Cyprus to Sell €400 Million in Gold, About 75% of Its Total Holdings, To Finance Part of Its Bailout

EUROPE, 15 Apr 2013

Tyler Durden, Zero Hedge – TRANSCEND Media Service

Curious why every bank and their grandmother, and most recently Goldman today, has been lining up to push the price of gold as low as possible? Here’s why:

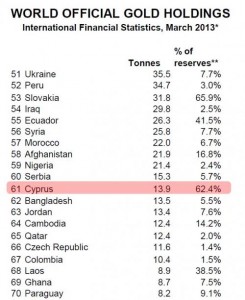

Or about 10 tons of gold. But… the bailout was prefunded and there was no need to provide any additional cash? What happened: was the deposit outflow discovered to have been even greater than the worst case scenario and thus Cyprus needed even more cash? As for the buyers? We will venture a guess: central banks buying at the lows.

Finally: congratulations Cypriots. You are now handing over your gold for the one time, unbeatable opportunity to remain a vassal state to the Eurozone. But at least you have your €.

The good news: Cyprus will have at least another 4 or so tons after selling the 10 demanded now, before the Troika kindly requests that Cypriot citizens sell a kidney or two to pay for the ongoing deposit outflow from its insolvent banks, and indirectly, the endless bailout of the Euro.

Full story from Reuters:

Cyprus has agreed to sell excess gold reserves to raise around 400 million euros and help finance its part of its bailout, an assessment of Cypriot financing needs prepared by the European Commission showed.

The draft assessment, obtained by Reuters, also said that Cyprus would raise 10.6 billion euros from the winding down of Laiki Bank and the losses imposed on junior bondholders and the deposit-for-equity swap for uninsured deposits in the Bank of Cyprus.

Nicosia would get a further 600 million euros over 3 years from raising the corporate income tax rate and the capital gains tax rate.

Out of the total Cypriot financing needs of 23 billion euros between the second quarter of 2013 and the first quarter of 2016, the euro zone bailout fund will provide 9 billion euros, the International Monetary Fund 1 billion and Cyprus itself will generate 13 billion, the assessment said.

Go to Original – zerohedge.com

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.