Global Peace Disruption: The Trump Trade Wars 2025

TRANSCEND MEMBERS, 26 May 2025

Prof Hoosen Vawda – TRANSCEND Media Service

Please note that this publication is rated for general readership. Parental guidance is recommended for minors.

In a materialistic world, trade and economic viability thereof is of paramount importance. Hence, government will weaponize trade to achieve neo-financial colonization.[1]

AI generated Imagery of President Trump Declaring Trade Wars, Globally. Photo Credit: Wikimedia Commons

Introduction

President Donald John Trump’s trade war policies and key developments since his inauguration on January 20, 2025, have generated enormous turmoil and systemic peace disruption extending from Vladivostok to Vancouver and beyond. These changes, effectively result in two aspects of Americanism. Firstly, the Presidential executive orders are aimed at increasing fiscal funds. Secondly and more importantly, to Make America Great Again (MAGA). The resultant fallout and private exclusionary deals with United Kingdom, have made the entire policy changes farcical, with unexpected retaliatory measures instituted by super powers like China. This has caused the Trump Administration to review the tariff revisnary policies and effect some degree of normality.

This publication examines and unpacks the entire Trump’s Trade War Policy and how it impacts on global peace efforts in the short term.

Definition of a Trade War

A trade war occurs when countries impose escalating economic barriers (such as tariffs, quotas, or sanctions) against each other to restrict imports, protect domestic industries, or gain leverage in negotiations. Unlike traditional wars, trade wars are fought with economic weapons rather than military force, but they can still cause significant geopolitical and financial damage.

Commonalities Between Trade Wars and Traditional Wars

- Strategic Conflict with Clear “Sides”

- Trade War: Involves two or more nations (e.g., U.S. vs. China) using tariffs and sanctions as weapons.

- Traditional War: Involves armed conflict between nations or factions (e.g., Russia vs. Ukraine).

- Commonality: Both involve adversarial relationships where each side seeks to weaken the other.

- Economic and Psychological Damage

- Trade War:

- Raises costs for businesses/consumers (e.g., U.S. households paying $1,190 more annually due to tariffs).

- Creates uncertainty, slowing investment and growth.

- Traditional War:

- Destroys infrastructure, disrupts supply chains, and causes inflation (e.g., Ukraine’s GDP dropping 30% in 2022).

- Commonality: Both inflict economic pain on civilians, even if trade wars do so indirectly.

- Use of “Weapons” and Counterattacks

- Trade War:

- Weapons: Tariffs, export bans, sanctions (e.g., U.S. 145% tariffs on China, China’s rare earth export restrictions).

- Counterattacks: Retaliatory tariffs (e.g., China’s 125% tariffs on U.S. goods).

- Traditional War:

- Weapons: Missiles, cyberattacks, blockades.

- Counterattacks: Military strikes, sabotage.

- Commonality: Both involve offensive and defensive maneuvers to pressure the opponent.

- Nationalistic Propaganda and Public Mobilization

- Trade War:

- Politicians frame tariffs as “patriotic” (e.g., Trump’s “America First,” China’s “self-reliance” rhetoric).

- Traditional War:

- Governments use propaganda to rally public support (e.g., WWII’s “Rosie the Riveter” campaigns).

- Commonality: Both rely on nationalism to justify sacrifices.

- Potential for Escalation and Proxy Battles

- Trade War:

- Can spill into tech bans (e.g., U.S. blocking Huawei) or currency manipulation.

- Traditional War:

- Can escalate into broader conflicts (e.g., WWI sparked by regional tensions).

- Commonality: Both risk uncontrolled expansion beyond initial disputes.

- Winners and Losers

- Trade War:

- Some industries benefit (e.g., U.S. steelmakers gain from tariffs), while others suffer (e.g., farmers losing export markets).

- Traditional War:

- Arms manufacturers profit, while civilians bear the brunt.

- Commonality: Both create uneven economic impacts within societies.

Key Differences

| Aspect | Trade War | Traditional War |

| Tools Used | Tariffs, sanctions, export controls | Bombs, troops, cyberattacks |

| Casualties | Economic (job losses, inflation) | Human (deaths, displacement) |

| Duration | Can last years (e.g., U.S.-China since 2018) | Often shorter but more intense |

| Resolution | Negotiated deals (e.g., truces) | Treaties or surrender |

Conclusion

While trade wars lack the visceral violence of traditional wars, they share core elements: conflict, strategy, collateral damage, and nationalism. Both can reshape global power dynamics—whether through economic dominance or military victory.

Historical Comparison: Smoot-Hawley Tariff (1930) vs. WWII Economic Warfare

To understand how trade wars and traditional wars differ—and overlap—we can examine two pivotal moments: the Smoot-Hawley Tariff Act of 1930 (a trade war escalation) and World War II economic warfare (a traditional war with trade dimensions).

- Smoot-Hawley Tariff Act (1930): A Trade War Case Study

Context: The U.S. raised tariffs on 20,000+ imports to protect farmers during the Great Depression.

Key Parallels to Modern Trade Wars

- Retaliation: Canada/EU imposed counter-tariffs, shrinking U.S. exports by 61% (1929–1933)

- Economic Damage: Global trade collapsed by 66%, worsening the Depression.

- Political Goals: Like Trump’s 2025 tariffs, Smoot-Hawley aimed to revive domestic industries but backfired by isolating the U.S.

Differences from Traditional War

- No Military Conflict: Unlike WWII, the “war” was fought with customs forms, not bullets.

- Slow-Motion Crisis: Effects took years to unfold, whereas WWII’s economic blockade (e.g., Allied sanctions on Japan) had immediate impacts.

- WWII Economic Warfare: Trade Tools in Traditional War

Context: Allies used embargoes, asset freezes, and blockades to cripple Axis economies.

Key Commonalities with Trade Wars

- Weaponized Trade: The U.S. banned oil exports to Japan (1941), mirroring China’s 2025 rare earths threats.

- Supply Chain Attacks: Like Trump’s semiconductor tariffs, WWII’s “Strategic Materials Act” hoarded resources (e.g., rubber, steel) for military use

- Collateral Damage: Civilian shortages occurred in both eras (e.g., U.S. rationing in WWII vs. 2025 inflation from tariffs)

Critical Differences

- Scale of Destruction: WWII caused $4 trillion in global GDP loss (adjusted for inflation); Smoot-Hawley’s damage was economic, not human.

- Alliances vs. Unilateralism: WWII trade measures were coordinated (e.g., Lend-Lease). Trump’s 2025 tariffs are unilateral, sparking fragmented retaliation.

- Lessons for Trump’s 2025 Trade War

- Retaliation is Guaranteed: Like Smoot-Hawley, Trump’s tariffs triggered swift countermeasures (e.g., China’s 125% tariffs)

- Global Systems Collapse: Both eras saw trade frameworks dismantled (1930s: Gold Standard; 2025: WTO rules eroded)

- Domestic Pain: Smoot-Hawley deepened unemployment; Trump’s tariffs risk 245,000 U.S. job losses

Key Distinction: WWII’s economic warfare had a clear endgame (Axis surrender). Trade wars lack resolution mechanisms—the 2025 U.S.-China “truce” is temporary 510.

Conclusion

While trade wars and traditional wars both use economic coercion, their stakes and timelines differ radically. Smoot-Hawley shows how protectionism can spiral; WWII demonstrates how trade tools amplify military strategy. Trump’s 2025 policies blend both playbooks—but without a wartime unity of purpose, the risks of miscalculation are high.

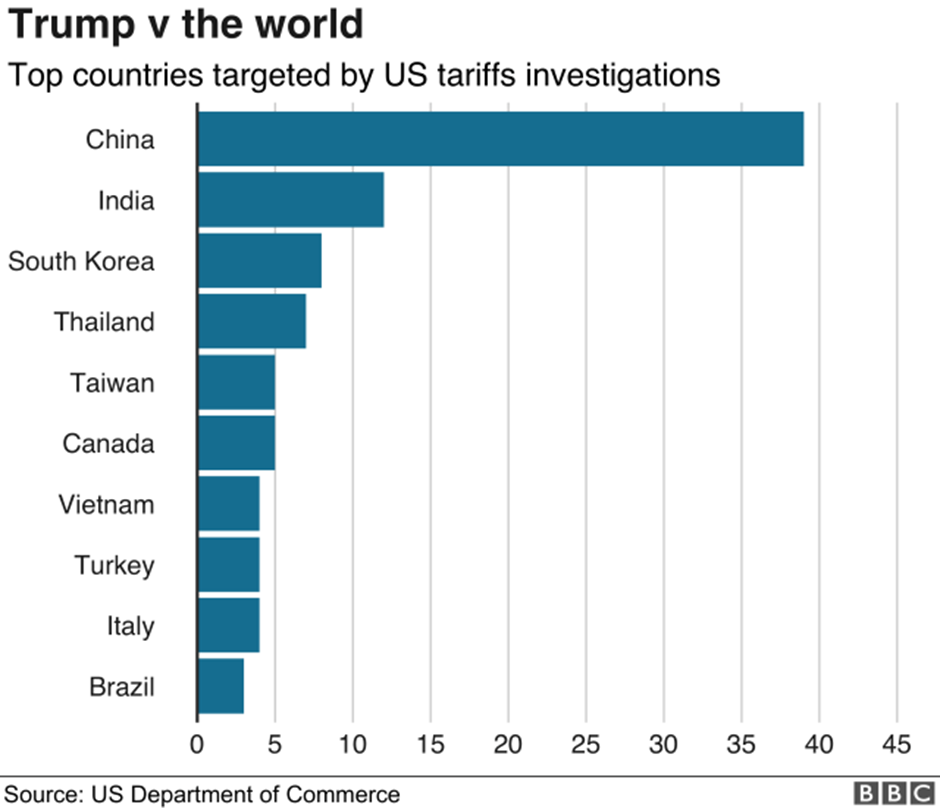

The Global Declaration showing affected countries of Trump Trade Wars

Photo Credit: US Department of Commerce BBC Documentary

List of major trade wars initiated since World War II, including the key players, rationales, and impacts on both initiators and targeted nations:

- U.S. vs. Japan (1970s–1980s)

- Initiator: United States

- Rationale: To counter Japan’s rising industrial dominance (e.g., autos, electronics) and address the U.S. trade deficit.

- Tools: Voluntary export restraints (VERs) on cars (1981), 100% tariffs on electronics (1987)

- Impact:

- U.S.: Temporary protection for Detroit automakers but higher consumer prices; trade deficit persisted.

- Japan: Export slowdown, but accelerated shift to high-value manufacturing (e.g., semiconductors).

- U.S. vs. EU (1963 Chicken Tariff War)

- Initiator: France/West Germany (EU precursors)

- Rationale: Protect European poultry farmers from cheap U.S. chicken imports

- Tools: Tariffs on U.S. poultry; U.S. retaliated with 25% tariffs on European brandy, trucks, and dextrin.

- Impact:

- EU: Shielded farmers but reduced consumer choice.

- U.S.: Long-term “chicken tax” on trucks still affects auto imports today.

- U.S. vs. Canada (1982–Present Lumber Wars)

- Initiator: United States

- Rationale: Alleged Canadian subsidies for softwood lumber (government-set prices).

- Tools: Tariffs up to 20%; Canada retaliated with duties on U.S. agricultural goods.

- Impact:

- U.S.: Higher lumber prices for homebuilders; job losses in construction.

- Canada: Export revenue declines but adapted by diversifying to Asian markets.

- U.S./Latin America vs. EU (1993 Banana Wars)

- Initiator: EU

- Rationale: Favor bananas from former Caribbean colonies over Latin American producers (owned by U.S. firms like Chiquita).

- Tools: EU tariffs on Latin American bananas; U.S. retaliated with tariffs on European luxury goods.

- Impact:

- EU: Protected small Caribbean farmers but faced WTO sanctions.

- U.S./Latin America: Won WTO case; EU gradually reduced tariffs by 2012.

- U.S. vs. China (2018–Present Trade War)

- Initiator: United States

- Rationale: Address IP theft forced tech transfers, and $375B trade deficit.

- Tools: Tariffs up to 25% on $550B of Chinese goods; China retaliated with tariffs on U.S. soybeans, autos.

- Impact:

- U.S.: Higher costs for consumers ($1,190/household); some manufacturing jobs returned.

- China: Export slowdown but accelerated self-reliance in tech (e.g., semiconductors)

- U.S. vs. Global Allies (2025 Trump Tariffs)

- Initiator: United States

- Rationale: “Reciprocal tariffs” to reduce trade deficits; curb fentanyl/migration 710.

- Tools: 10% baseline tariff + 145% on China (later reduced to 30%); Canada/Mexico faced 25% tariffs 10.

- Impact:

- U.S.: Projected 0.7% GDP drop; inflation risks 10.

- Targets (China/EU/Canada): Retaliatory tariffs; supply chain disruptions.

Key Observations:

- Patterns: Trade wars often start with protectionist goals but lead to higher consumer costs and global supply chain disruptions 16.

- Retaliation: Targeted nations typically impose counter-tariffs, hurting both sides (e.g., U.S. farmers during China trade war) 510.

- Long-Term Shifts: Some countries adapt by diversifying trade (e.g., Canada to Asia) or boosting domestic industries (e.g., China’s tech push).

For further details, explore sources like History.com [2]or Britannica.[3]

- Overview of Trump’s Trade War (2025-Present)

Since taking office, Trump has aggressively expanded tariffs, framing them as tools to combat “unfair trade practices,” boost domestic manufacturing, and address national security concerns (e.g., fentanyl trafficking). Key themes include:

- Sweeping tariffs: Imposed on imports from China, Canada, Mexico, the EU, and others, with rates reaching historic highs (e.g., 145% on Chinese goods).

- Reciprocal tariffs: A 10% baseline tariff on nearly all imports, with higher rates for countries running trade surpluses with the U.S. (e.g., 20–50% on select nations).

- Retaliation: Trading partners like China, Canada, and the EU responded with counter-tariffs, escalating tensions.

- Economic impact: Projected to reduce U.S. GDP by 0.7%, raise consumer costs (e.g., $1,190/household in 2025), and trigger global market volatility.

- Timeline of Key Actions

January–February 2025

- Jan 20: Trump inaugurated; vows to overhaul trade policies.

- Feb 1: Imposes 25% tariffs on Canada/Mexico and 10% on China under “national emergency” claims (fentanyl/immigration).

- Feb 4: China retaliates with tariffs on U.S. farm goods (e.g., 15% on soybeans)

- Feb 10: Expands steel/aluminum tariffs to 25% for all countries, removing exemptions.

- Feb 13: Announces “reciprocal tariffs” to match other nations’ trade barriers.

March 2025

- Mar 4: Doubles China tariffs to 20%; imposes 25% on Canada/Mexico (later exempts USMCA-compliant goods).

- Mar 12: Steel/aluminum tariffs take effect; EU threatens retaliation.

- Mar 26: Announces 25% auto tariffs (effective April 3).

April 2025

- Apr 2: Unveils 10% universal tariff + higher rates for 57 trade-surplus nations (e.g., 34% on China). Dubbed “Liberation Day”.

- Apr 9: Suspends most reciprocal tariffs for 90 days (except China, raised to 125%). Total China tariffs hit 145%.

- Apr 22: Launches probes into semiconductor/pharmaceutical tariffs

May 2025

- May 8: U.K. deal lowers auto/steel tariffs but retains 10% baseline.

- May 12: U.S.-China agree to 90-day truce, reducing tariffs to 30% (U.S.) and 10% (China)

- Major Tariff Categories

- Country-Specific:

- China: 145% peak (IEEPA + reciprocal tariffs)

- Canada/Mexico: 25% (exempting USMCA goods).

- EU: 20% reciprocal rate.

- Product-Specific:

- Autos: 25% (April 2025) 5.

- Steel/Aluminum: 25% (March 2025)

- Semiconductors/Pharma: Proposed 25%+ (under investigation).

- Global Reactions & Retaliation

- China: Imposed 125% tariffs on U.S. goods, restricted rare earth exports.

- Canada/EU: Retaliated with tariffs on U.S. agricultural and manufactured goods

- Markets: April 2025 saw stock crashes and supply chain disruptions

- Economic Projections

- U.S. Impact:

- $2.1 trillion in tariff revenue (10-year estimate).

- 0.7% GDP reduction; 1.2% drop in market income by 2026.

- Global: OECD warns of recession risks; inflation spikes expected

Conclusion

Trump’s 2025 trade war marks a dramatic escalation, blending economic nationalism with geopolitical strategy. While aimed at reshaping global trade, the policies have triggered widespread retaliation and economic uncertainty. The recent 90-day truce with China offers temporary relief, but the long-term trajectory remains volatile.

For further details, the reader may explore the cited sources (e.g., Tax Foundation[4] or AP[5] News).

Rationale for Trump’s Trade War Campaign (2025) and How It Aims to “Make America Great Again” (MAGA)

- Core Rationale Behind the Trade War

President Trump’s trade policies are driven by a blend of economic nationalism, geopolitical strategy, and populist rhetoric, anchored in the following justifications:

- Addressing Trade Imbalances and “Unfair” Practices

- Reciprocity: Trump argues that the U.S. has been exploited by trading partners due to asymmetrical tariffs (e.g., the U.S. average tariff rate is 3.3%, vs. India’s 17% or the EU’s 5%) 210. His “reciprocal tariffs” aim to force other nations to lower their barriers or face matching U.S. tariffs.

- Trade Deficits: The U.S. goods trade deficit hit $1.2 trillion in 2024, which Trump frames as a threat to sovereignty and jobs. Tariffs are touted as a tool to rebalance trade.

- National Security and Supply Chain Resilience

- Dependence on Adversaries: Trump highlights reliance on China for critical goods (e.g., rare earths, pharmaceuticals) and Mexico/Canada for fentanyl precursors as emergencies justifying tariffs under the International Emergency Economic Powers Act (IEEPA)

- Manufacturing Decline: U.S. manufacturing’s share of global output fell from 28.4% (2001) to 17.4% (2023). Tariffs aim to revive sectors like steel, autos, and semiconductors.

- Political and Populist Messaging

- Border Security Link: Tariffs on Mexico/Canada are tied to migration and fentanyl, with Trump claiming they pressure these nations to curb drug trafficking 610.

- MAGA Nostalgia: The campaign evokes post-WWII industrial glory, promising to restore “blue-collar masculinity” through factory jobs.

- How the Trade War Aims to MAGA

Trump’s team argues the short-term pain of tariffs will yield long-term gains:

- Economic Sovereignty

- Reshoring Jobs: By making imports costlier, tariffs incentivize domestic production. For example, steel tariffs aim to revive Pennsylvania’s steel industry.

- Leverage in Negotiations: The 90-day pauses (e.g., with China and the UK) are framed as victories, forcing concessions like reduced auto tariffs for the UK.

- Revenue and Protectionism

- Taxing Imports: The 10% baseline tariff is projected to raise $2.1 trillion over a decade, offsetting income taxes (though economists dispute this math)

- Shielding Industries: Sector-specific tariffs (e.g., 25% on autos) protect U.S. automakers from foreign competition.

- Geopolitical Dominance

- Confronting China: The 145% peak tariff pressures Beijing on fentanyl, intellectual property, and rare earths exports.

- Rewriting Trade Rules: The “Liberation Day” tariffs (April 2025) seek to dismantle the WTO-led global order, replacing it with bilateral deals.

- Risks and Contradictions

- Consumer Costs: Tariffs add $1,190/household annually (2025), with price hikes on electronics, clothing, and cars.

- Retaliation: China targets MAGA strongholds (e.g., blocking U.S. beef/poultry exports from Iowa/Nebraska)

- Political Backlash: GOP leaders warn voter patience may expire by midterms if economic pain persists.

Conclusion: Trump’s trade war is a high-stakes gamble to reshape global trade in America’s favor, blending protectionism with populist appeal. While it energizes his base, its success hinges on whether short-term disruptions translate into lasting industrial revivals and trigger a broader economic downturn.

Impact of Trump’s 2025 Trade War on Ordinary Households

- Ordinary Households in the U.S.

Trump’s aggressive tariffs since January 2025 have imposed significant costs on American consumers, with effects varying by income level:

- Higher Living Costs:

- The average U.S. household faces an additional 1,190inannualcosts∗∗duetotariffsin2025,risingto∗∗1,190inannualcosts∗∗duetotariffsin2025,risingto∗∗1,462 in 2026.

- Lower-income households bear a disproportionate burden, experiencing twice the cost increase compared to high-income families due to reduced product variety and less flexibility in spending adjustments.

- Price Hikes and Shortages:

- Job Market & Income:

- 245,000 U.S. jobs were lost in Trump’s first-term trade war, primarily in manufacturing and retail.

- Trucking, logistics, and agriculture sectors face layoffs due to reduced trade volumes and retaliatory tariffs (e.g., China’s tariffs on U.S. soybeans).

- Psychological & Economic Uncertainty:

- Consumer confidence hit a 13-year low in April 2025, with fears of inflation and job losses.

- Businesses delay investments, exacerbating economic stagnation (U.S. GDP shrank 0.3% in Q1 2025).

- Ordinary Households in China

China’s economy initially showed resilience (5.4% growth in Q1 2025), but households face localized pain:

- Income and Employment Losses:

- The 2.5% most tariff-exposed Chinese workers saw 2.52% lower incomes and 1.62% fewer manufacturing jobs.

- Satellite data (night-light intensity) revealed declining economic activity in industrial hubs.

- Consumer and Investor Behaviour:

- Households reduced stock market participation due to higher income volatility and risk aversion.

- Retaliatory tariffs on U.S. goods (e.g., agriculture) raised food prices but were partly offset by alternative imports.

- Long-Term Shifts:

- China is diversifying trade away from the U.S. (e.g., boosting exports to the EU and Southeast Asia)

- The 90-day tariff truce (May 2025) offers temporary relief, but long-term uncertainty persists

Key Takeaways

- U.S. households pay more for goods, face job instability, and endure economic anxiety.

- Chinese households experience income cuts in export-heavy regions but benefit from state-led trade pivots.

- Both nations face trade diversion (e.g., U.S. firms sourcing from Vietnam, China selling to Europe)

For details, the reader is invited to refer to Tax Foundation[8] and Newsweek[9].

Computer Chips and links to Trade War

Computer chips (semiconductors) are at the heart of modern trade wars due to their strategic importance in technology, military systems, and economic competitiveness. Here’s how they intersect with trade conflicts, illustrated with real-world examples:

- Chips as a Geopolitical Weapon

Why?

- Semiconductors power everything from smartphones to AI and missiles. Controlling their supply chain grants economic and military leverage.

- The U.S. and China are locked in a “Chip War” to dominate design, manufacturing, and access to advanced chips.

Example: U.S. vs. China Export Controls

- In 2025, the U.S. imposed 145% tariffs on Chinese chips and banned exports of advanced AI chips (e.g., Nvidia’s H100) to cripple China’s tech/military growth 36.

- China retaliated by restricting exports of gallium and germanium (critical for chipmaking), hurting U.S. defense contractors.

Outcome: A global scramble to secure chip supplies, with companies like TSMC building plants in the U.S. to avoid tariffs.

- Tariffs Disrupting Supply Chains

Why?

- Chips rely on a global supply chain: Designed in the U.S. (Nvidia)[10], made in Taiwan (TSMC[11], [12]), assembled in China, and used globally. Tariffs disrupt this flow.

Example: Gaming Consoles Hit by Tariffs

- In 2025, U.S. tariffs on Chinese-made electronics (e.g., PlayStation 5, Nintendo Switch) raised console prices by 30–40%

- Sony and Nintendo shifted production to Vietnam, but new U.S. tariffs (up to 46% on Vietnam) nullified the cost savings

Outcome: Higher consumer prices and supply chain chaos, with companies stockpiling chips preemptively 14.

- Subsidies and “Chip Nationalism”

Why?

- Countries are spending billions to onshore chip production, fearing over-reliance on rivals.

Examples:

- U.S.CHIPS Act: 52.7billiontoboostdomesticchipmaking,counteredbyChina’s52.7billiontoboostdomesticchipmaking,counteredbyChina’s150 billion subsidy for SMIC[13] (its top chipmaker).

- EU Chips Act: €43 billion to reduce dependence on U.S./Asian chips.

Outcome: A subsidies arms race, with TSMC (Taiwan) caught in the crossfire as it builds plants in the U.S., Japan, and Germany

- Tech Decoupling and “Silicon Blockades”

Why?

- The U.S. aims to cut China off from advanced chips (e.g., for AI/supercomputers), while China pushes self-sufficiency.

Example: Huawei’s Survival Tactics

- After U.S. sanctions, Huawei developed its 7nm chips (via SMIC) despite export bans, using older tech to bypass restrictions.

- China now produces 60% of global surveillance chips (e.g., HiSilicon), reducing reliance on U.S. firms like Intel.

Outcome: A fragmented tech ecosystem, with Chinese chips powering domestic products but lagging in cutting-edge innovation .

- Secondary Effects: Shortages and Inflation

Why?

- Trade wars create bottlenecks. In 2025, chip lead times hit 4+ months, and prices rose 18% due to tariffs and hoarding.

Example: Auto Industry Crisis

- U.S. tariffs on Chinese/Mexican auto parts (25%) disrupted car production, echoing the 2021 chip shortage.

- Ford and GM warned of $1,000+ price hikes per vehicle.

Outcome: Higher costs for consumers and stalled tech adoption (e.g., AI, EVs).

Key Takeaways

- Chips = Power: Control over semiconductors translates to economic/military dominance.

- Tariffs Reshape Supply Chains: Companies flee China but face new trade barriers (e.g., Vietnam tariffs).

- Subsidies Fuel Rivalry: The U.S., EU, and China are spending trillions to “win” the chip war.

- Tech Decoupling is Accelerating: Separate U.S. and Chinese tech ecosystems are emerging.

For additional reference please see: CEPA on the “Chips War” [14] Deloitte’s 2025 Semiconductor Outlook [15]

Final Thought: The chip trade war is a high-stakes game of “musical chairs”,nations and firms are scrambling to secure their place before the music stops.

The Bottom Line

The Bottom Line is there are no winning and losers in Trade Wars, globally. In either case, the initiator and the bearers of the brunt of these Trade Wars are the disadvantaged sectors of the respective communities. In the United States, this would mainly be the African Americans to suffer the most with exponential rise in the basic cos of living. In developing countries, as well as war ravaged nations, the Trade Wars will delay recovery and rebuilding the country. This would be most severely experienced in Palestine, in toto, Sudan, Yemen, Ethiopia, Myanmar, Latin American countries, Bangladesh and Mozambique. It is to be noted that the Arab block, the imposition of Trade Wars or Trade Peace does NOT matter whatsoever. The Arab countries will by Trade Peace by a process of by Trade Peace by extravagant gifting to President Donal Trumps, for example Oatar’s gift to Trump, recently of a $400 million recently when the President of United States visited the country. Similarly, huge contracts and privileges are given to Jarred Kushner for certain business rights in exchange for “Generalised Peace” for without the support and protection of United States, the Arab Bloc will NOT last a few days as confirmed by President Trump.[16],[17],[18],[19],[20]

References:

[1] Author’s personal quote May 2025

[2] https://www.bing.com/ck/a?!&&p=0cf80e4369b97d0f280afc3b2085e2606003beaee2a1c03f26fac568aa32b164JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=History.com++trade+wars+2025&u=a1aHR0cHM6Ly9lbi53aWtpcGVkaWEub3JnL3dpa2kvMjAyNV9Vbml0ZWRfU3RhdGVzX3RyYWRlX3dhcl93aXRoX0NhbmFkYV9hbmRfTWV4aWNv&ntb=1

[3] 2025 United States trade war with Canada and Mexico – Wikipedia

[4] https://www.bing.com/ck/a?!&&p=2c696b54b07300bca20b8d0900d2f5525816b1b35a71e34182f38f702e85e054JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=tax+foundation+website&u=a1aHR0cHM6Ly90YXhmb3VuZGF0aW9uLm9yZy8&ntb=1

[5] https://www.bing.com/ck/a?!&&p=0d6f68731a8b5f027a485fac788548dcab6bee8b7c75663070b4bb3e8f53e808JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&u=a1L25ld3Mvc2VhcmNoP3E9QXNzb2NpYXRlZCtQcmVzcytUcmFkZStXYXJzK1RydW1wJnFwdnQ9QXNzb2NpYXRlZCtQcmVzcytUcmFkZSt3YXJzK3RydW1wJkZPUk09RVdSRQ&ntb=1

[6] https://www.bing.com/ck/a?!&&p=01e23606882c9259a24a3810eba88cfd91c2d1d2dd0f9c17d6c1a180b59ce2c0JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=McDonald%e2%80%99s+trade+war+impact&u=a1aHR0cHM6Ly93d3cudm9yb25vaWFwcC5jb20vYnVzaW5lc3MvVHJhZGUtV2Fycy0tTWNEb25hbGRzLUV4cGFuc2lvbi1XaWxsLVVTLVRhcmlmZnMtU2xvdy1Eb3duLU5ldy1PcGVuaW5ncy00MzM1Izp-OnRleHQ9VGhlJTIwVS5TLiUyMGdvdmVybm1lbnQlMjdzJTIwMjUlMjUlMjB0YXJpZmZzJTIwb24lMjBrZXklMjBpbXBvcnRzLGFjcm9zcyUyMGJvcmRlcnMlRTIlODAlOTRiZXR3ZWVuJTIwdGhlJTIwVS5TLiUyQyUyMENhbmFkYSUyQyUyME1leGljbyUyQyUyMGFuZCUyMGJleW9uZC4&ntb=1

[7] https://www.bing.com/ck/a?!&&p=5bfc4d0e5f500b0e00044b894439e28ce62c7da33c918c61fed1c4c4ad16d731JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=Harley-Davidson+trade+war&u=a1aHR0cHM6Ly93d3cubW9uZXljb250cm9sLmNvbS9uZXdzL2J1c2luZXNzL2hhcmxleS1kYXZpZHNvbi1zZWVrcy1yZXRhbGlhdGlvbi1pZi1ldXJvcGUtdW5pb24tdGFyZ2V0cy1pdHMtbW90b3JjeWNsZXMtMTI5ODAxNzcuaHRtbCM6fjp0ZXh0PVVTJTIwbW90b3JjeWNsZSUyMG1hbnVmYWN0dXJlciUyMEhhcmxleSUyMERhdmlkc29uJTIwaGFzJTIwY2FsbGVkJTIwZm9yLEV1cm9wZWFuJTIwVW5pb24lMjAlMjhFVSUyOSUyQyUyMHJlcG9ydHMlMjBUaGUlMjBXYWxsJTIwU3RyZWV0JTIwSm91cm5hbC4&ntb=1

[8] https://www.bing.com/ck/a?!&&p=c41dd4001ed920e4abef874fa1f0613d556a748fecaf53873e5ef7aed84e9e7dJmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=Tax+Foundation&u=a1aHR0cHM6Ly90YXhmb3VuZGF0aW9uLm9yZy8&ntb=1

[9] https://www.bing.com/ck/a?!&&p=82051cac0fe39d40e6ed96c9ff3ffc3f147a5521c8de5518cab4c4db4fe9f5c9JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=Newsweek+Trump+Trade+Wars+2025&u=a1aHR0cHM6Ly93d3cubXNuLmNvbS9lbi11cy9tb25leS9tYXJrZXRzL2RpZC1kb25hbGQtdHJ1bXAtbG9zZS1jaGluYS10cmFkZS13YXItMTAtZXhwZXJ0cy13ZWlnaC1pbi9hci1BQTFFR3J1ND9vY2lkPUJpbmdOZXdzU2VycA&ntb=1

[10] https://www.bing.com/ck/a?!&&p=487190f1e480f0af88d6a7bf2a8d16dfb1db0f69accd8f203e7c0734df5023cfJmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=Designed+in+the+U.S.+(Nvidia)&u=a1aHR0cHM6Ly9hcG5ld3MuY29tL2FydGljbGUvbnZpZGlhLWFpLWFydGlmaWNpYWwtaW50ZWxsaWdlbmNlLXRhcmlmZnMtZGNmNDgxMTJjZTk4YTdiNjFiZmQzMjE1NzM1OWNlMmY&ntb=1

[11] https://www.bing.com/ck/a?!&&p=0d28070d8ac7bdda0c18dd862d6ec4a351af4d2caedec976a4c85f1306875a4dJmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&u=a1L25ld3Mvc2VhcmNoP3E9VFNNQytBbmQrVHJ1bXArVHJhZGUrV2FycyZxcHZ0PVRTTUMrYW5kK3RydW1wK3RyYWRlK3dhcnMmRk9STT1FV1JF&ntb=1

[12] https://www.bing.com/ck/a?!&&p=81352f32de0fdc19bff17f450de8840e1518076099478a56825c915eeb3ec138JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=TSMC+and+trump+trade+wars&u=a1aHR0cHM6Ly93d3cubW9uZXljb250cm9sLmNvbS93b3JsZC90c21jLWhpdHMtYmFjay1hdC11cy13YXJucy10YXJpZmZzLWNvdWxkLWRlcmFpbC0xNjUtYmlsbGlvbi1hcml6b25hLWludmVzdG1lbnQtYXJ0aWNsZS0xMzA0NDM2MS5odG1s&ntb=1

[13] https://www.bing.com/ck/a?!&&p=10cf798abd7d2ad2e0a6d38008b3bd4073e2491321d552f985459c81c6c42facJmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=Act%3a+52.7billiontoboostdomesticchipmaking%2ccounteredbyChina%e2%80%99s52.7billiontoboostdomesticchipmaking%2ccounteredbyChina%e2%80%99s150+billion+subsidy+for+SMIC+&u=a1aHR0cHM6Ly9wZXJraW5zY29pZS5jb20vaW5zaWdodHMvdXBkYXRlL2NoaXBzLWFjdC1hbGxvY2F0ZXMtNTItYmlsbGlvbi1zdWJzaWRpZXMtcmV2aXRhbGl6ZS1zZW1pY29uZHVjdG9yLW1hbnVmYWN0dXJpbmc&ntb=1

[14] https://www.bing.com/ck/a?!&&p=5510616d2a783237dcbb1a17068051dd8998fda9426931b5afb2251376b25e46JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=CEPA+on+the+%22Chips+War%22+&u=a1aHR0cHM6Ly9jZXBhLm9yZy9jb21tZW50YXJ5L3BhcnQtZml2ZS1jaGlwcy13YXItMjAyNS8&ntb=1

[15] https://www.bing.com/ck/a?!&&p=adb7298cb774288dd6621892a88ecab09f9aa1d89dcbdab8a5b81168603736feJmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=Deloitte%e2%80%99s+2025+Semiconductor+Outlook+&u=a1aHR0cHM6Ly93d3cyLmRlbG9pdHRlLmNvbS91cy9lbi9pbnNpZ2h0cy9pbmR1c3RyeS90ZWNobm9sb2d5L3RlY2hub2xvZ3ktbWVkaWEtdGVsZWNvbS1vdXRsb29rcy9zZW1pY29uZHVjdG9yLWluZHVzdHJ5LW91dGxvb2suaHRtbA&ntb=1

[16] https://www.bing.com/ck/a?!&&p=c2c335ace54f46421bc8d34be4dfe214b5f8daa0658deadeb713a6b3d5eb5b74JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=without+the+support+and+protection+of+United+States%2c+the+Arab+Bloc+will+NOT+last+a+few+days+as+confirmed+by+President+Trump.&u=a1aHR0cHM6Ly9oaXIuaGFydmFyZC5lZHUvZm9yZ2VkLWJ5LWZpcmUtdGhlLXNlY3VyaXRpemVkLXJlbGF0aW9uc2hpcC1iZXR3ZWVuLXRoZS11cy1hbmQtc2F1ZGktYXJhYmlhLw&ntb=1

[17] https://www.bing.com/ck/a?!&&p=90fc0c024acad44c7ed58831e316c18cc54d562538ea7b71d012325f955c1626JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=without+the+support+and+protection+of+United+States%2c+the+Arab+Bloc+will+NOT+last+a+few+days+as+confirmed+by+President+Trump.&u=a1aHR0cHM6Ly93d3cuY25uLmNvbS8yMDIzLzEwLzAyL21pZGRsZWVhc3QvZ3VsZi1hcmFiLXN0YXRlcy11cy1zZWN1cml0eS1wYWN0LW1pbWUtaW50bC8&ntb=1

[18] https://www.bing.com/ck/a?!&&p=d5e5cae4b8f06d9d1de83dbb5b9f614978126302fbf8faab40abda9bd226b316JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=without+the+support+and+protection+of+United+States%2c+the+Arab+Bloc+will+NOT+last+a+few+days+as+confirmed+by+President+Trump.&u=a1aHR0cHM6Ly93d3cuYXRsYW50aWNjb3VuY2lsLm9yZy9ibG9ncy9tZW5hc291cmNlL29uZS1odW5kcmVkLWRheXMtb2YtdHJ1bXBzLW1pZGRsZS1lYXN0LXBvbGljeS1tb25leS1tZWRpYXRpb24tYW5kLW1pbGl0YXJ5LWZvcmNlLw&ntb=1

[19] https://www.bing.com/ck/a?!&&p=6f9c6384d3af6b03fa6cbbee21277de9661903abdd86830adb6041d28d6f83ecJmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=without+the+support+and+protection+of+United+States%2c+the+Arab+Bloc+will+NOT+last+a+few+days+as+confirmed+by+President+Trump.&u=a1aHR0cHM6Ly93d3cucGJzLm9yZy9uZXdzaG91ci9wb2xpdGljcy9iaWRlbi1zYXlzLXUtcy13aWxsLW5vdC13YWxrLWF3YXktZnJvbS1taWRkbGUtZWFzdA&ntb=1

[20] https://www.bing.com/ck/a?!&&p=141cc837a81346d581fb0c747a8323b0bcb3024507f314fd73bbd53d14aa16e3JmltdHM9MTc0ODA0NDgwMA&ptn=3&ver=2&hsh=4&fclid=0c3c9d6e-714f-6e96-05f4-88d2706c6f48&psq=without+the+support+and+protection+of+United+States%2c+the+Arab+Bloc+will+NOT+last+a+few+days+as+confirmed+by+President+Trump.&u=a1aHR0cHM6Ly9mb3JlaWducG9saWN5LmNvbS8yMDI1LzA1LzIzL3RydW1wLW1pZGRsZS1lYXN0LXBvbGljeS1ndWxmLXN0YXRlcy8&ntb=1

______________________________________________

Professor G. Hoosen M. Vawda (Bsc; MBChB; PhD.Wits) is a member of the TRANSCEND Network for Peace Development Environment.

Professor G. Hoosen M. Vawda (Bsc; MBChB; PhD.Wits) is a member of the TRANSCEND Network for Peace Development Environment.

Director: Glastonbury Medical Research Centre; Community Health and Indigent Programme Services; Body Donor Foundation SA.

Principal Investigator: Multinational Clinical Trials

Consultant: Medical and General Research Ethics; Internal Medicine and Clinical Psychiatry:UKZN, Nelson R. Mandela School of Medicine

Executive Member: Inter Religious Council KZN SA

Public Liaison: Medical Misadventures

Activism: Justice for All

Email: vawda@ukzn.ac.za

Tags: China, International Trade, Tariffs, Trade, Trump, USA

This article originally appeared on Transcend Media Service (TMS) on 26 May 2025.

Anticopyright: Editorials and articles originated on TMS may be freely reprinted, disseminated, translated and used as background material, provided an acknowledgement and link to the source, TMS: Global Peace Disruption: The Trump Trade Wars 2025, is included. Thank you.

If you enjoyed this article, please donate to TMS to join the growing list of TMS Supporters.

This work is licensed under a CC BY-NC 4.0 License.

Join the discussion!

We welcome debate and dissent, but personal — ad hominem — attacks (on authors, other users or any individual), abuse and defamatory language will not be tolerated. Nor will we tolerate attempts to deliberately disrupt discussions. We aim to maintain an inviting space to focus on intelligent interactions and debates.