Thus, almost everywhere in the Western world, but especially in the United States, the globalization of the economy took on the colors of neoliberal ideology. The system of individual rights was instrumentalized to establish the absolute primacy of private enterprise, entrepreneurial expertise, and individual leadership. State disengagement, the breaking down of barriers between financial institutions, the deregulation of finance, and the trickle-down doctrine were promoted. Very quickly, this led to the concentration of capital, the means of production, and decision-making centers in the hands of a handful of individuals. A plutocracy of stateless billionaires, representing one-tenth of one percent (0.01) of the world’s population, controlled large corporations, major media and, in the United States where it is mostly concentrated, it controlled also the election campaigns for Presidents, Governors, Senators, and Representatives, whether Democrats or Republicans.

Vassalized states bowed their heads

For decades, Western states have kowtowed to large companies and their leaders. They have competed with each other to attract them to their territory. It came down to who would offer the biggest subsidies, the best tax breaks, and the most attractive tax loopholes. They reduced the number of tax brackets, eliminated taxation of capital, tolerated tax evasion, and demanded low royalties on exploration, exploitation, and the profits of extractive companies. They assumed the costs of decontaminating and upgrading the exploited lands after the departure of these companies. They even subsidized the companies and tolerated exorbitant salaries and excessive severance packages for their leaders.

States allowed minimal royalties to be paid to songwriters on Spotify and tolerated large retailers competing with bookstores by selling popular books at a lower price. States also tolerated the fact that GAFAM (Google, Amazon, Facebook, Apple, Microsoft, etc.) did not pay taxes. It is also in this context that plenty of room was left for the Uberization of certain companies that did not feel obliged to be good corporate citizens.

Unforeseen side effects

The disastrous consequences for nation-states that blindly endorsed neoliberal globalization were not immediately grasped. What was presented as nothing more than free trade agreements actually opened the gate to an ever-widening gap between private enterprise and the real needs of populations. It was not immediately understood that this ideology would increase the tendency of companies to place their profits in financial assets instead of reinvesting them in the real economy. The oligarchs thus contributed to the creation of financial bubbles, investments in derivative products or stashing cash in tax havens.

Vassal states of the West, as well as many sovereign states around the world, gradually realized that economic neoliberalism went hand in hand with the merger of companies and banks, the relocation of businesses abroad, and deindustrialization.

The United States is itself is confronted with the deindustrialization of its economy. Even if the Russian population is half the size of that of the United States, Russia produces a greater number of engineers. According to the website Elucid, in 2020, the proportion of students enrolling in an engineering program in Russia was 23%, while it was only 7% in the United States [1]. 79% of the US GDP comes from the service sector. Its main industrial clusters (Big Tech, Big Pharma, the military-industrial complex, and extractive companies) are to varying degrees dependent on components from abroad. For example, half of the components of Boeing aircraft come from Europe.

Another side effect is the impact of offshoring on China. This country accounted for a 4% share of global GDP in 2001. Even if Chinese growth has slowed down in recent years, China’s share of global GDP was 16.9% in 2023[2]. China has become one of the leading economic forces on a global scale in just twenty years. This is perhaps the most important side effect.

The dollar, a wealth pump

The deindustrialization of the US economy, combined with the rise of China, has created a wave of panic in the United States. One might wonder why. It is understandable that North Americans might feel the painful shock of being economically displaced, but that is no reason to panic. To understand this what is happening, we must realize that the US’ most precious commodity is not one company or another. It is the dollar. The United States is, first and foremost, a producer of money. Since the Bretton Woods Agreement signed at the end of World War II, the US currency has enjoyed a special privilege. It was the world’s reserve currency. This status was maintained even after the US chose in 1971 to decouple their currency from gold.

This privilege allowed the US to print money and run up huge deficits, safely knowing that their astronomical debt would always be financed no matter what. As a benchmark currency, the US dollar provided a safe haven in which other countries could invest. With the dollars created, the US could purchase any goods they wanted and live beyond their means. Foreign countries exporting in the United States, meanwhile, could use their US dollars to purchase goods all over the world and/or reinvest part of their profits into US Treasury bonds. This wonderful system still works, although its days may be numbered.

Of course, exporting countries are captive states of the US state, not only because they want the US to continue buying their products, but also because they want their investments in the US dollar to continue earning them interest and dividends. They therefore do not want the value of the US dollar to decline.

This system, however, has transformed the United States into an importing country, and thus plagued with a recurring deficit in its trade balance. The debt has gradually increased to reach peaks ($36 trillion in July 2025[3] and it will exceed $41 trillion with the budget law that has just been passed). The annual deficit in its trade balance is one trillion dollars. This is not a problem in itself. As long as the US dollar is the de facto world reserve currency, there is no limit that cannot be crossed. They can continue to increase the debt.

Clouds on the horizon

The greatest threat posed by China’s economic strength is not just that its economy is growing rapidly and outpacing that of the United States in purchasing power parity. The problem for the US is that China, on guard for its sovereignty, is for that same reason respectful of the sovereignty of other nations. It therefore is also respectful of their national currencies. It accepts global trade in the national currencies of the various countries.

But the more it engages in international trade without using the dollar, the more the dollar will lose its status as the world’s reserve currency. This has already begun. At the turn of the 1990s, the dollar represented about 70% of central banks’ foreign exchange reserves. It has continued to decline since then. By 2025, this proportion had fallen to 58%[4]. The US dollar is therefore at risk of losing more and more of its value.

To finance its debt and continue to attract foreign investors, the United States will then have to raise its interest rates. This will slow down the economy and increase the debt burden. It will also lead to inflation and increased debt service. Foreign investors will eventually wonder whether the United States might eventually intend to erase its own debt, or “restructure” it, to use the jargon used in such matters. In light of such a danger, these investors will increasingly tend to sell off their US Treasuries bonds and diversify even more their economic trading partners.

To prevent these consequences, the United States imposed “sanctions” on countries that refused to submit to its domination. They have imposed no fewer than 18,000 sanctions on individuals, companies, and states. They have intervened militarily 250 times around the world since 1990. They have been at war for 231 of their 248 years as a state. They have deployed 800 military bases in about 100 countries. They made sure to involve European vassal countries in the implementation of a set of “sanctions” imposed on Russia. By portraying the special military operation as an unprovoked aggression, they were able to justify the interruption of direct Russian sales of oil and gas to Europe. They also blew up the Nordstream pipeline. They are still very present in the Middle East, particularly in Iraq and Syria, in order to control the flow of oil and gas in the region.

In short, they have imposed their domination on the world by the use of force. However, that had the opposite effect to what was intended. The actions taken by the US to impose their economic supremacy by coercion had the effect of a self-fulfilling prophecy. By seeking to force recalcitrant countries to submit, they encouraged them to be wary. Which country will be the next one to be subjected to their “sanctions”? Which country will experience an invasion or regime change? Which states will the United States seek to destabilize next? It is the (justified) fear of being the next targets that pushes the countries of the Global South to organize among themselves in order to develop cooperation free from hegemony, blackmail, threats, and aggression. The United States and its outlaw behavior are the best recruiters of members for the BRICS.

The entry of the BRICS on the scene

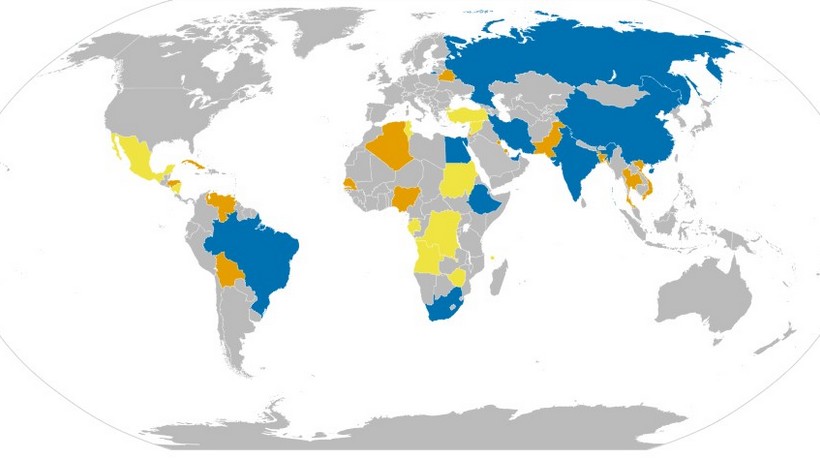

It was in this context that the BRICS, as countries that were not part of the G7, emerged in 2009. Initially, there were five countries: Brazil, Russia, India, China, and South Africa. Five other countries were subsequently added: Egypt, the United Arab Emirates, Ethiopia, Iran, and Indonesia. These 10 countries represent half of the world’s population and 35% of global GDP in current value (44% in purchasing power parity).

Ten countries have recently been granted BRICS+ partner status: Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda, Uzbekistan, and Vietnam. These countries can participate in certain BRICS initiatives, such as annual summits. They can also contribute to the preparation and drafting of official documents. They cannot vote at the meetings.

The new development bank established by the BRICS already grants more credits than the World Bank[5]. The participating members all have an equal voice in the distribution of these credits. They seek not to repeat the misdeeds of US imperialism. The BRICS seek to free themselves from the grip of the West and especially the United States on the global economy. They are trying to develop institutions independent of the International Monetary Fund and the World Bank. In the longer term, they want to proceed with de-dollarization. This would involve first using their own currencies for international trade, then equipping themselves with a common currency (instead of a single currency) backed by a basket of raw materials. A similar movement within Europe itself proposes abandoning the single currency in favor of a common currency, which would allow the restoration of national currencies. Abandoning the Euro is notably defended by Aurélien Bernier, Frédéric Lordon, Jacques Sapir, Emmanuel Todd and Éric Toussaint.

Conclusion

Instead of competing with each other, the BRICS+ have taken the initiative to offer an alternative path to the one that involves submitting to the United States. To counter the US threat, populations will eventually push the heads of state to engage in a common strategy and to sign together a Convention on the Diversity of National Economies echoing the 2005 Convention on the Diversity of Cultural Expressions[6]

Notes:

[1] https://www.youtube.com/watch?v=2FdysG7zgTM

[2] https://www.geo.fr/geopolitique/la-part-de-la-chine-dans-leconomie-mondiale-diminue-pour-la-deuxieme-annee-consecutive-218436

[3] https://www.sudouest.fr/international/etats-unis/la-dette-americaine-de-plus-de-36-000-milliards-inquiete-de-plus-en-plus-les-marches-financiers-25090939.php

[4] https://www.chathamhouse.org/2025/04/us-dollars-role-international-monetary-system-now-dangerously-flux#:~:text=At%20the%20end%20of%202024%2C%20the%20dollar%20accounted%20for%2058,that%20share%20was%2065%20percent

[5] https://www.youtube.com/watch?v=OTLk_F9RDxQ

[6] Convention sur la diversité des expressions culturelles, UNESCO, 2017, https://fr.unesco.org/creativity/convention/texts

____________________________________________

Samir Saul holds a doctorate in history from the University of Paris and is a professor of history at the Université de Montréal. His latest book is L’Impérialisme, passé et présent. Un essai (2023). He is also the author of Intérêts économiques français et décolonisation de l’Afrique du Nord (1945-1962) (2016), and La France et l’Égypte de 1882 à 1914. Intérêts économiques et implications politiques (1997). He is also co-editor of Méditerranée, Moyen-Orient : deux siècles de relations internationales (2003). Email : samir.saul@umontreal.ca

Michel Seymour is a retired professor in the Department of Philosophy at the Université de Montréal, where he taught from 1990 to 2019. He is the author of a dozen monographs, including A Liberal Theory of Collective Rights, 2017; La nation pluraliste, co-authored with Jérôme Gosselin-Tapp, for which the authors won the Canadian Philosophical Association Prize; De la tolérance à la reconnaissance, 2008, for which he won the Jean-Charles Falardeau Prize of the Canadian Federation for the Humanities and Social Sciences. He also won the Richard Arès prize from Action nationale magazine for Le pari de la démesure, published in 2001. Email : seymour@videotron.ca web site: michelseymour.org