.cl. Solidaridad, Participacion, Transparencia: conversaciones sobre el socialismo en Rosario, Argentina. Available free on the blogspot lahoradelaetica.

This article originally appeared on Transcend Media Service (TMS) on 24 Apr 2017.

Anticopyright: Editorials and articles originated on TMS may be freely reprinted, disseminated, translated and used as background material, provided an acknowledgement and link to the source, TMS: Celebrating the Fifth of May, is included. Thank you.

If you enjoyed this article, please donate to TMS to join the growing list of TMS Supporters.

This work is licensed under a CC BY-NC 4.0 License.